Gold Demand in Tech and Industry Up for Eighth Straight Quarter

Demand for gold in technology and industrial sectors grew for the eighth consecutive quarter in Q3, according to the World Gold Council Global Demand Trends Q3 report.

Overall, gold used in technological applications grew 1% to 85.3 tons in the third quarter. That marked the eighth consecutive quarter of year-on-year growth. Strong demand in the electronics sector helped drive overall industrial and tech demand for the yellow metal higher.

The traditional technology hubs of Mainland China and Hong Kong, Japan and the US all registered growth in gold volumes in Q3 — 1.9%, 1.0% and 3.0% respectively. Taiwan and Singapore registered minor falls in demand, but both they are relatively small players in the sector.

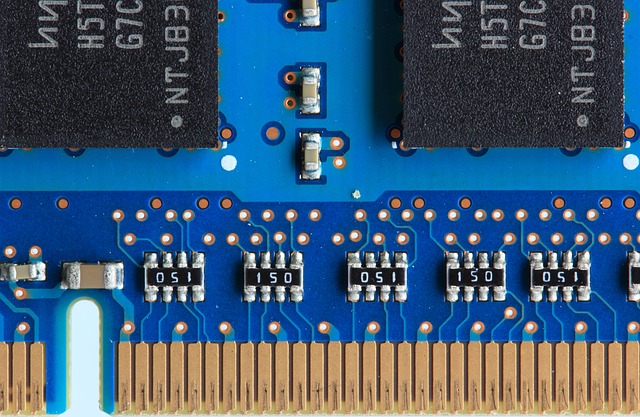

The amount of gold used in electronics fabrication increased by 2% year-on-year to 68.5 tons. The memory sector continued its recent strong performance. The WGC report estimated growth was in the range of 2-5% overall. Strong demand for servers and smartphones drove the increase. Both require ever growing amounts of memory.

The demand for printed circuit boards (PCBs) also pushed industrial demand for gold higher. The strong market for servers supported demand, together with growth in the automotive industry and 5G infrastructure deployment. Gold used in PCBs was estimated to be 5-7% higher year-on-year.

Gold remains a key metal in R&D activities. During the recent GOLD2018 conference held in Paris last summer, over 500 attendees from around the world gathered to share their gold-based research. There were many examples of technologies moving towards commercialization.

As we’ve reported on extensively, gold is increasingly being used in the healthcare field. For instance, scientists have discovered a process using gold nanoparticles that helps reduce inflammation and speeds healing in damaged muscles. Scientists have also developed a blood test using gold nanoparticles that could help with cancer treatment. In fact, scientists have developed a number of cancer treatments using gold nanoparticles over the last few years. Scientists at UC Berkeley have developed a process using gold to repair the mutation that causes Duchenne muscular dystrophy. And earlier this year, a team of Chinese researchers announced they were able to partially restored the sight of blind mice by replacing their deteriorated photoreceptors – sensory structures inside the eye that respond to light – with nano-wires made of gold and titanium.

We generally think of gold as an investment as well as money, but it is increasingly being used to improve our quality of life and heal the sick. The use of gold in the field of medicine, and more broadly in technology and industry, will likely put upward pressure on demand for the yellow metal in the future.

Over the past decade, the tech sector accounted for more than 380 tons of gold demand annually. That’s 13% ahead of central bank purchases during the same time period.

Tech demand for both gold and silver will likely continue to increase over the next several decades. Silver demand has always been heavily influenced by industrial use, but gold is becoming more and more important in industry, especially in high tech applications. It’s important to consider these supply and demand fundamentals as you analyze the broader precious metals markets.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]