A Glance at Major World Treasury Bonds Paints an Increasingly Negative Picture

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

Peter Schiff has stated clearly for the record that this financial system is headed towards collapse. While many like to point at inflation as the key indicator to pay attention to, we have been offering another: interest rates.

Indeed, the pathologically falling interest rates taking place across the world are more of a signal that this system is headed for collapse than inflation, which we also believe will have its day. In other words, the mainstream economic commentators who keep telling us to get ready for rising rates are dead wrong.

This recent article provides a detailed explanation as to exactly why this is happening.

Interest rates should be in equilibrium. Pushed down by entrepreneur-borrowers who can’t stomach high rates and savers who won’t lend their savings to banks for low rates, interest rates should remain moderated. That’s how rates would function in a truly free market.

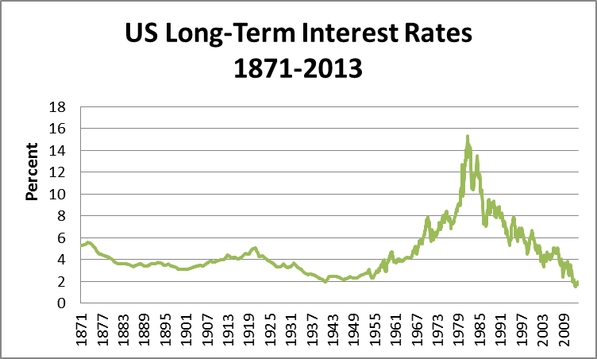

Instead they are out of control. Where they used to maintain a steady consistent level, they now swing to extremes. First, they skyrocketed to extraordinarily high levels (1980). And now they are plunging towards extremely low levels, and even into negative territory.

Negative interest rates are one of many reasons to buy gold now. Download SchiffGold’s Free White Paper: Why Buy Gold Now?

This was all set in motion when FDR started pulling the US off the gold standard in 1933, and it kicked into high gear when Nixon put the final nail in the coffin in 1971 when he “closed the gold window” (temporarily, of course) which de-linked the US dollar from gold.

Now that our monetary system is completely disconnected from real money – i.e. gold – interest rates are totally unmoored and out of control. The next stop is oblivion (i.e. negative rate territory across the board) and the beginning of the implosion of our financial system.

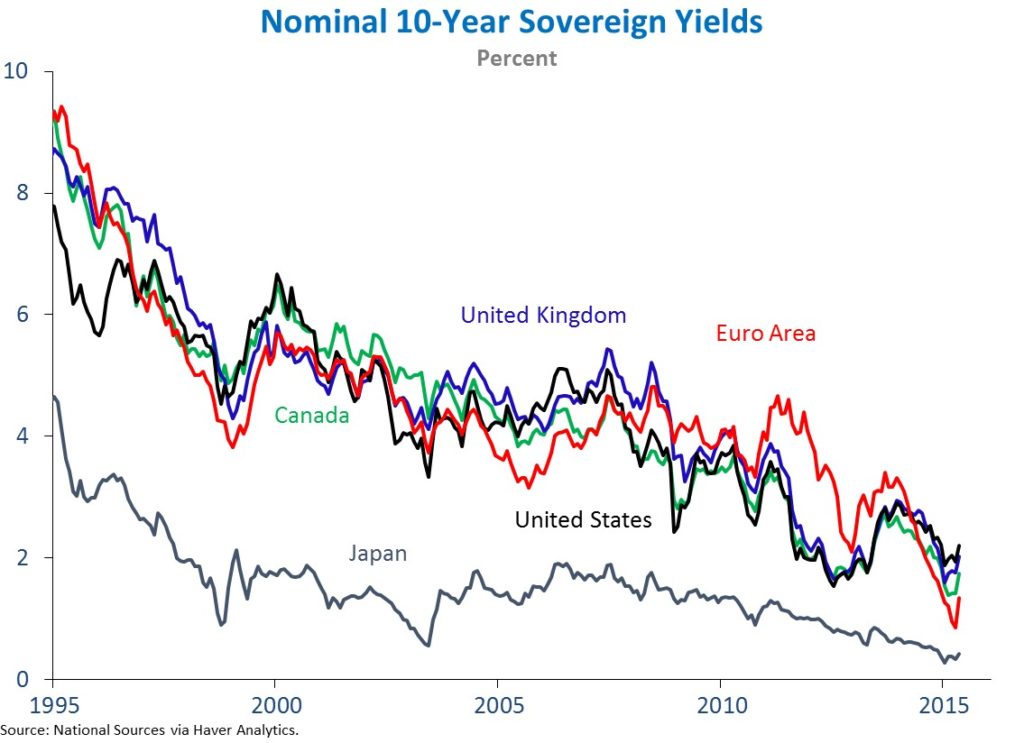

Here is what 10-year sovereign bond yields look like on a global scale (as of last year). As you can see, there is a clear trend.

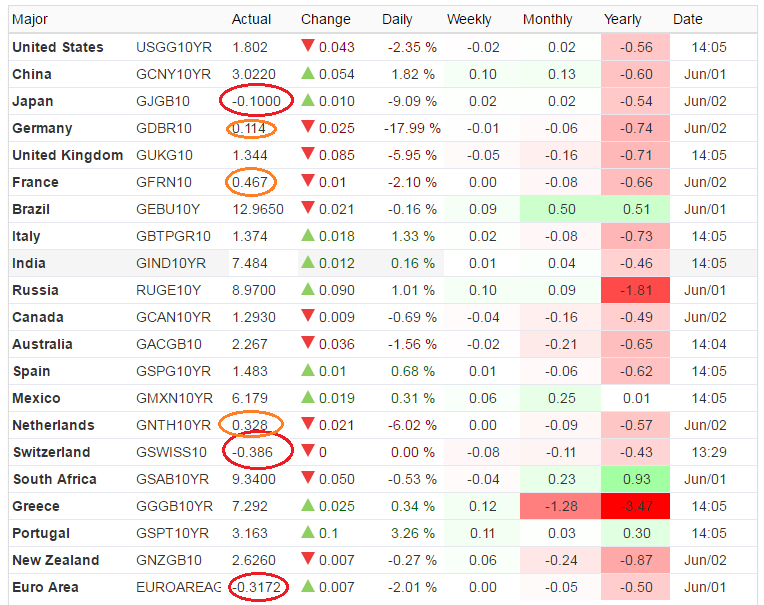

And here is a snapshot of major government 10-year treasury yields as they currently stand:

As you can see, three major 10-year government bonds (Euro, Swiss and Japanese) are in negative territory already. And Germany, France and the Netherlands aren’t too far behind. Time will tell which one of these will be the next to fall. But, make no mistake, fall, they will. And when the US 10-year clocks in at sub-zero, the stuff may be about to hit that proverbial fan.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

Leave a Reply