In the spring of 2021, the Fed was still insisting spiking inflation was “transitory.” Fast forward one year. Inflation is as hot as ever. Fed Chair Jerome Powell was forced to abandon the transitory narrative last fall. In April, the CPI was up 8.3% on an annual basis. Today, Powell admits the Fed was wrong, but claims everybody else made the same mistake.

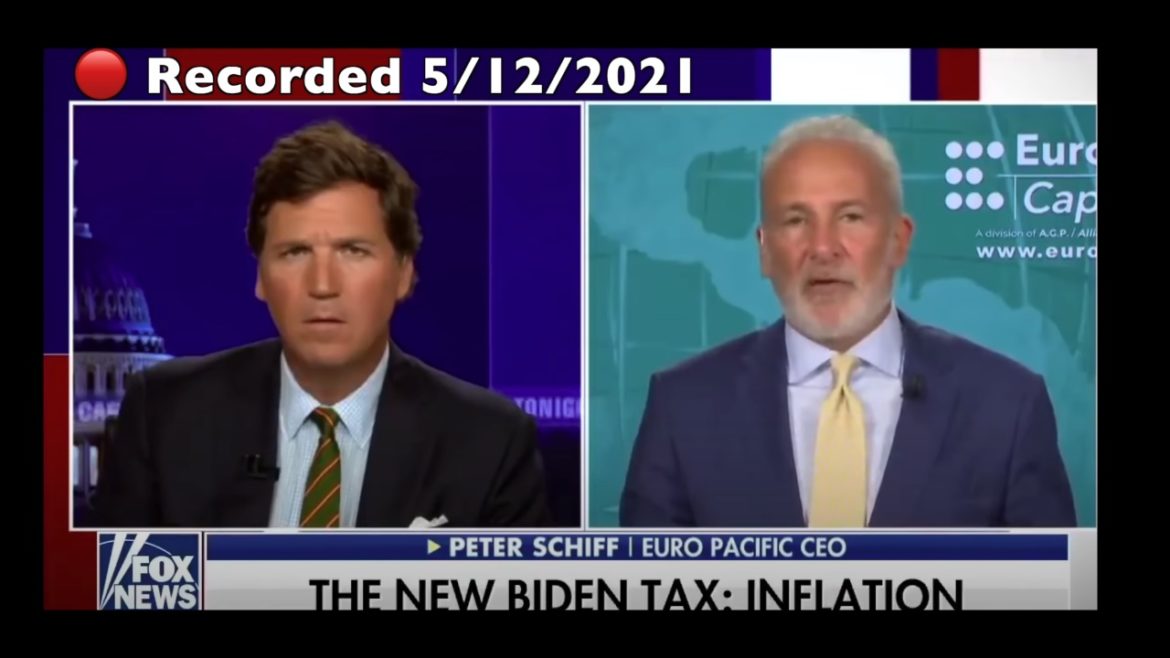

Well, not everybody, as the following clips prove.

The following provides an in-depth analysis of the COMEX futures options market for gold and silver.

Gold: Recent Delivery Month

Gold started June delivery with 22,394 contracts outstanding. This is below April and December, but above August, October, and February. It is about on par with last June.

Despite rising through the month, the Fed balance ended up shrinking slightly by $25 billion in May, even as it slightly increased its Treasury holdings.

This was the first monthly decline in the balance sheet since $220B of “Other” rolled off in July 2020. In that case, “Other” were repurchase agreements with foreign entities to provide liquidity and alleviate stress in the global markets.

When the Federal Reserve tinkers with interest rates, it creates all kinds of economic distortions. This is very obvious in the housing market. Over the last couple of years, the Fed blew up a giant housing bubble. Now, the central bank has pricked that bubble. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey looks at the housing market as a microcosm of the broader economy.

According to the seasonally adjusted data, M2 contracted by $83B in April. The Money Supply analysis last month highlighted the slowing money supply growth rate, but this is the first contraction seen since January 2010.

There is all kinds of spin out there when it comes to inflation. Peter Schiff recently appeared on News Nation to talk about the economy. He explained that the spin misses the mark. The real source of inflation isn’t the pandemic or Putin. It’s the Federal Reserve.

People come up with all kinds of excuses for inflation. First, they told us there was no inflation. Then they insisted that it was transitory. Then they claimed it was caused by greedy corporations. Later they shifted the blame to Putin. But none of this gets to the root cause of inflation – the expansion of the money supply by the Federal Reserve.

The Fed has barely started raising interest rates but the air is already seeping out of the housing bubble.

New single-family home sales plunged by 16.6% from March and were down 26.9% year on year. New home sales dropped to the lowest level since the lockdown in April 2020.

The Federal Reserve has talked a lot about fighting inflation. But what has it actually done?

In practice, not a lot. It has nudged interest rates up 75 basis points. And while the Fed has ended the massive quantitative easing program that it ran during the pandemic, it pushed balance sheet reduction back from May until June. In fact, the balance sheet has crept upward throughout the entire month of May.

Federal Reserve Chairman Jerome Powell insists the central bank can fight inflation because the economy is strong. President Joe Biden keeps telling us the economy is strong. The talking heads on CNBC insist the underlying economy is strong. In a recent podcast, Peter Schiff talked about the economy. As it turns out, it’s not so strong.