Risk vs. Return: Silver Looks Like a Good Bet

If you have the choice between an investment with low risk and a high potential for return, or an investment with high risk and a low potential for return, which would you take?

The answer seems obvious, right? You want to take on the lowest risk possible while getting the best potential for a good rate of return.

Well, if you factor risk levels into your investment calculation, buying silver looks like a good bet right now – especially when compared to stocks and real estate.

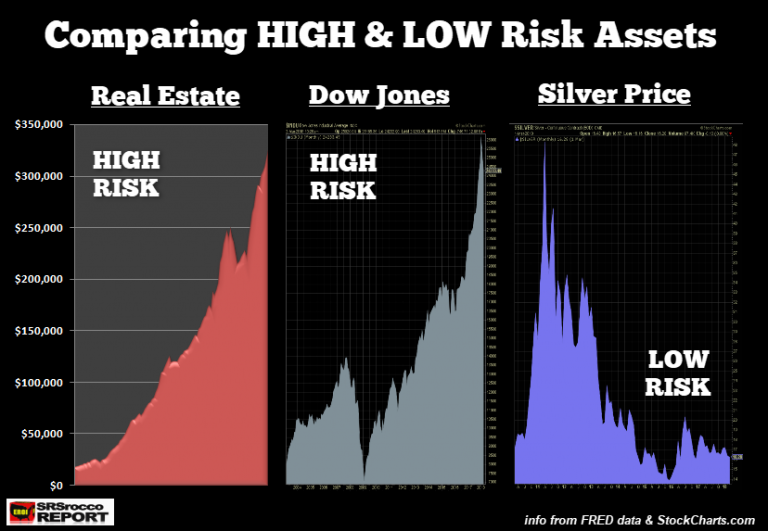

As SRSrocco shows, stocks and real estate are at extremely high-risk levels right now. On the other hand, there appears to be very little risk inherent in the silver market.

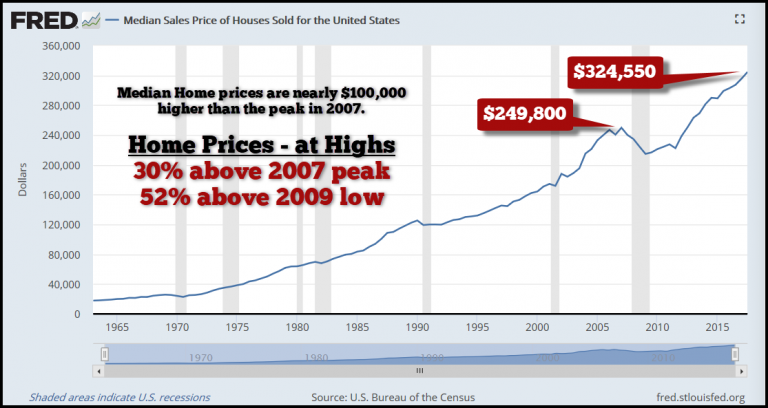

Taking a closer look at data compiled by the St. Louis Fed, we find that the median home price is nearly $100,000 higher today than it was in 2007, at the height of the real estate bubble. The current home price stands 30% higher than its previous 2007 peak and has grown 52% above its last low (2009). As SRSrocco notes, this indicates real estate is a high-risk market right now.

However, Americans are piling into new and existing homes because they believe the prices will continue higher forever. Unfortunately for American homeowners and buyers, the Fed’s current policy to increase interest rates over the next year is not positive for the real estate market.”

The Dow Jones index is even deeper in bubble territory. It’s risen 220% since its low during the financial crisis.

Going by the 200-month moving average, the Dow Jones Index is 11,000 points higher, or 45% over-valued. However, if we went by the Dow Jones low in 2009, then the index is 73% over-valued. Again, when assets are way above their baseline values, then they enter into a high-risk category. It doesn’t matter if US home prices or the broader stock markets continue to move higher for a while, they are still highly risky assets.”

Now consider silver. It is far below its highs in 2011 and is just 40 cents above the 200-day moving average. In other words, it’s price is at a low point in its historic cycle, meaning it is a relatively low-risk asset right now.

On top of that, the silver-gold ratio remains historically high. This means silver is undervalued compared to gold. Currently, the silver-gold ratio stands over 79 to1. This means you can buy 79 ounces of silver with one ounce of gold. Compare that with the historic average ratio which hovers around 16:1. The modern average over the last century is around 40:1. As Peter Schiff said in a video over the summer, “This is silver on sale.”

Finally, the fundamentals look good for silver. Analysts expect strong demand in 2018 in an environment of tightening supply.

If you are looking for a low-risk investment with the potential for a high rate of return, it might be a great time to look at silver.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]