Much hotter than expected CPI data for October stole the spotlight on Wednesday, but there was more bad news on the inflation front that received less attention. The annual Producer Price Index (PPI) increase in October tied September’s record, as rising producer prices continue to undercut the “transitory inflation” narrative.

The consumer price index was expected to come in hot yet again in October. It came in sizzling.

The actual CPI numbers for last month were even hotter than expected as “transitory” inflation remained well above 5% on an annual basis for the sixth straight month.

Last week, Australia, France, India, the US and the UK announced the launch of the “One Sun, One World, On-Grid” initiative. The plan is to connect solar energy grids across borders. This could provide a big boost to silver demand.

Despite government officials and central bankers continuing to peddle the “transitory” inflation narrative, the average American isn’t buying it. They feel the squeeze of rising prices in their wallets. And it’s the average American who is hurt particularly hard by the skyrocketing cost of living. Peter Schiff appeared on the Megyn Kelly show to talk about how inflation really hurts working and middle-class Americans.

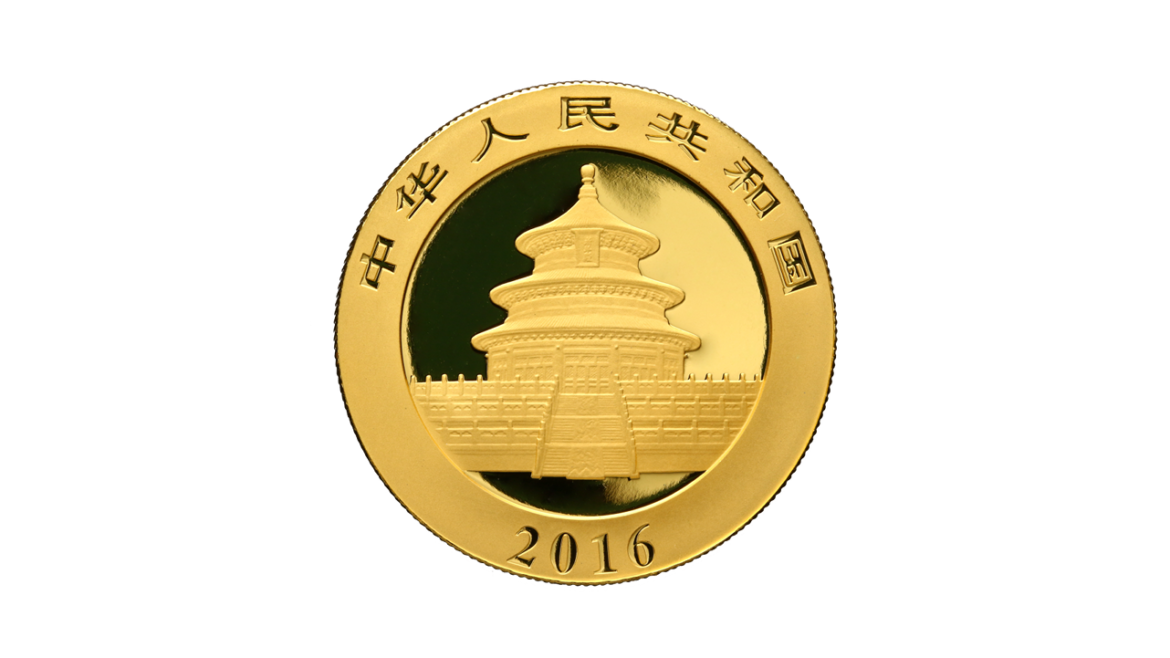

Gold demand remained strong in October according to the latest data released by the World Gold Council.

Both gold withdrawals from the Shanghai Gold Exchange (SGE) in October and gold imports in September were up year-on-year, and Chinese ETF gold holdings set a new record. These all signal that the Chinese gold market continues to recover after it was hit hard by the coronavirus pandemic.

American consumers aren’t buying the transitory inflation narrative.

Even after five straight months of annual CPI increases over 5%, Jerome Powell continues to insist inflation is “transitory” and the result of a “supply chain problem.” But according to the New York Federal Reserve Survey of Consumer Expectations, people aren’t buying this story. They expect inflation to be running at 5.7% a year from now. And in three years, they still expect the inflation rate to be at 4.2%.

After all the drama, Congress finally did what everyone knew it would do. It raised the debt ceiling by $480 billion in October. The Treasury wasted no time and quickly added $480 billion to the national debt in the second half of the month.

With this new debt tagged on, if the Fed has to raise rates to 6% to fight inflation, it would increase interest costs by $250 billion within 6 months and nearly $1 trillion within a few years. This is why the Fed must tell everyone that inflation is transitory.

American consumers piled on more debt in September as higher prices squeezed wallets.

Consumer credit grew by $29.9 billion in September, bringing the total to $4.37 trillion, according to the latest data from the Federal Reserve. The increase in consumer debt nearly doubled the consensus estimate of a $15.5 billion increase.

Despite the Fed announcing it will begin tapering QE and a better than expected jobs report, gold rallied on Friday. In his podcast, Peter Schiff said this is sign sellers are exhausted.

October jobs came in at 531k, finally beating expectations with strength shown across the board. Furthermore, August and September were both revised upwards by over 100k. ‘

Perhaps even more surprising is the early reaction in the gold/silver market. More on this below.