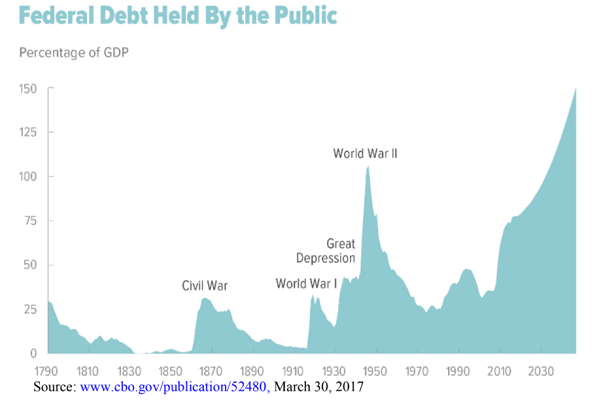

The US national debt stands at over $21 trillion and neither political party in Washington D.C. seems inclined to do anything about it. In fact, the GOP tax plan winding its way through the political process will add an estimated $1.5 trillion more to the debt over the next decade. And that doesn’t even account for the increases in spending that Congress will certainly approve over that timespan.

Of course, all of this government debt has serious ramifications. Corporations are also piling on credit. Last month, Mint Capital strategist Bill Blain predicted that “the great crash of 2018 is going to start in the deeper, darker depths of the credit market.”

Now consider this. China has an even bigger debt problem than the US, and analysts say it could threaten global financial security.

When I was a kid, my mom always went shopping on the day after Christmas. She wasn’t going out to spend her Christmas cash on some goody Santa failed to leave under the tree. She went out with the express purposes of buying Christmas cards, wrapping paper and decorations.

But why go out and buy Christmas items the day after Christmas? After all, you’re not going to need that stuff for about 11 months.

The Federal Reserve is in the midst of inflating its third big bubble. During an interview with Greg Hunter last month, Peter Schiff said the third time isn’t going to be the charm.

There is one thing Republicans and Democrats should agree about – buy gold.

But like everything else, the yellow metal has become politicized. If you believe the stereotype, only people on the right buy gold. A recent article by Martin Tiller at Nasdaq.com highlighted the phenomenon.

After a somewhat tepid October, gold inflows into ETFs picked up again in November, driven primarily by investors in Europe.

Global gold-backed ETFs increased their holdings by 9.1 tons last month, according to the latest data released by the World Gold Council. This continues a streak of monthly gains. In October, inflows came in at 3.3 tons, after surging in August and September.

We think of platinum and palladium as the “industrial metals,” but in 2016, there was more gold used in industrial applications than either of these two metals.

According to a report released by the World Gold Council, demand for gold in electronics has been growing since the fourth quarter of 2016. On top of that, other emerging technologies in the health and energy sectors are also driving up the industrial demand for gold. All of this could have a positive impact on overall gold demand in the future.

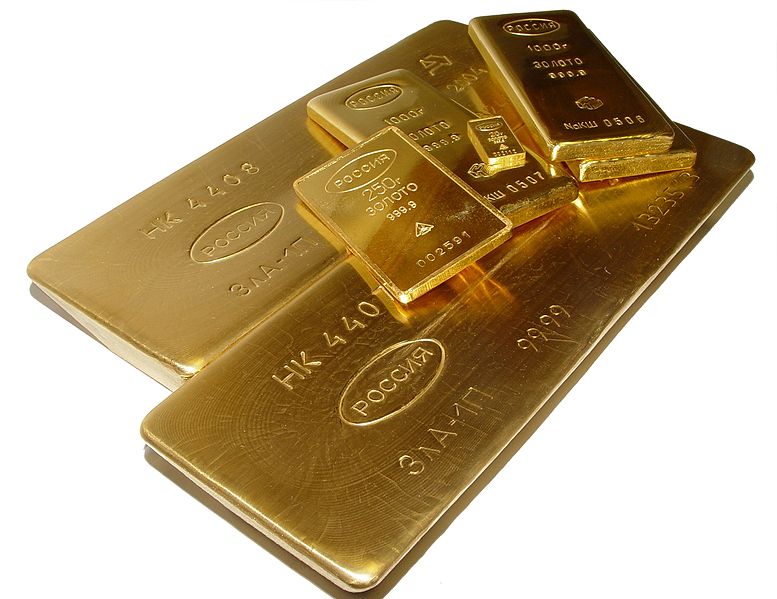

Russia’s gold holdings have topped 1,800 tons.

To put that into perspective, between 2000 and 2007, the Russian central bank held just 400 tons of gold. At that point, the country launched an aggressive gold acquisition program. In October of this year alone, the Bank of Russia bought 21.8 tons of gold. At 1,801 tons, the yellow metal now accounts for 17.3% of the country’s reserves. In the second quarter of 2017, Russia accounted for 38% of all gold purchased by central banks. Russia ranks sixth in the world in gold holdings behind the United States, Germany, Italy, France, and China.

Russia’s growing gold hoard is helping to establish economic and political stability and independence for the country.

Pres. Donald Trump has nominated another swamp creature to sit on the Federal Reserve board of governors.

Marvin Goodfriend does not come from the ranks of politicians. He’s an academic – an economics professor at Carnegie Mellon University. But he’s perfectly suited for the role of central planner. He fits right in with the other central bankers running what investment guru Jim Grant once called “the Ph.D. standard” monetary system, as opposed to the gold standard.

Loose monetary policy has dumped billions of dollars of easy money into the world’s financial systems over the last eight years, pumping up a whole slew of bubbles. We are still on the upside of the business cycle, with stock markets hitting record levels it seems like on a daily basis. But if history serves as any kind of indicator, a crisis is on the horizon.

What will precipitate it? That’s the proverbial $64,000 question.

Jim Rickards has compared financial crises to an avalanche. Snow piles up becoming increasingly unstable. Eventually, it reaches the point when all it takes is one more snowflake to set off an avalanche.

In a recent column, Rickards highlights three potential “snowflakes” that could set off the next deluge.

Earlier this month, Mint Capital strategist Bill Blain warned that the bond bubble is about to burst.

A crash in the bond market would likely take stocks down with it, but there is another impact that is less obvious. It could have a huge impact on the United States’ ability to finance its massive debt.