Turkey: A Microcosm of Gold’s Role in a Modern Society (Video)

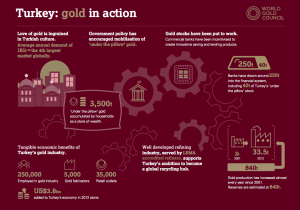

The World Gold Council has released a fascinating new report on Turkish gold demand and gold culture. Many gold investors are aware that China and India have been the top gold consumers in the world, but Turkey has a thriving gold economy as well. In fact, Turkey is the world’s 4th largest gold consumer, and in many ways, gold is even more integrated into the Turkish economy.

- At least 3,500 metric tons of gold is saved “under the pillow” of Turkish citizens.

- Turkey works actively to encourage wise investment and savings of this gold.

- Gold ATMs are common in Turkey, making it easy for consumers to buy high-quality physical bullion.

- About a quarter million Turks are employed by the gold industry.

- Gold consumption made up about 12% of Turkey’s GDP in 2013.

Turkey: Gold in Action is available for download here. Here’s a video introduction featuring the report’s highlights.

Follow along with this full transcript:

Turkey is a microcosm of gold supply and demand in action, illustrating the broad role gold can play in modern society. In our report, Turkey: Gold in Action, we have a look at the role gold can play in the daily life of the world’s fourth largest gold consuming country, and the positive effect gold can have in boosting Turkey’s economy.

In 2012 alone, gold consumption, fabrication, and recycling added at least 3.8 billion US dollars to Turkey’s economy. Turkey has a small, but growing gold mining industry, with production increasing every year since 2001. In 2001, annual output stood at 2 tonnes, growing to 33.5 tonnes in 2013 – a compound annual growth rate of 20%.

Mining companies have made significant investments in Turkey. Over the past 25 years, gold mining companies invested over 700 million US dollars in mining and exploration. Over the past 5 years, the three largest gold miners have invested over 1 million US dollars.

“[Video of interview with Mehmet Yilmaz of Tupgrag Metal (El Dorado):] ‘I can easily say that Turkey is very important asset for El Dorado, since we have two operations here, and approximately 2,200 employees in Turkey, since we’ve been producing almost half of the gold production in Turkey. Corporate social responsibility projects – they’re always very important for El Dorado. We believe that we have to fulfill all our regulatory requirements by just paying the taxes, royalties, and other premiums. We believe that we have to somehow return some of our funds back to the community by creating successful corporate responsibility projects. We even started those projects before the operation started. We created four main areas for our corporate social responsibility projects. These are education, public health, environmental activities, and also infrastructures in rural areas.’ [End interview]

“Over recent years, recycling has taken on greater significance, and refiners play a key role in this market. Processing large amounts of recycled gold, but also processing a large amount of domestically generated gold. Gold typically reenters the supply chain via consumers selling back their gold jewelry, bars, and coins to jewelry retailers.

“Gold is deeply engrained in Turkish culture. There’s a long tradition of gold demand. Over the past 10 years, Turkey accounts for around about 6% of total global consumer demand.

“[Video of interview with Naci Kurtulan, Kurtulan Jewellery:] ‘In Turkish culture, gold is security. It’s traditional to give high-karat gold presents on special days, like weddings. We love to use 24-karat gold, and our inspirations are coming from out culture…’ [End interview]

“Turkey’s jewelry industry benefits from exports and healthy tourist trade. Indeed, the exports have made a positive contribution to Turkey’s trade balance. Between 1998 and 2013, Turkey’s jewelry exports grew from $209 million to $3.3 billion. Turkey’s long-standing desire for gold has resulted in Turkish households accumulating a large stock of gold tucked under the pillow; at least 3,500 tonnes, by our estimates. This accounts for around 12% of GDP in 2013.

“[Interview with Mustafa Dereci, Kuveyt Turk Bank:] ‘Under the pillow stock is a famous saying. Actually nobody keeps their gold under the pillow, but it’s just a saying. It refers to unused, idle gold in the form of jewelry or any way; totally unused and idle, unproductive.’ [End interview]

“Banks have created new and innovative gold products to help tease the gold out from under the pillow. This includes gold savings accounts, which allowed consumers and savers to trade gold, Turkish lira, and other currencies; gold accumulation plans, which allow savers to save gold on a regular basis; fixed-term gold deposit accounts, which pay interest rates; and fairly, gold ATMs, which allow consumers to buy hallmarked gold.

“[Interview with Mustafa Dereci:] ‘Gold is very stable, and it is as liquid as paper money. When we come to the products and services based on gold, Turkish banks have the most diversified range of products based on gold.’ [End interview]

“Turkey, perhaps better than anywhere else, illustrates the broad role that gold can play in modern society. For more information, and to read our report, Turkey: Gold in Action, please visit our website.”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

Leave a Reply