Precious Metals Are Back in the Spotlight

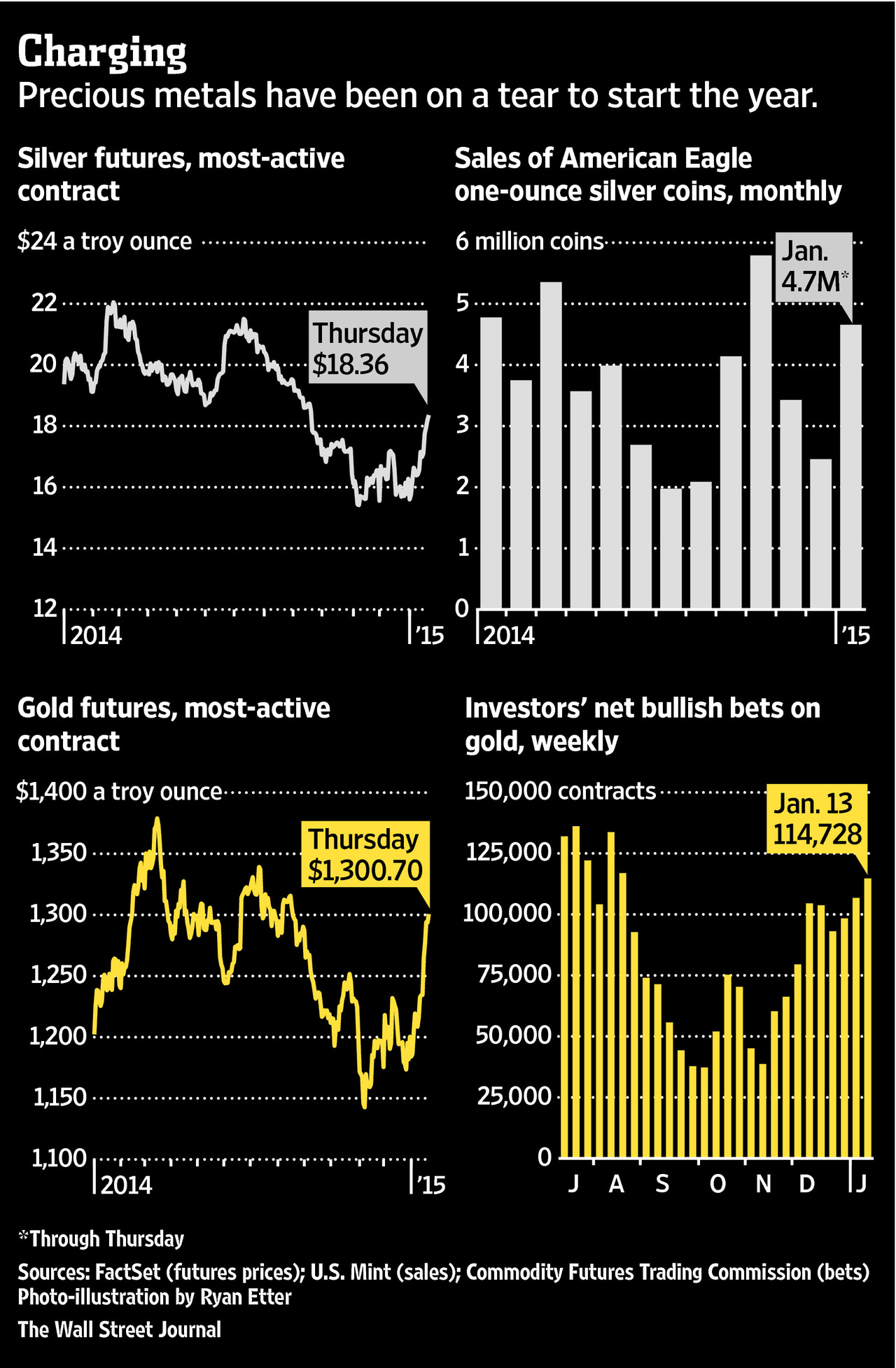

As of this morning, gold is up more than 10% and silver is up more than 16% since the beginning of the year. Gold stocks have also been strong, especially in the mining sector. While the S&P 500 has dropped about 1%, the Arca Gold Miners Index is up nearly 25%. Unsurprisingly, the mainstream financial media is starting to jump on the gold bandwagon.

In an article on the front page of its business section, The Wall Street Journal looks at all the factors influencing bullish sentiment for precious metals thus far in 2015. These include:

- Bubbly stock markets at or near record highs are making investors nervous.

- There are fears that European QE could trigger inflation.

- The Swiss franc’s euro peg has created massive volatility in the foreign exchange markets.

- Collapsing oil prices have money managers looking to other commodities like precious metals.

- Exchange-traded funds have increased gold holdings by 1.2 million ounces in January – the most since August 2012.

- Large speculative investors are placing their most bullish bets on metals in five months.

- The US Mint has already sold a massive amount of American Silver Eagles. Could 2015 see another sales record for the mint?

While Peter Schiff has encouraged investing in precious metals for the past two decades for fundamental reasons, it wasn’t until speculators got excited by metals that gold and silver shot up to their record highs in 2010 and 2011. Could 2015 be the beginning of another speculative rush into precious metals? Peter thinks so, because the world is going to lose faith in the ability of central banks and politicians to centrally manage global economies.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

While gold bullion is most often sold in bar or 1oz coin form, the Korean retail market is benefitting from gold’s latest success with a very atypical marketing strategy. It has been traditionally thought that investors prefer larger increments of bullion because they simplify calculations and have a lower transaction cost than buying the same amount of gold in smaller increments. Demand for traditional bars and coins in South […]

While gold bullion is most often sold in bar or 1oz coin form, the Korean retail market is benefitting from gold’s latest success with a very atypical marketing strategy. It has been traditionally thought that investors prefer larger increments of bullion because they simplify calculations and have a lower transaction cost than buying the same amount of gold in smaller increments. Demand for traditional bars and coins in South […] With the eventual introduction of central bank digital currency (CBDCs) now seemingly inevitable, there are a lot of directions central banks could take with their digital currency projects that would have dramatic implications for the price of gold.

With the eventual introduction of central bank digital currency (CBDCs) now seemingly inevitable, there are a lot of directions central banks could take with their digital currency projects that would have dramatic implications for the price of gold. Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

[…] READ MORE […]

Finally gold is going up.

They can fool some but not everybody ,no wonder people buying gold and silver.I think and hope that in short future Comex and London fix will go bankrupt.They can print money but not gold and silver and that is their big, big weakness.