If you have the choice between an investment with low risk and a high potential for return, or an investment with high risk and a low potential for return, which would you take?

The answer seems obvious, right? You want to take on the lowest risk possible while getting the best potential for a good rate of return.

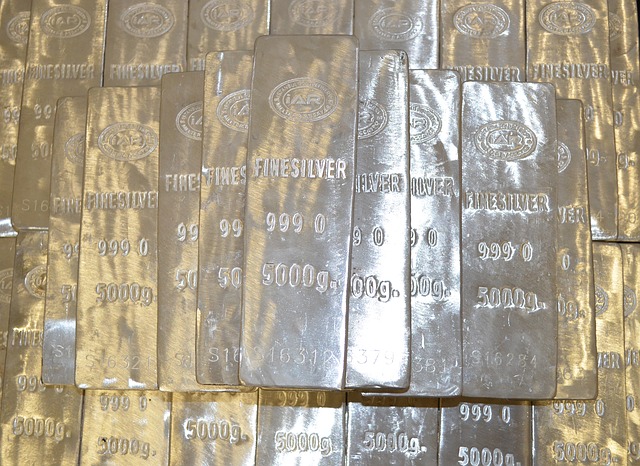

Well, if you factor risk levels into your investment calculation, buying silver looks like a good bet right now – especially when compared to stocks and real estate.

Three more states are moving toward repealing taxes on the sale of gold and silver bullion.

Last week, Alabama Gov. Kay Ivey signed a bill into law exempting the sale of gold and silver bullion from state sales and use tax. The repeal of the tax not only lowers the cost of investing in gold and silver, it will also open the door to using precious metals in everyday transactions, and it takes the first step toward breaking the Federal Reserve’s monopoly on money.

Last week, Peter Schiff was a guest with Nicholas Merten of DataDash. In comparing and contrasting Bitcoin and gold, Peter brought up the fact that gold has intrinsic value outside of its use as money. People want to own gold because of its unique qualities.

The reason gold became money in the first place is because everybody wanted gold because of what gold is, because of the tangible, physical properties of that rare element – all of the things that you can do with the metal. It is a luxury good that people have desired for time immemorial.”

And in recent years, gold has been increasingly valued for its use in various technological applications. In a report late last year, the World Gold Council reported the demand for gold in the technology sector has been growing since 2016 and that growth is continuing to accelerate due to new innovations.

Jobs numbers came out Friday better than expected.

According to the Labor Department, the US economy added 313,000 jobs last month, the most since October 2015. Economists had anticipated a gain of about 200,000. Wage growth was less stellar, ticking up just 0.1%. Analysts projected a 0.2% increase after a pretty significant jump of 0.3% in January spooked markets with inflation fears.

In his latest podcast, Peter Schiff said if he was a conspiratorial person – and he’s not – he would say, “Wait a minute, this looks too good to be true.”

Sales of silver jewelry in the US were strong last year, according to a survey conducted by the Silver Institute.

US retailers reported 17% average growth in the sale of silver jewelry in 2017.

President Trump’s top economic advisor announced his resignation this week in the midst of a budding trade war.

Gary Cohn heads the National Economic Council. He was a “free trade” guy and generally opposed to high tariff policies. Most analysts think his resignation is a sign he lost the internal White House struggle over trade policy. Trump took the opportunity to promise he will replace Cohn with somebody “great.”

Cohn’s resignation gave Peter Schiff a different idea. Maybe we should just fire all of these government economists.

Could rising interest rates pop the renewable energy bubble?

As the Federal Reserve and other central banks try to turn off the easy money spigot, we will likely see a growing number of corporate bankruptcies in the coming years. The renewable energy sector is particularly vulnerable and exemplifies broader problems in the global economy.

China, Japan and some other countries have a nuclear option they could use in the pending trade war.

If deployed, it could serve as the pin that pops the stock market bubble. At the same time, it could put the US government in a nasty spot as it tries to fund its profligate spending and upward spiraling debt.

What is this nuclear option?

Silver demand for industrial applications as well as jewelry production is expected to increase in 2018, pushing overall demand higher.

The Silver Institute outlined silver market trends for 2018, along with the latest technological innovations involving the white metal in its latest issue of Silver News.

There’s been a lot of focus on inflation and interest rates and how they will impact the gold market in the coming months. But gold has two fundamentals going for it that aren’t getting nearly the same kind of attention.

Simple supply and demand.