Supply and Demand Fundamentals Drive Gold Rally

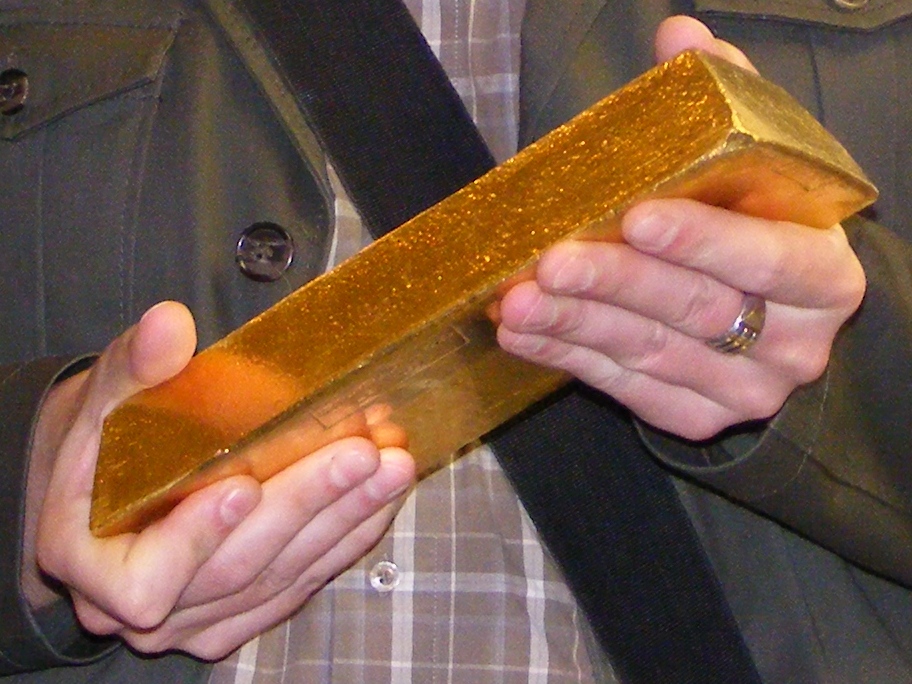

Shaky economic news, negative interest rates, and stock market turmoil have helped drive the recent gold rally, but an even more fundamental principle underlies the yellow metal’s surge – simple supply and demand.

As a recent CNBC report put it:

Consumers are lapping up gold at a time supply is declining, helping underpin a rally in the precious metal.”

While China’s central bank continues to buy gold, adding another 0.6% to its holdings in February, the Chinese people are also pulling money out of stocks and investing it in gold, according to Padraig Seif, chief executive of Hong Kong-based trading firm, Finemetal Asia.

But it’s not just investors in traditional markets like China and India that are buying gold. According to the CNBC report, demand is surging in emerging markets as well:

Demand from emerging markets in particular is strong as currencies such as the Indonesian rupiah, the Malaysian ringgit and the Vietnamese dong has fallen sharply in the last 12 to 18 months against the US dollar, prompting consumers in these markets to buy physical gold, which is seen as a haven in times of tumult.”

We see see more evidence of a reobust appetite for gold in the continued demand for bullion coins. After selling out of American Gold Eagles at the end of 2015, the US Mint reported brisk sales as 2016 got underway. In January, the mint sold 124,000 ounces of Gold Eagles compared with just 81,000 ounces in the first month of 2015. It was the highest January sales level since 2013.

In fact, demand for gold is so strong the world’s largest asset manager recently had to temporarily suspend the creation of new shares of its gold ETF due to the demand for the physical metal.

On the other side of the equation, surging demand is happening in an environment of shrinking supply. According to the World Gold Council, total supply declined 4% in 2015 to 4,258 tons. That represents the lowest level since 2009.

Seif said when you look at the fundamentals, the recent rally in gold comes as no surprise:

Market sentiment has changed quite a bit…on the supply side, more and more bullion banks are pulling out of the bullion trade so on the supply side, you’ve got a decrease in supply; on the demand side you’ve got an increase. It’s quite natural then that the gold price will go up.”

With economic storm clouds gathering in the US and negative interest rates becoming the norm, it appears factors driving demand won’t soon abate. That means the fundamentals continue to look favorable for gold.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

In this uncertain world keeping all eggs in one basket is very silly idea.The gold is the best “insurance”

I keep hearing that the quantity of outstanding “paper gold” represents over 500 times the amount of physical bullion extant. If more physical gold is being removed from the marketplace, won’t this ratio explode geometrically? If available physical declines by 20%, the ratio goes from 500 to 625, right? How many years of net production from mining would be required to fulfill these paper claims on gold??