Gold Is on the Move

The following article was written by Mary Anne and Pamela Aden for the September 2010 edition of Peter Schiff’s Gold Letter.

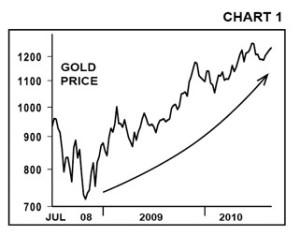

Gold is looking good. Over the past few weeks, it surged from $1160 to near $1250. That’s an impressive 7.8% monthly rise, and even though gold is rapidly approaching its all time record high, it’s poised to move still higher.

Gold is looking good. Over the past few weeks, it surged from $1160 to near $1250. That’s an impressive 7.8% monthly rise, and even though gold is rapidly approaching its all time record high, it’s poised to move still higher.

What’s Driving the Gold Price Up?

There are several key factors coming together at the same time and all of them are bullish for gold. But if we had to boil it down, the bottom line is uncertainty. This makes investors nervous, which has always been good for gold. But is this response rational?

We think so. Gold is the ultimate safe haven and as the economy stumbles, demand for gold has grown. That’s been the case for almost a decade. In the second quarter of 2010, for instance, the economic indicators were down and gold demand was up 36%.

Investors are concerned. Not only did the economy falter this month, but the stock market declined as well. This has fueled uncertainty about the government’s policies, the potential for a “double dip” recession, and the danger of a deflationary period.

At times like this, safety becomes the paramount consideration. Risk is avoided, and that’s when gold shines. Gold provides a shelter from the storm, regardless of what lies ahead. The ongoing rise in the gold price has reinforced this maxim.

As you can see in Chart 1, gold has not had a steep downward correction in nearly two years. It’s been moving up slowly and steadily. Consistently rising prices eventually attract attention, and that’s now starting to happen.

It doesn’t hurt that some of the most successful and well-known money managers have been buying gold and gold-related investments. But, despite the fact that growing demand has kept upward pressure on the gold price, the yellow metal has not yet become popular with mainstream investors. That’s still to come, and it’s one reason why gold’s upside potential will continue to remain positive.

Uncertainty Is Growing

While mainstream investor sentiment shifts to gold, uncertainty looks set to increase in tandem.

Federal Reserve Chairman Bernanke recently affirmed that the Fed will do whatever it takes to boost the economy. In recent weeks, the Fed again started buying US government debt in the hope of stimulating the economy, and it is prepared to do much more.

If that means buying underwater mortgages, financing the ever-ballooning federal debt, or printing enough new dollars to fill the Grand Canyon, then so be it. As home sales fall and jobless claims rise, the pressure has mounted for Washington to act.

More and more investors understand that the side effects of Fed’s actions will be a weaker dollar and high inflation.

In the end, whether deflation, recession, or inflation is the result, uncertainty is being kicked up several notches. This simply adds to gold’s appeal.

On the international front, it’s the same story. Demand is growing, especially in Asia and Europe. Investors are generally nervous and uneasy. They want something safe; and, as we saw again this month, gold always emerges as the safe harbor in times of uncertainty.

In fact, with each passing month, the case for gold grows stronger. For now, if gold can break above its record high of $1262.40 (basis December), it’ll attract even more attention and the price will then likely surge. It’s getting very close to that level now, so stay tuned…

Mary Anne and Pamela Aden are authors of The Aden Forecast, an investment newsletter now in its twenty-ninth year. It is one of the longest continually published investment newsletters in the world. They specialize in the precious metals and foreign exchange markets, as well as the US and international equity and credit markets.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

Leave a Reply