Ditching before the Fiscal Cliff

By Peter Schiff

Turn on the TV and this is what you’ll hear: The US budget is heading for a fiscal cliff. If a deal isn’t reaching in Congress by the end of this year, a combination of automatic tax hikes and budget cuts will sink America into economic depression. There is no escape.

Of course, my readers know that the fiscal cliff is merely an example of the piper having to be paid. The problem isn’t the bill, but that we ran it up so high in the first place. Any deal to avoid the cliff by borrowing even more money may allow the piper to keep playing a while longer, but when the music finally stops, the next fiscal cliff will be that much larger.

My readers also know that there are several ways for investors to avoid the cliff altogether. Perhaps the most secure is buying precious metals. However, given what we know, it may seem confusing that the spot prices of gold and silver have been moving sideways.

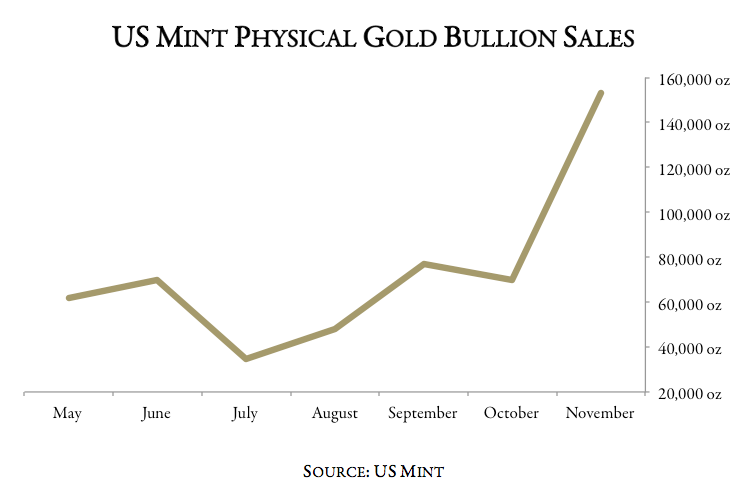

However, these headline prices have largely concealed a more important indicator: physical bullion sales are booming.

An Under-the-Radar Rally

The figures are astounding. For US Gold Eagle coins, mint sales are up some 150% from the QE3 announcement on September 13th. Despite what the spot prices show, there has been a tremendous surge in people buying physical gold.

But why hasn’t this translated into higher spot prices?

It seems clear that the spot prices of both gold and silver are being driven right now by a large pool of institutional capital moving into and out of instruments like commodity ETFs. The movements have been predictable: When there is a sign of a deal coming out of Washington, the spot prices move up. If negotiations are faltering, there is instead a major selloff.

Physical bullion investors are a different breed. We are in this market for the long haul. When I increase my physical gold and silver holdings, I do it because I see the long-term fundamental picture for the US getting worse.

Getting a Read on the Bullion Bull

While the ETF speculators are trying to anticipate the market’s – and each other’s – immediate reaction to whatever 11th hour deal is struck, I believe physical bullion investors are sending a clear signal: this whole debate is out of order.

A J.P. Morgan study concluded that 82% of the hit to GDP if we go over the fiscal cliff would be related to tax increases, not spending cuts. And if the legislators reach a deal? It will only result in more tax increases and much fewer spending cuts. These guys just don’t get it.

Looking back to the debt ceiling debate of August 2011, we saw big movements into physical gold there as well. What investors are concluding as they hear these grand debates is that whatever the result, the budget, the dollar, and the taxpayer will lose.

They are deciding to get off this runaway train. Because the real fiscal cliff isn’t coming on December 31st – it is coming when there is a global flight from the US dollar.

The Real Fiscal Cliff

The Democrats are complaining that the fiscal cliff imposes too steep demands on those who receive entitlements. Republicans are trying to protect the military budget. What no one seems to want to address is what happens as foreign creditors increasingly decide to stop financing this bonanza.

To a large extent, this is already happening. China has already become a net-seller of Treasuries and is diverting more of its reserves into gold. The Chinese government recently approved banks holding gold as a reserve asset and made it easier for banks to trade gold amongst themselves.

While Japan and other Keynes-drunk governments have filled some of the gap with increased purchases, a supermajority of new issues are being bought directly by the Fed. That was the idea behind QE3 Plus, as described in last month’s commentary.

Because of the acute trauma in Europe and certain institutional mandates to hold Treasuries, much of this new inflation is being absorbed. This has caused what may be the most dangerous of situations. It has allowed the inflationists to paint people like me as the boy who cried wolf. It seems to them that no matter how irresponsible Congress and the Fed are, we are immune from economic consequences.

In reality, all this money printing is like pulling back a spring. Pent up inflationary forces are building, and when they are unleashed, the debate will be over faster than they can say “oops.”

The Only Way to Win Is Not to Play

Those buying into physical gold and silver see this inevitability and are getting prepared. We believe there is no sense playing Russian roulette with our savings. Every time Washington raises that debt ceiling or announces another stimulus, it’s like one more click of the trigger.

When the global markets finally wrap their heads around the scale of US insolvency, the response will be as fierce as it is rapid. In such a once-in-a-century scenario, physical gold and silver are among the few assets without counterparty risk. From the looks of the physical bullion sales charts, I’m not the only investor who has figured this out.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […]

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […] California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […]

California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […] The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […] Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

Leave a Reply