Staggering US Mint Silver Eagle Coin Sales

Peter Schiff’s latest research report, The Powerful Case for Silver (available for download here), noted the wide gap between US Mint sales of American Silver Eagle and American Gold Eagle coins. The numbers continue to amaze. In a commentary on Wealth Wire, Steve St. Angelo goes through the numbers and explains why smart investors are making big plays on physical silver. For those who cannot afford to buy gold right now, silver is a great alternative to consider.

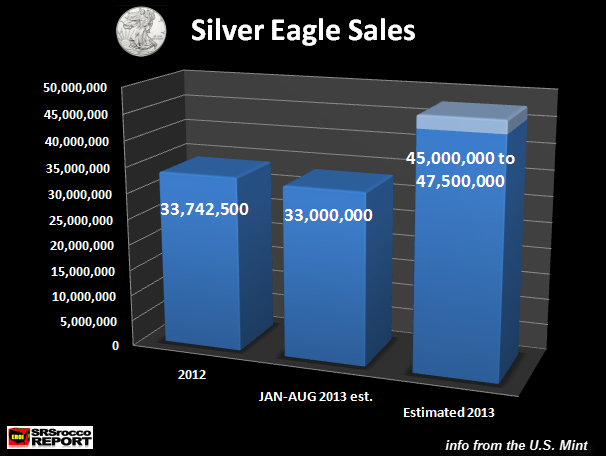

“Ever since the big take-down in the price of the precious metals in April of this year, an interesting trend has taken place in the Gold & Silver Eagle market. While demand for both coins remained strong in the first four months of the year, investors are now overwhelming purchasing more Silver Eagles…

Silver Eagle sales are on track to surpass the total sales for 2012 within the next 2-3 weeks. I forecast that total sales for Silver Eagles by the end of August will be 33 million oz. Of course, we could see a bit more or less depending how the U.S. Mint updates its records.”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In April, the U.S. economy added a disappointing 175,000 jobs, falling short of expectations and nudging unemployment up to 3.9% (see current trends here). This signals a slowing economy that might force the Federal Reserve to put the guard rails back on. Our guest commentator gives a deeper look at a worrisome trajectory: while part-time […]

In April, the U.S. economy added a disappointing 175,000 jobs, falling short of expectations and nudging unemployment up to 3.9% (see current trends here). This signals a slowing economy that might force the Federal Reserve to put the guard rails back on. Our guest commentator gives a deeper look at a worrisome trajectory: while part-time […] Beneath the sweet surface of our favorite treats lies a bitter reality: inflation has sent cocoa prices soaring to unprecedented heights. Once deemed the food of the gods and now a daily indulgence for millions, chocolate is facing a dramatic upheaval as wholesale cocoa prices have rocketed past $11,000 per ton. Our guest commentator explains […]

Beneath the sweet surface of our favorite treats lies a bitter reality: inflation has sent cocoa prices soaring to unprecedented heights. Once deemed the food of the gods and now a daily indulgence for millions, chocolate is facing a dramatic upheaval as wholesale cocoa prices have rocketed past $11,000 per ton. Our guest commentator explains […] As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

Leave a Reply