Commodities in Step with Precious Metals

The following article was written by Mary Anne and Pamela Aden for the March 2011 edition of Peter Schiff’s Gold Letter.

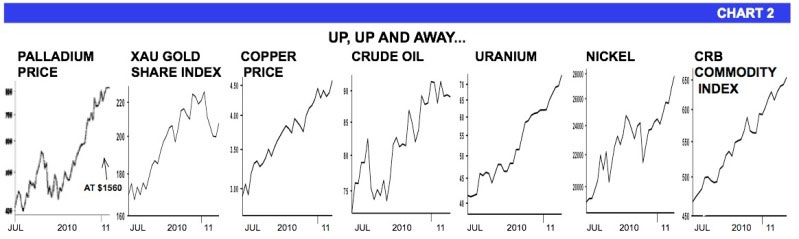

The commodity market is on fire! Be it copper, cotton, cattle, corn, sugar, energy, or resources… most tangibles are at record highs or new highs. This is why the CRB index also recently hit a record high.

The commodity market is on fire! Be it copper, cotton, cattle, corn, sugar, energy, or resources… most tangibles are at record highs or new highs. This is why the CRB index also recently hit a record high.

Growing global demand has been the main driving force, with a boost from other factors like natural disruptions and political scares.

Gold and silver tend to move in the same general wave as the rest of the commodity world, but the reasons why are different in many ways.

Distinct Waves

Gold bounced up in February, after declining 7.25% in January, on events in the Middle East, safe haven buying, strong demand, political uncertainty, lingering debt concerns in Europe, high unemployment, growing inflation in the emerging markets, and just general uncertainty all around.

Meanwhile, the resource and energy sectors rose because global economic growth is looking positive. China and Japan helping the EU ease its debt crisis was a positive factor in the commodities’ recent move upward.

In other words, good news is good for commodities because it implies more demand for these products, while bad news is generally good for gold.

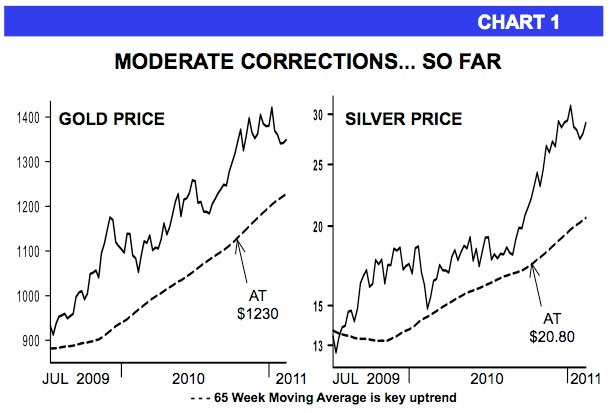

When they both rise together, like they did in recent weeks, silver shoots up, well outperforming both. Chart 1 shows silver move back well above $30.

Same Direction

Despite their opposite attractions, commodities and precious metals have a common bond: they rise with inflation – which may be the most important factor today.

The evidence of inflation abounds. World food prices are at records. Copper and several base metals are at or near record highs. Energy is near records. Brent crude oil hit $100 in London, while many energy shares jumped up. That is, food and shelter are getting expensive around the world for the first noticeable time since 2008 (see Chart 2).

Commodity prices are currently experiencing their fifth monthly gain. Farmers and miners are struggling to keep prices contained.

How do individuals and governments cope with all this inflation? Precious metals, of course.

Gauging the Tailwinds

This month, we took a hard look at the world’s gold reserves and here’s what we found: the average gold reserves for all countries are just below 12%. For the largest gold holders (the US, Germany, Italy, and France) this percentage ranges from 67% to 75%. In comparison, the countries with the largest ambitions for change, Russia and China, currently have only 7.2% and a very low 1.8%, respectively, of their total reserves in gold.

We also know that China has the largest cash reserves in the world. So it only makes sense that China is going to use a lot of this cash, which is mainly in US dollars, to buy more gold.

What About Those Headwinds?

Incredibly after 10 years, gold and silver are still not mainstream… far from it. Institutional ownership is also very low. In 1980, it was 3%; today, it’s 0.60%, which shows how under-owned the precious metals still are in this global market.

It’s actually fascinating how much this bull market has gone unnoticed. That means the best of this bull market is still well in the future, but it also means early investors will deal with the volatility of a more thinly traded market.

Use weakness as a buying opportunity.

Hot Commodities

The hard assets are all heading in a very promising direction as gold and silver hit new bull-market highs. Those investors still stuck in traditional portfolios of muni-bonds, T-bills, and large amounts of cash should take note.

Both precious metals and the broader commodities markets are definitely distinct waves, but they’re both moving in the same direction – away from paper currencies and sovereign debt. It’s time to either ride the waves or be overtaken by them.

Mary Anne and Pamela Aden are authors of The Aden Forecast, an investment newsletter now in its thirtieth year. It is one of the longest continually published investment newsletters in the world. They specialize in the precious metals and foreign exchange markets, as well as the US and international equity and credit markets.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

Leave a Reply