Gold: More than Just a Hedge

Conventional wisdom holds that gold is a good store of value, and provides a hedge of protection against inflation and economic upheaval. But a close look at the data reveals gold offers a long-term growth trajectory comparable to other financial asset classes.

In fact, as we reported in August, gold has actually outperformed the stock market so far this century. If we index both gold and the S&P 500 to 100 as of Dec. 31, 1999, gold had returned 86% more than the market.

Over the past 17 years, the S&P 500 has undergone two major contractions, both of them resulting in a loss of around 40%. Gold, meanwhile, has held its value well, boosting its appeal as a portfolio diversifier.”

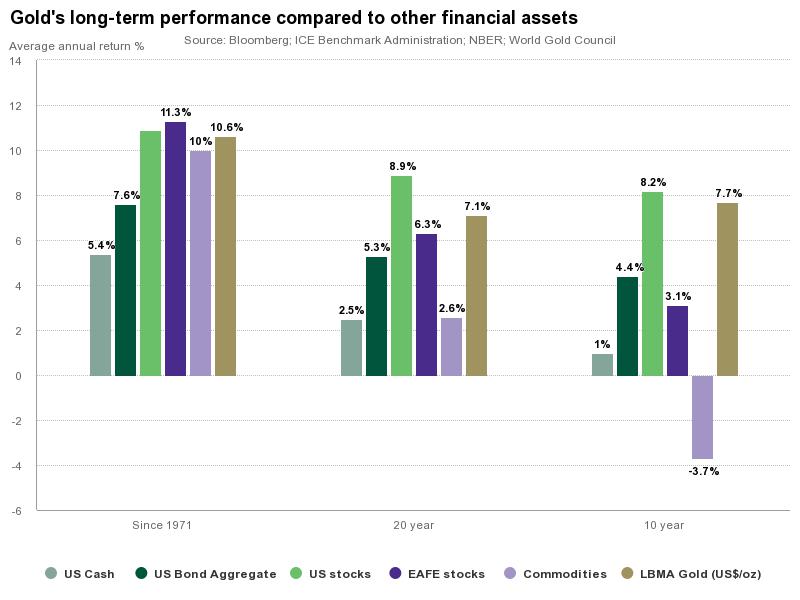

Analysis by the World Gold Council shows that gold actually compares favorably with a number of financial assets when you analyze growth, whether you look at a 10-year, 20-year, or even a 40-year time span.

Looking over the last 10 years, gold grew 7.7%. The only asset class with stronger growth was US stocks, coming in at 8.2%. EAFE (Europe, Australasia, Far East) stocks, the US Bond Aggregate and US cash all showed significantly lower growth. Commodities actually fell 3.7% during that time. Bonds were the closest rival to gold, but only grew 4.4%.

Going back 20 years, we see a very similar dynamic. Gold remains the second best asset class for growth only behind US stocks. Other financial assets show better results than we saw over the 10-year time frame, but gold still rises above the rest.

Looking back to 1971, gold continues to hold its own. Gold has grown 10.6% in that time span. Both US and foreign stocks slightly outperform gold, with EAFE stocks leading the way at 11.3%. Gold outperformed bonds, cash and commodities.

The World Gold Council included this analysis in a recent report on sovereign wealth funds, arguing that they should include gold.

Gold has unique qualities that can meet the needs of sovereign wealth funds. It features a long-term pro-growth trajectory without sacrificing its short-term diversification and safe haven characteristics. It has virtually no correlation with funding sources like oil, while continuing to be one of the world’s most liquid asset classes. As a new era of uncertainty dawns on global markets, the evolving nature of gold promises to give it a pivotal role in enhancing the wealth of nations.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]