Gold and Silver Both Drain from Comex Inventory

Gold and silver have both significantly drained from the Comex inventory since August 1.

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock data at the Comex to show the physical movement of metal into and out of Comex vaults.

Registered = Ready for Delivery,

Eligible = Warrant assigned but can be made available for delivery

Current Trends

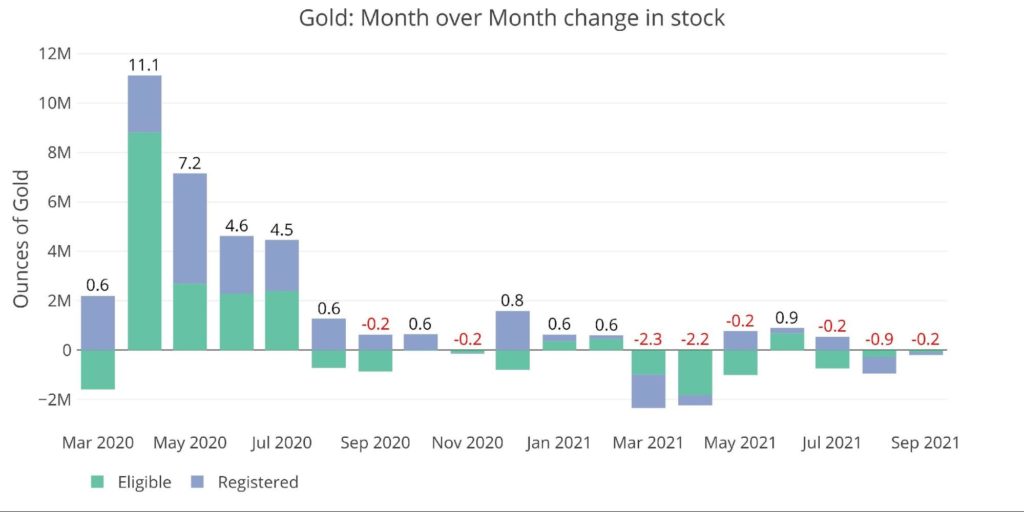

Over 1 million ounces of gold left the Comex vaults since August 1. This continues the current trend that has been in place since March 2021 of metal draining from the Comex.

Figure: 1 Recent Monthly Stock Change

The same has occurred with silver. While July and August saw some inventory added, the drainage began again in September.

Specifically, Registered (silver available for delivery) declined by 5.5M ounces. Registered may have increased by 3.7M since Sept. 1, but that is really people taking ownership of the bars and leaving them at the Comex.

Figure: 2 Recent Monthly Stock Change

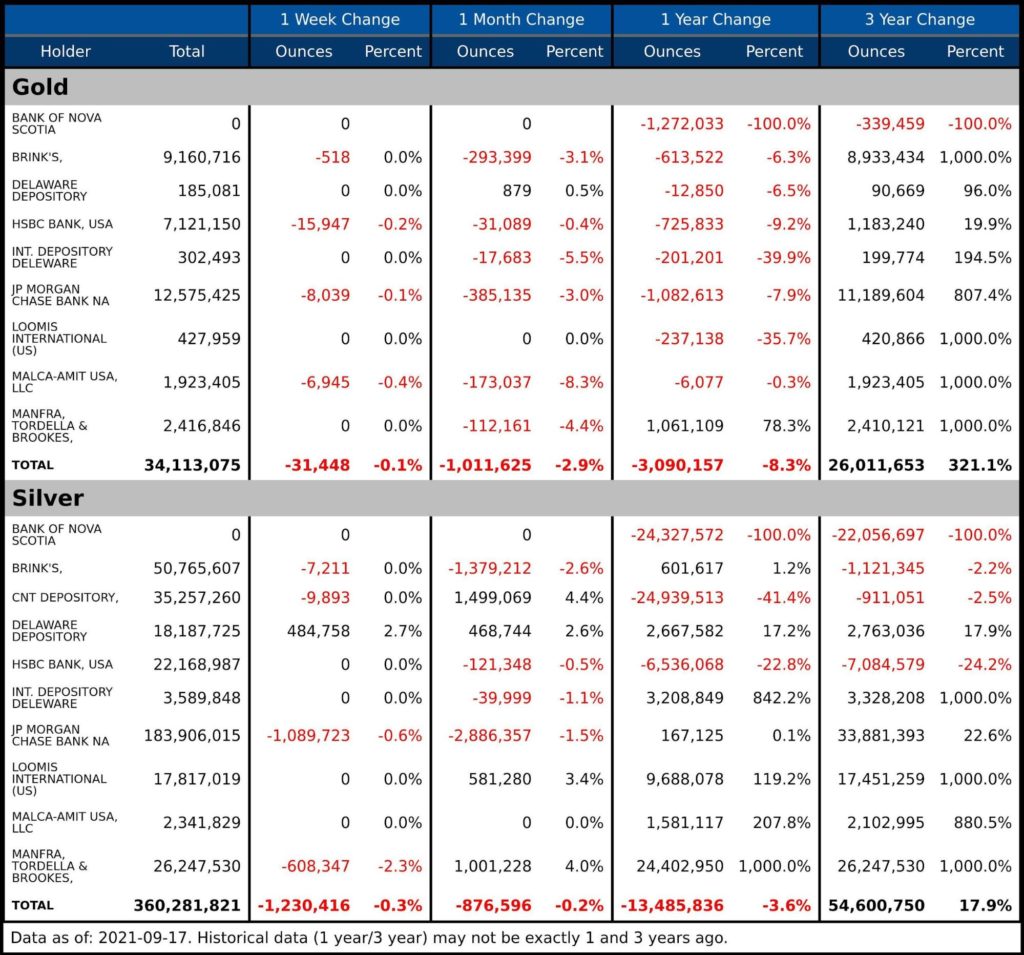

The table below summarizes the movement activity over several time periods.

Gold

- In the last month, the Comex lost 1m ounces of gold which is 33% of the total over the last 12 months. This means the trend is accelerating.

- The latest week saw a slowdown of only 31k ounces, so it will be interesting to see if this picks back up.

Silver

- In the last week, silver saw a whopping 1.2M ounces leave Comex vaults and nearly 3.8M leave Registered.

- Both these figures represent about 10% of the total over the last 52 weeks.

- As Figure 2 above shows, the drainage of silver was strong from Feb to June. The recent activity may demonstrate the drainage trend has continued in the face of falling prices.

Figure: 3 Stock Change Summary

The next table shows the activity by bank/Holder. It shows where the large supply came from in 2020 (see charts below) and also where the drainage has been coming from recently.

Gold

- Over the last month, every vault except one (Deleware) has seen gold supply drain or stay flat.

- Even Manfra saw 112k ounces drained and they are the only vault in positive territory over the last 12 months

Silver

- The activity in silver has been more complex with some vaults adding and others losing.

- JP Morgan and Manfra lost 1.6M ounces in the last week alone where Delaware added 400k

- JP Morgan has lost almost 3M ounces in the last month which represents 1.5% of their massive war chest of silver

Figure: 4 Stock Change Detail

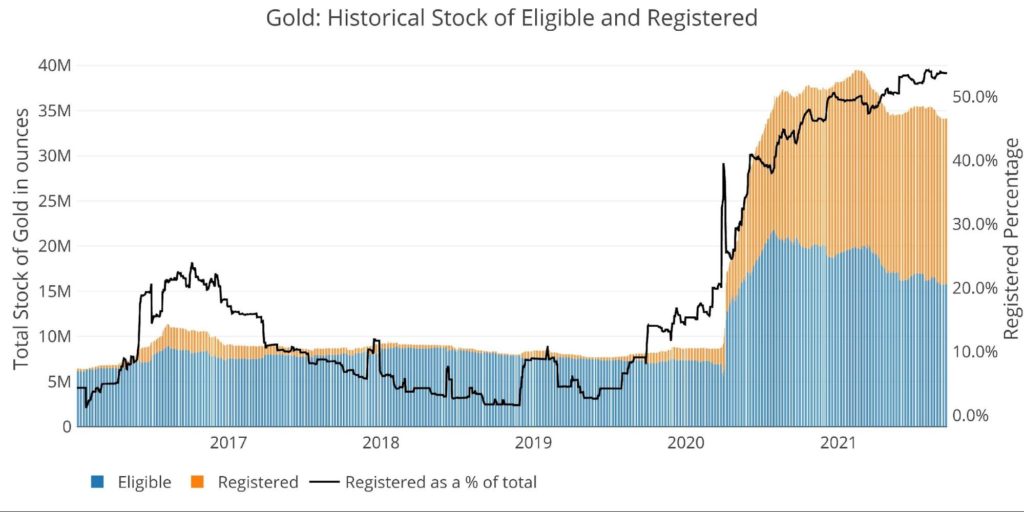

Historical Perspective

Zooming out and looking at the inventory for gold and silver since 2016 shows the impact that COVID had on the Comex vaults. Gold had almost nothing in the Registered category before JP Morgan and Brinks added their London inventory with nearly 20m ounces. Prior to COVID, this meant that almost no gold was available to move from Registered into Eligible. That changed quickly but since the start of 2021 available inventory has been declining. It remains well above pre-COVIDevels though.

Figure: 5 Historical Eligible and Registered

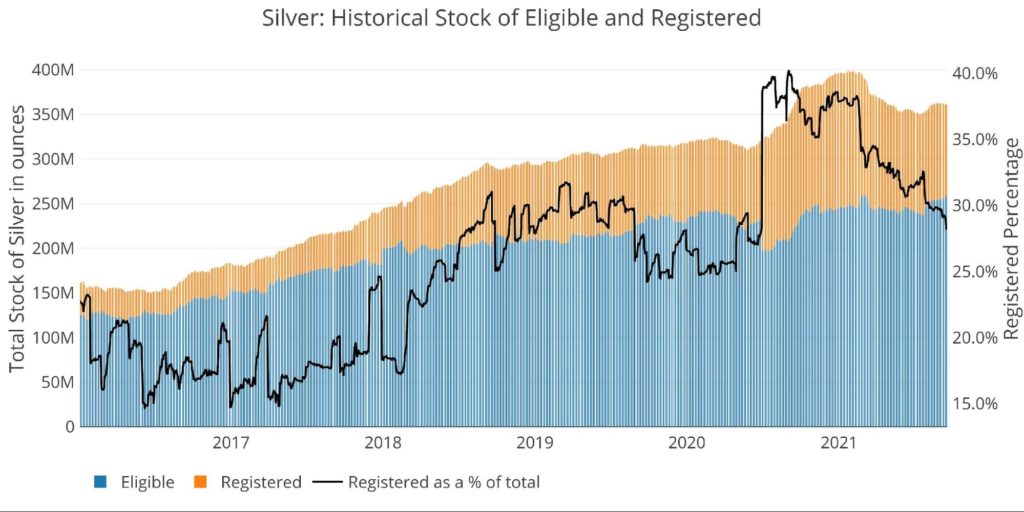

Silver also saw an increase in Registered around March 2020, but this has been draining much more steadily back to Pre-COVID levels. Interestingly the ratio of Registered to Eligible is the lowest it has been since COVID started and even sits below 2019 levels.

Figure: 6 Historical Eligible and Registered

Available supply for potential demand

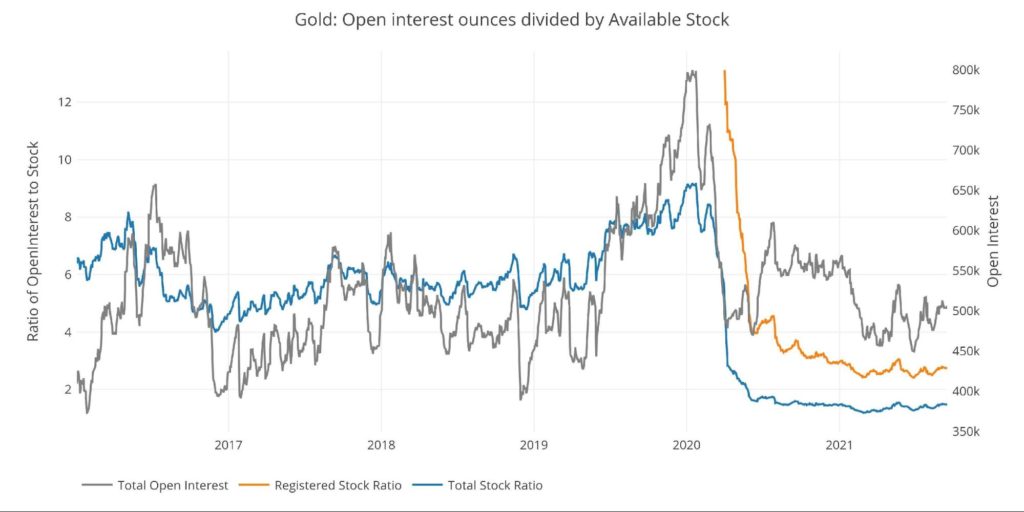

Many critics point to the massive open interest compared to available inventory at the Comex. As can be seen in the chart below, the ratio of open interest to available stock has fallen from over 8 to 2.76. This value is up slightly from the 2.5 seen in August, but it still gives the Comex plenty of supply to meet physical demand for over 1/3 of total open interest (the vast majority of contracts will never stand for delivery).

Figure: 7 Open Interest/Stock Ratio

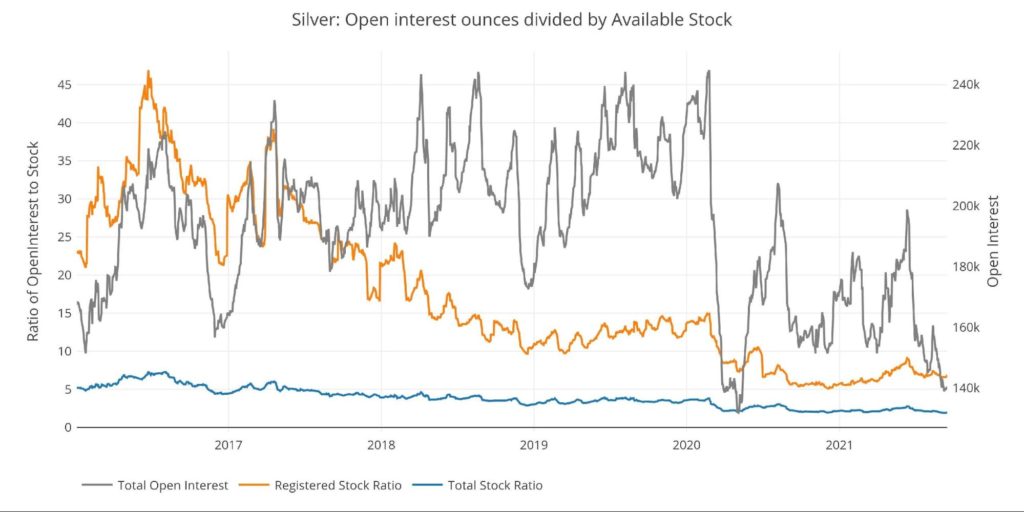

Coverage in silver is not nearly as strong with 6.9 open interest ounces to each available physical supply of registered. This was as low as 6.75 in July, so has been creeping up in recent weeks.

Figure: 8 Open Interest/Stock Ratio

What it Means for Gold and Silver

While the monthly delivery of contracts certainly represents physical demand. Tracking the activity in the Comex vaults shows the actual movement of metal. In a true crisis, it’s very possible the vaults at the Comex could be drained rather quickly.

Data Source: https://www.cmegroup.com/

Data Updated: Nightly around 11 PM Eastern

Last Updated: Sep 17, 2021

Gold and Silver interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect.

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect. The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on.

The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on. In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter.

In February, the data showed that Yellen was making a big bet that long-term rates would not stay elevated for long. This was demonstrated by the volume of short-term debt issuance. The Treasury was willing to pay higher rates to keep the maturity of the debt shorter. Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]

Please note: the CoTs report was published on 03/22/2024 for the period ending 03/19/2024. “Managed Money” and “Hedge Funds” are used interchangeably. The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always […]