One of the major technical indicators for investors is the 50 Day Moving Average (DMA) vs the 200 DMA. This analysis examines these moving averages for both gold and silver along with other technical indicators.

Wouldn’t it be cool if you could just talk and your words would alter reality?

It would elevate you to superhero status — or super-villain depending on your propensity to use your power for good or evil.

You know, there’s a real-life person who at least appears to have this superpower.

The Federal Reserve wrapped up another FOMC meeting with a whole lot of talk and very little action. Interest rates remain at zero and quantitative easing continues unabated. The mainstream headlines are all focusing on the prospect of QE tapering. In this episode, Friday Gold Wrap host Mike Maharrey explains why he’d write a completely different headline about this Fed meeting.

This analysis focuses on gold and silver physical delivery on the Comex as we move from September into October. See the article What is the Comex for more detail.

Peter Schiff says gold will explode and the dollar will implode when the markets figure out the Fed is crying wolf when it comes to monetary tightening.

The Federal Reserve wrapped up another meeting without making any changes to its current extraordinary, loose, inflationary monetary policy. But the central bank did hint that it may start tapering its quantitative easing program “soon.”

The Federal Reserve wrapped up its September FOMC meeting Wednesday and once again left its extraordinary loose “emergency” monetary policy in place. Quantitative easing continues unabated. Interest rates remain at zero. But the Fed did signal it may begin to taper quantitative easing “soon.” In his podcast, Peter Schiff broke down the FOMC statement and Fed Chair Jerome Powell’s post-meeting press conference. He said he thinks when it comes to tightening monetary policy, the Fed is bluffing.

The silver-gold ratio has ballooned again, indicating that silver is once again a bargain buy.

During a gold bull market, silver typically outperforms gold. We saw this during the big runup in the price of both metals through the early months of the pandemic. In the third quarter of last year, silver charted its best quarter since 2010, finishing up 27.62% through the three months ending Sept. 30. Going back further, silver spiked 106.6% off its March 2020 low.

In yet another sign “transitory” inflation might not be so transitory, FedEx has announced plans to significantly hike shipping rates in 2022.

FedEx said it will raise rates for US domestic, export and import services by 5.9%, on average next year. Some freight rates will rise as much as 7.9%. The company also plans to raise its Ground Economy rates along with fuel surcharges. The rate hikes will go into effect on Jan. 3.

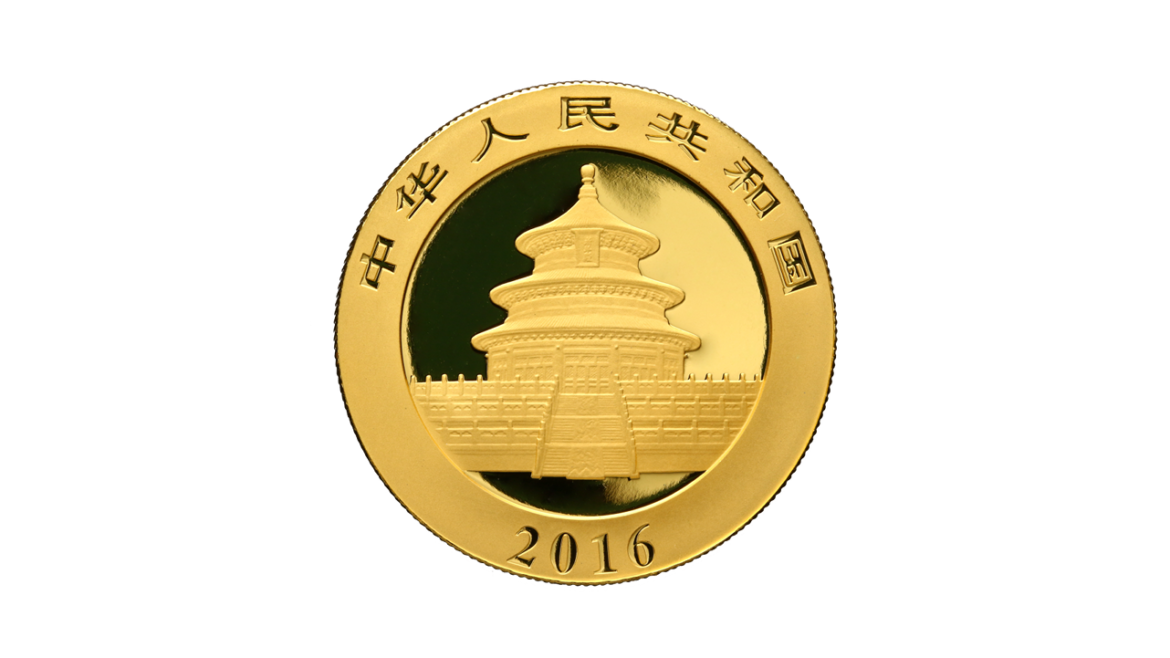

The Chinese gold market continues to show signs of recovery after it was hit hard by the coronavirus pandemic.

Chinese gold demand rebounded sharply in the first half of 2021 after plummeting in 2020, and imports remained strong in July, above 2019 levels, according to the latest data from the World Gold Council.

China ranks as the world’s largest gold consumer.

A Reuters article by Stefano Rebaudo argued that the Federal Reserve might welcome a “bond market tantrum” that pushes bond yields higher. But does the Fed really want higher interest rates? And what would that mean for the economy?

Despite the post-pandemic economic improvement and wide expectations that the Fed will begin tapering quantitative easing in the near future, bond yields have remained stubbornly low. Ten-year Treasury yields remain stuck just above 1.3%.