September 21 Comex Delivery Countdown: Gold Shows Life, Silver Mixed

This analysis focuses on gold and silver physical delivery on the Comex set for September 21, 2021. See the article What is the Comex for more detail.

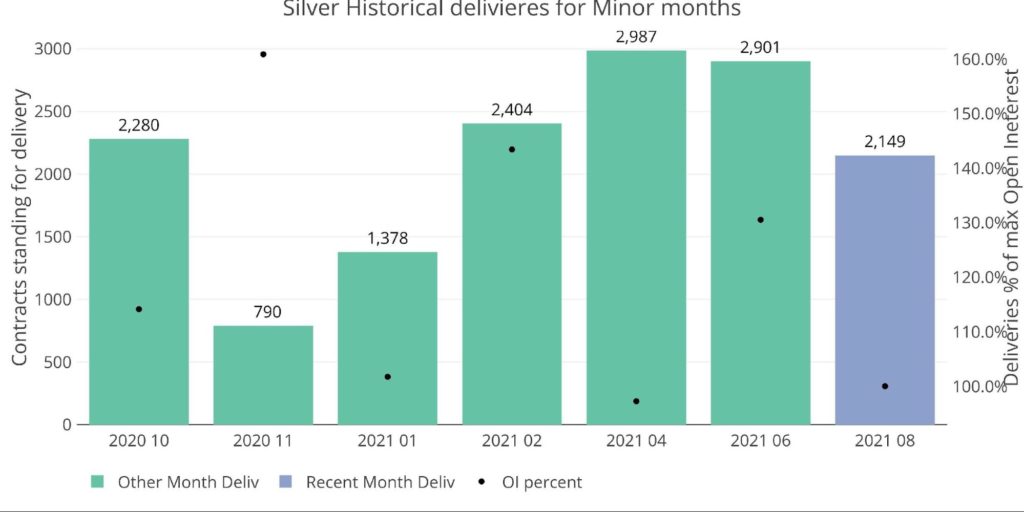

Silver: Recent Delivery Month

Silver completed a minor delivery month. As can be seen below, the amount delivered is below recent months at 2,149 contracts. Currently, there are zero contracts open, so this is most likely the total for the month.

Figure: 1 Recent like-month delivery volume

Looking at the mid-month activity also shows middling results. The red bar below indicates how many contracts were open and delivered in the same month. August had 149 such contracts, above April’s 74 but below the 679 from June. The mid-month contract open for delivery (a strong indication of physical demand) is the main driver for August being below the June contract as shown above.

Figure: 2 24 month delivery and first notice

Despite a slightly lower number than the last several minor months, it’s still important to put this August into historical context. The chart below shows the notional amount of delivery in previous Augusts. Some of the discrepancies are due to the current silver price being higher and not only high contract volume, but the most recent August is substantially above previous August contracts. This shows that delivery demand is still historically high.

Figure: 3 Notional Deliveries

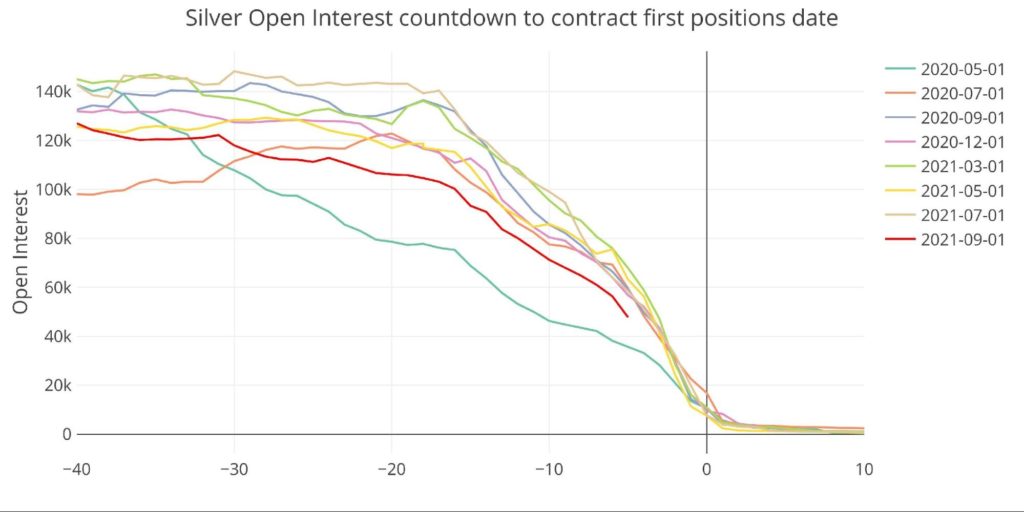

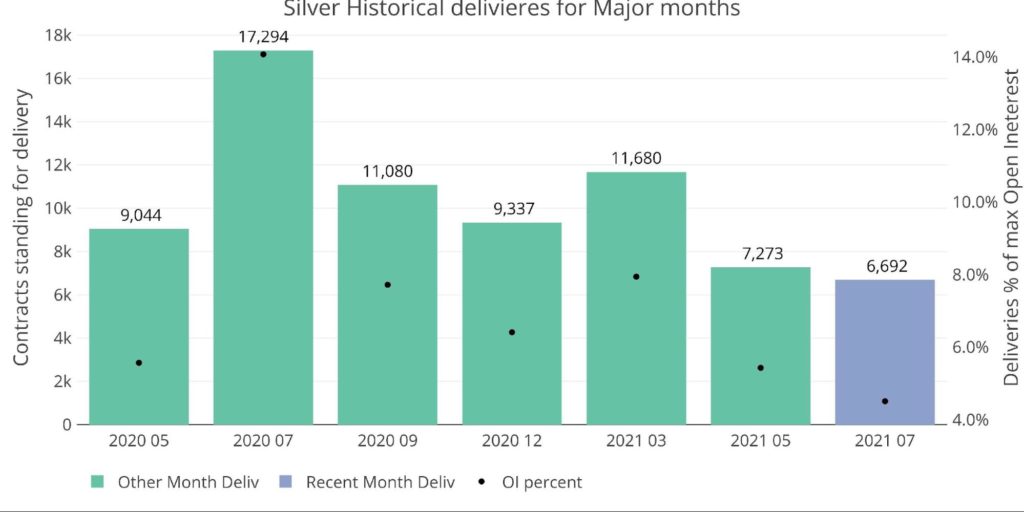

Silver: Next Delivery Month

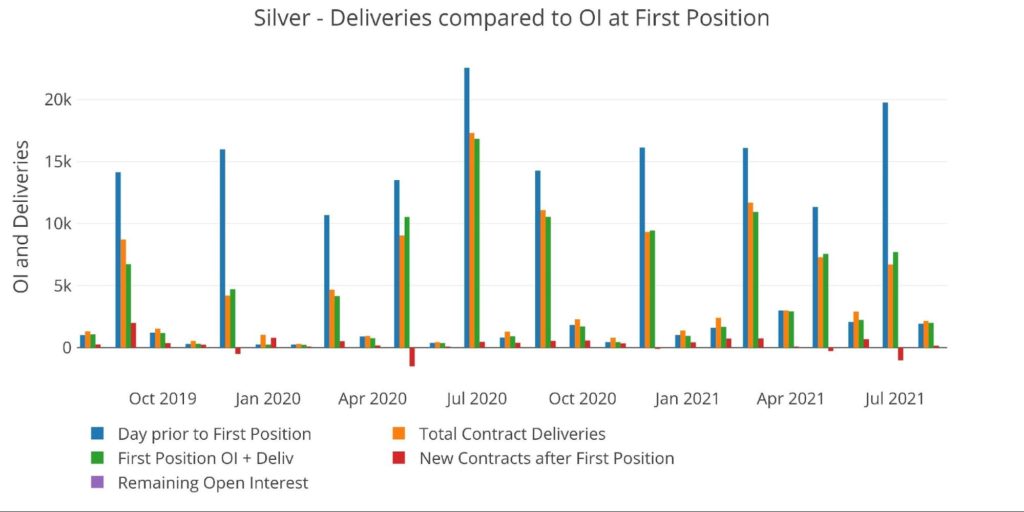

Jumping ahead to September, a major delivery month shows that silver is below the trend line compared to recent major months. It is still too early to gauge what delivery will be like for September based on the chart below, but with 5 days to go there are still 47k contracts open for September.

Figure: 4 Open Interest Countdown

Deliveries have been on a steady decline since peaking last July at 17,294 contracts. July saw some very suspicious behavior. Looking like a record delivery month was possible, Open Interest fell off a cliff on the final day before first notice (see Figure 2 above).

This month should be a good indication of whether the physical delivery is still very strong or starting to wane.

Figure: 5 Historical Deliveries

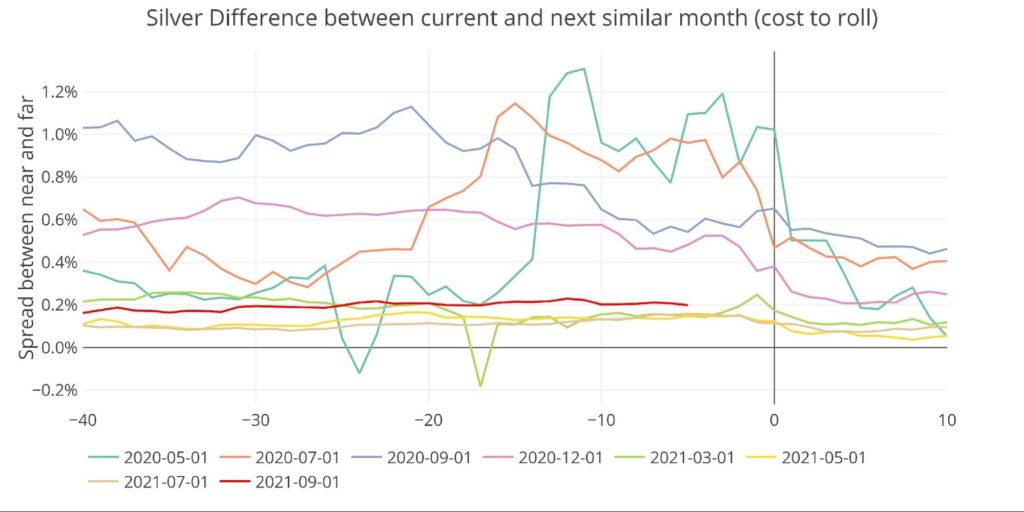

Major Month: Cost to Roll

The cost to roll is the difference between the current month and the next major month (December). It has been slightly above recent months, but might not be high enough to trigger significant deliveries.

Figure: 6 Roll Cost

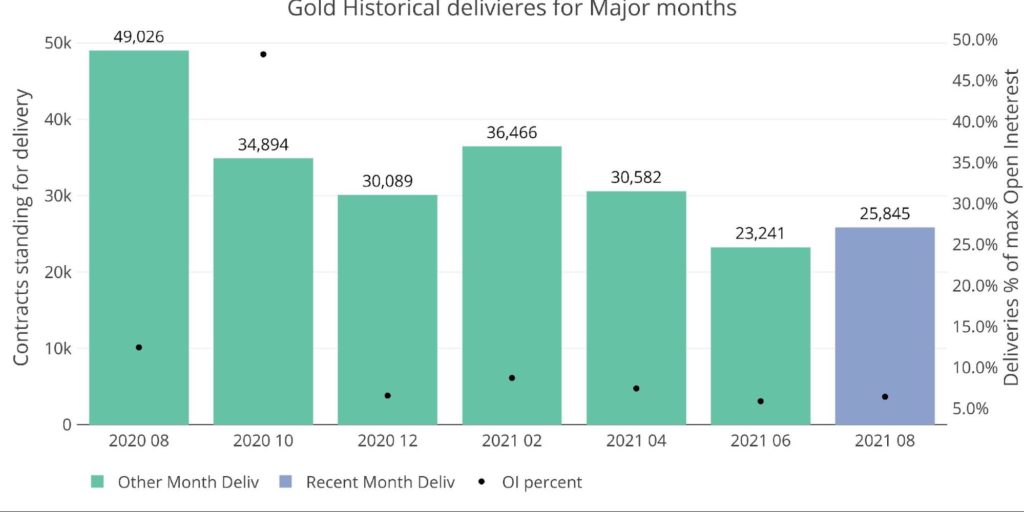

Gold: Recent Delivery Month

The charts below follow the same order as the silver charts above.

August gold is a major delivery month. August gold finally reversed the trend, finishing higher than June with 25,845 contracts standing for delivery and 51 contracts still open.

Figure: 7 Recent like-month delivery volume

The more compelling story is what happened during the month. August gold only had 19k contracts open at First Position. This means that 6,863 contracts have been open for immediate delivery during the month of August. From a major month perspective, that is the largest number since last June saw 7,969 contracts opened for delivery.

This implies strong physical demand for gold. After falling month after month it was great to see an uptick in delivery volume. Especially because it occurred mid-month. August originally looked like it would be a big miss (green bar below).

Figure: 8 24 month delivery and first notice

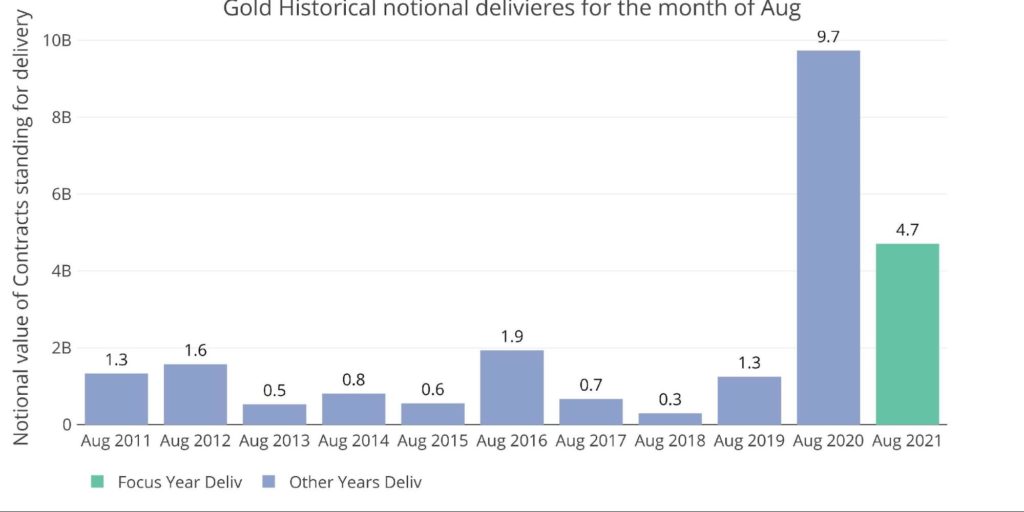

Putting August into historical context shows that this last August dollar delivery is well above all other August months except 2020. At 4.7B dollars of gold being delivered, this is more than double the pre-2020 record.

Figure: 9 Notional Deliveries

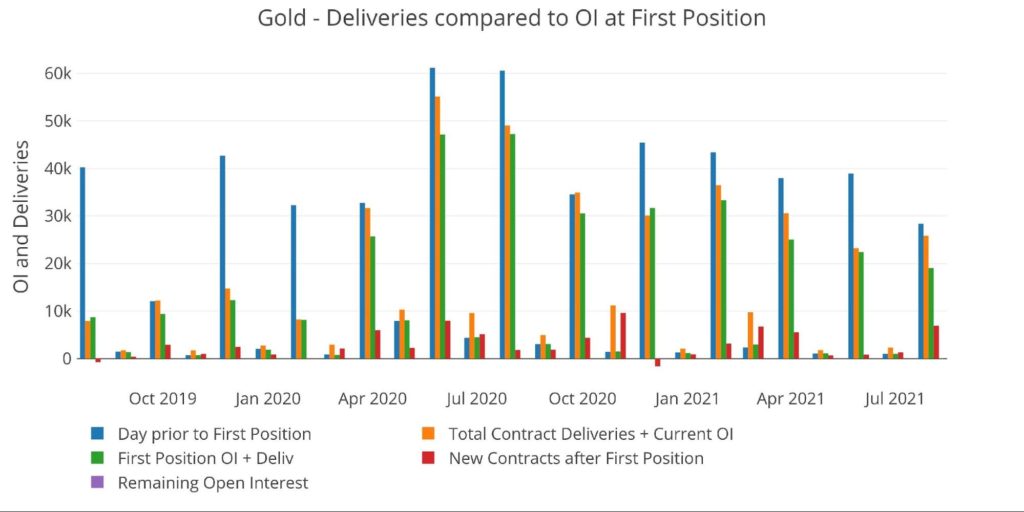

Gold: Next Delivery Month

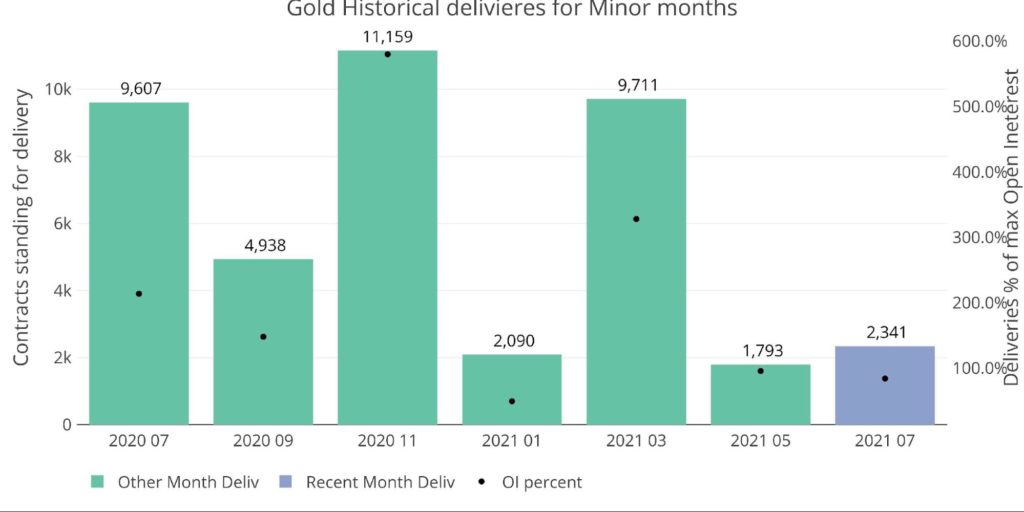

September gold is a minor delivery month. The current trajectory is promising. Open Interest was drifting down and capitulated during the gold flash crash. Since then, gold September has seen a strong rebound. It still sits below recent minor months, but the trend has been an acceleration into the close. If the trend holds, the next 5 days should show an increase in contracts.

Figure: 10 Open Interest Countdown

The last several minor months show a very choppy pattern. There have been a few massive months but also low delivery months. It was good to see July trending above May and January, but it’s still a far cry from the bigger months. Currently, September sits at 1,915 so it’s very possible that September beats out July. If so, this will show growing physical demand and more evidence the downward trend may be reversing.

Figure: 11 Historical Deliveries

Wrapping up

A few months ago, physical demand for gold was looking very weak. It’s possible that the technical picture may have resulted in capitulation. With the Fed looking to delay tapering, gold may see a stronger fourth quarter than most money managers were positioned for. Next week’s COTs report will show the final positioning prior to Labor Day and August jobs numbers.

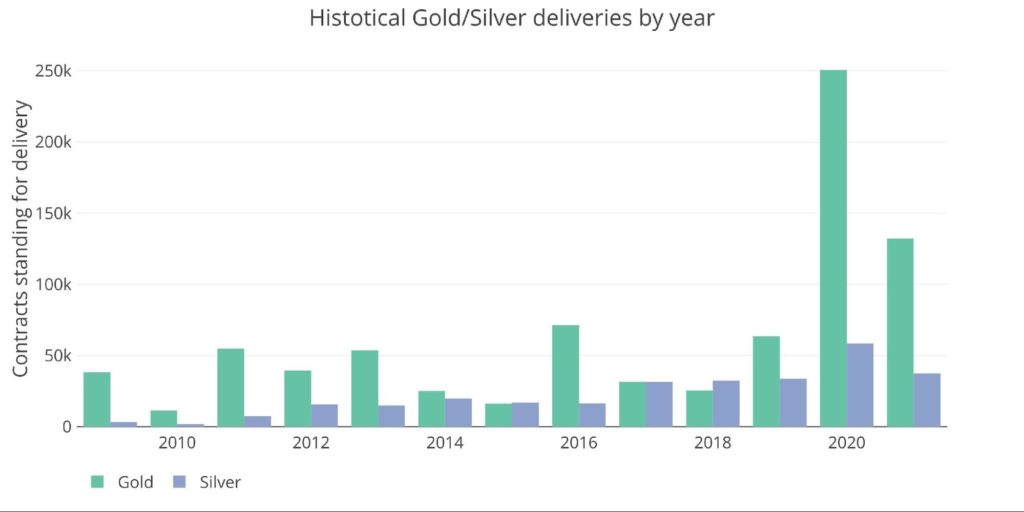

Silver is looking mixed. Neither strong nor weak. Most likely it will follow gold in the months ahead. While a strong fourth quarter probably won’t be enough to top delivery demand from 2020, it’s still clear that physical demand is much stronger than pre-2020 levels.

Figure: 13 Annual Deliveries

Data Source: https://www.cmegroup.com/

Data Updated: Nightly around 11 PM Eastern

Last Updated: Aug 23, 2021

Gold and Silver interactive charts and graphs can be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect.

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect. The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on.

The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on. In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter.

In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter. Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]

Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]