Gold and Silver Blast Off

The following article was written by Mary Anne and Pamela Aden for the November 2010 edition of Peter Schiff’s Gold Letter.

October saw gold soaring to record highs while silver shot up even more, reaching a 30-year high. Yes, the stronger phase of the bull market is flexing its muscles.

October saw gold soaring to record highs while silver shot up even more, reaching a 30-year high. Yes, the stronger phase of the bull market is flexing its muscles.

Gold’s exceptional rise has now reached our current target level at $1,350. It’s been a super rise, up 55% since April 2009… or, to put it another way, gold has soared 17% in the last 10 weeks alone!

Bubble, Bubble, Toil & Trouble?

Gold is still far from the mania stage. The average investor is just starting to appreciate the rise in gold. They know things aren’t right and they are learning that gold is a safe haven. They see the dollar falling, the economy dragging with debt, and the Fed trying to keep it together. The public is concerned, but a gold mania is clearly not here yet.

Remember, it’s not just the US, Europe is also hurting. Whether we like it or not, no country wants a strong currency right now. With stiff competition for exports in the global economy, governments believe a weaker currency gives them an edge on trade.

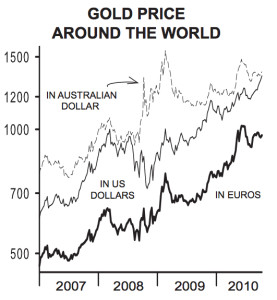

This is one important reason why gold is rising in all currencies, as Chart 1 shows. Gold reached a record high last June in euros and Swiss francs, and it’s holding near its highs versus the Australian dollar.

Most interesting is the Swiss franc. It’s been one of the strongest currencies, reaching a record high against the dollar in recent weeks at the same time gold hit a record high. Yet when comparing gold to the Swiss franc, you can see it’s holding near its record high. In other words, gold is stronger than the Swiss franc.

Paradigm Shift

It took the financial crisis and the ongoing aftermath to change the way people view gold. Confidence is growing and the change in the central banks’ actions and attitude toward gold was key in giving a green light to investors.

Central banks stopped selling gold and they’ve become net buyers this year for the first time in two decades. They’re expected to buy 15 metric tonnes of gold this year, which is a major turnaround. Gold is becoming an important reservable asset.

Gold miners have been shutting down their hedging too. Anglo Gold Ashanti, the third largest mine, is closing their hedging by 2011. This means gold miners also believe gold is going higher. Plus, the global holdings of gold exchange-traded funds (ETFs) are at a record.

How Long Can It Last?

Some people claim that gold is in a bubble and it’s ready to fall. If you think a substantial rise in government confidence and a bull market in the dollar is at hand, then you would be correct to think gold is due to slide. We don’t see it.

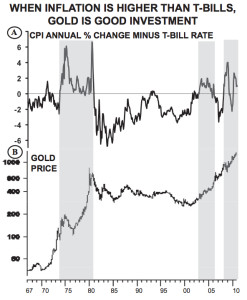

Historically low interest rates in the US and Europe are providing another boost for gold because it doesn’t have to compete with the currencies, since gold does not pay interest. But actually, during the 1970s bull market, interest rates rose with gold. The key here is inflation as Chart 2 shows.

You can see that when inflation is higher than the T-Bill rate (above zero, shaded area), it coincides with a bull market in gold. So, as long as inflation is higher than short-term interest rates, the environment will continue to be positive for gold.

Silver Shines Brighter

Silver has jumped up to a 30-year high, gaining 31% in 10 weeks. It beat our previous $23 target. And as much as silver has already risen, it’s still clearly not overbought. It’s on a roll and our next target is the $27-$30 level.

When silver is stronger than gold it tends to coincide with a rising resource sector. Silver then gets the benefit of being both a precious metal and a base metal. This is another way of saying that if the emerging economies remain strong and demand for resources stays high, silver should continue to outperform gold.

Too Late to Buy?

For new buyers, our suggestion is to buy gradually this month and next. Buy gold, silver and mining shares on weakness. Palladium has been very strong, rising 38% since July. Platinum is following. Both are in major uptrends above $420 and $1500, respectively.

Mary Anne and Pamela Aden are authors of The Aden Forecast, an investment newsletter now in its twenty-ninth year. It is one of the longest continually published investment newsletters in the world. They specialize in the precious metals and foreign exchange markets, as well as the US and international equity and credit markets.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

Leave a Reply