Volatile Times Ahead

The following article was written by Mary Anne and Pamela Aden for the April 2011 edition of Peter Schiff’s Gold Letter.

Gold nearing $1500, silver nearing $40, oil well above $100! What a week… what a month… what a year!

Gold nearing $1500, silver nearing $40, oil well above $100! What a week… what a month… what a year!

Escalating violence in Libya is adding fuel to the already strong bull markets, especially with concern growing that turmoil could spread into even more countries.

The threat of possible supply disruptions is providing the real fire under oil, while demand continues to grow. Gold and silver, in turn, are the safe havens as inflation concerns and uncertainty prevail.

But from another angle, gold and silver are also being driven higher by the same force that is driving the unrest – namely, a sea of liquidity introduced by the Federal Reserve. Since the Fed has shown no sign of changing course, we expect much more volatility to come.

Inflation Starvation

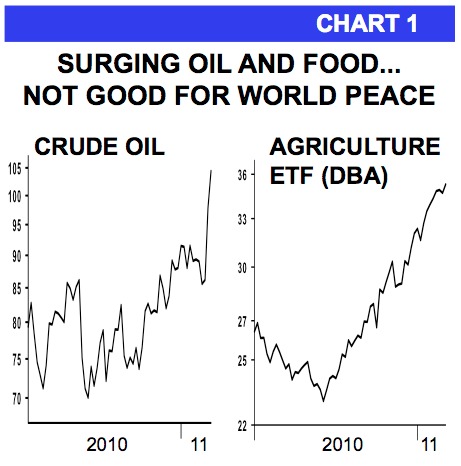

In this market, the major danger is coming from soaring agricultural prices. Global food prices rose to a record in February. Rising food and oil are a deadly match because these “needs” make up a large portion of the budgets of the world’s poor (see Chart 1). When someone loses their ability to eat and get to work, they have nothing left to lose by taking to the streets.

Just since last June, 44 million people were pushed into extreme poverty according to the World Bank. This alone explains why governments are being toppled in the Middle East and North Africa. The United Nations says other countries at risk of food riots are Bolivia and Mozambique.

China’s Prudence

In volatile times, protecting yourself, your family, and your assets is most important. China is smart. While the West debases its currencies, China continues to appreciate the bull market in gold. Most interestingly, the government is making it even easier for its citizens to buy gold.

Late last year, for instance, the World Gold Council (WGC) and the Industrial & Commercial Bank of China (ICBC) got approval to launch a gold investment product, called the ICBC Gold Accumulation Plan, where average Chinese can obtain gold-linked savings accounts. Over one million accounts have already been opened with over 12 tons of gold backing them.

One million people represents 0.07% of the total Chinese population. Assuming growth trends continue, this represents a very deep well of potential gold buyers.

Central Banks Still on Board

Central banks are still buying and holding gold for the first time in 21 years.

Once again, China is the leader. Its demand for small bars and coins increased by 70% year-over-year in 2010, and new purchases have already climbed to 200 metric tons in the first two months of 2011.

The Middle East is joining in as well. Demand for bars and coins jumped 39% in Q4 from a year earlier, according to the WGC.

We only see this trend growing as countries seek some form of insurance in a fast-changing geopolitical landscape.

On the Verge of Another Milestone

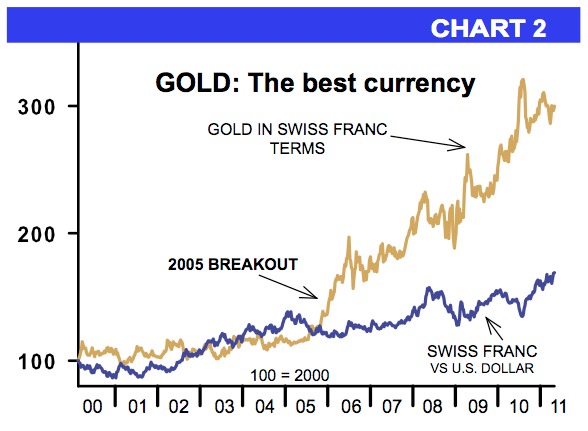

In 2005, the first milestone in the bull run occurred when gold broke clearly above $500. This was the rise when it broke clearly away from the dollar and started soaring in all currencies (see gold in Swiss francs on Chart 2).

2009 was the next milestone when gold broke clearly above $1000. This started a stronger phase of the bull market, and since then, gold hasn’t looked back.

With gold now approaching $1500, we’re nearing another significant psychological level. Gold will most likely resist near $1500 before moving clearly above this level. The $2000 area will then be the next target.

Will $5000 – $6000 or more end up being the final destination? Time will tell. It looks like this is a possibility, but it’s more important to keep an eye on the market and stay with the trend for as long as it lasts.

Right now, the gold bull doesn’t even appear to have gone mainstream. Just ask your neighbors.

Brace for Impact

Gold’s 7.25% decline in January was very mild… barely a correction, which means a significant decline is still to come. For a broader look, since the 2008 meltdown, gold has gained 104% with only a 13.3% decline along the way. For now, global turmoil will keep a floor under prices, but there may be a pull back when the situation stabilizes.

As has been our recommendation, if you have no physical gold in your portfolio, it’s a wise idea to start averaging in by making regular purchases. If you already have large holdings, you may wish to wait until the next correction to buy with both hands.

We see more volatility in the months and years ahead. It’s safer to be in precious metals than to wait for the “right price” and be left without. Clearly, the world’s major governments feel the same way.

Mary Anne and Pamela Aden are authors of The Aden Forecast, an investment newsletter now in its thirtieth year. It is one of the longest continually published investment newsletters in the world. They specialize in the precious metals and foreign exchange markets, as well as the US and international equity and credit markets.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

Leave a Reply