Black Gold Loses Glitter

Peter Schiff’s new commentary at Euro Pacific Capital examines the supply and demand factors that could be influencing the plunging price of oil. If you want to listen to Peter discuss the economic repercussions of this possible bubble in black gold, listen to his podcast here.

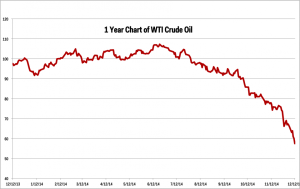

The stunning 40% drop in the price of oil over the past few months has scrambled global economic forecasts, changed the geo-political landscape, and has severely pressured many energy sector investments. Economists are scratching their heads to determine if the drop is good or bad for the economy or whether cheap oil will add to or decrease unemployment, or complicate the global effort to “defeat” deflation. While all of these issues merit detailed discussions, the first question to address is if the steep drop is here to stay and whether energy prices will stay low enough, for long enough, to seriously reshuffle the economic deck. Based on a variety of factors, this is not likely to happen. I believe a series of technical, industrial, and monetary factors will combine to push oil back up to, and potentially beyond, the levels that it has seen over the last few years.

The dominant narrative explaining the current situation is that oil has collapsed largely because the growing mismatch between surging supply and diminishing demand. But there is little evidence to suggest that such conditions exist on the global stage.

According to the data available this month from the International Energy Agency (IEA), global demand for crude oil has increased by .74%. from 2013 to 2014, and is 3.6% higher than the average demand seen over the past five years (2009-2013). The same trend holds true for the United States, where 2014 demand is expected to come in 1.3% higher than 2013 and essentially the same as the average demand over the previous five years. (As an aside, the relative stagnation of U.S. oil demand provides a strong counterpoint to the current belief that the U.S. economy is stronger in 2014 than it has been in recent years).

So if the low prices are a function of supply and demand, but demand has not collapsed, then the difference has to be supply. The theory here is that the fracking and shale boom in North America has flooded the world market with unexpected supply, thereby pushing down the price. While it is true that the new drilling techniques have revolutionized energy production in the U.S. and Canada, the increase in production has been mostly negligible on the global stage.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

Leave a Reply