A Stormy October, but Not for Gold

Is the world waking up to the economic reality Peter Schiff has been warning about all year long? With the current chaos in the stock market and rise in the price of gold, mainstream commentators and economists around the world are starting to wonder if stocks really are in bubble territory. All sorts of technical indicators are driving speculative investors to seek the safe-haven of gold. Take a look at some of these ominous indicators highlighted by the Economic Collapse Blog:

- The S&P 500 and Nasdaq Composite experienced the worst three-day decline since 2011.

- The price of oil is plummeting, which happened just before the 2008 financial crisis. Oil hasn’t been this cheap for two years.

- The Volatility Index (VIX) is at its highest since the European debt crisis, indicating a lots and lots of fear on Wall Street.

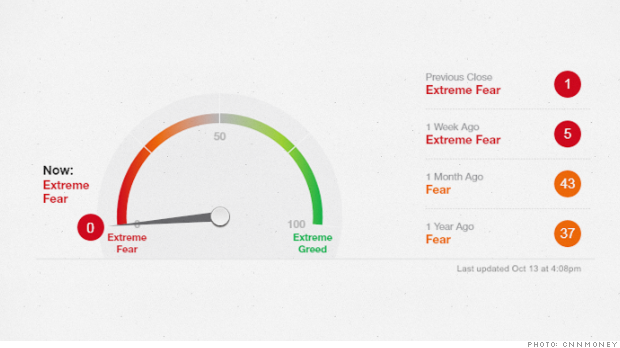

On Monday, CNN’s Fear & Greed Index hit zero, a level it hasn’t touched since 2011, right after Standard & Poor’s downgraded US debt.

Meanwhile, compare this to gold. As of yesterday, the yellow metal has experienced it longest rally in two months, erasing all of its previous losses. At a current price of about $1241, gold is now up almost 4% since 2013. The S&P, on the other hand, is up only 1.4%.

Technical comparisons aren’t the only thing bolstering the case for gold this season. The Telegraph reported last month that the “super-rich” are have been rushing to stockpile large, 12.5 kilogram gold bullion bars. That’s more than 27 pounds and millions of dollars worth of gold in a single bar! Here’s some details from the article:

The sales of 1kg gold bars, worth about £25,000 each, has doubled during the three months ended August, when compared to the same period last year, according to ATS Bullion sales figures. Sales of the more popular gold coins such as the quarter ounce sovereign and one ounce Krugerrand have also doubled this year, according to figures from BullionByPost.”

Perhaps the Europeans are realizing what the Chinese have always known – that in times of economic trouble, precious metals are the only reliable investment.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

Leave a Reply