Consumer Price Index (CPI) data for April came in much hotter than expected. Year-on-year, inflation is up 4.2%. The big number even prompted Federal Reserve Vice Chairman Richard Clarida to say, “We were surprised by higher than expected inflation data.”

Peter Schiff appeared on Tucker Carlson’s show to talk about the consequences of more printed money chasing fewer goods. Peter said inflation is going to hit the middle class harder than the pandemic.

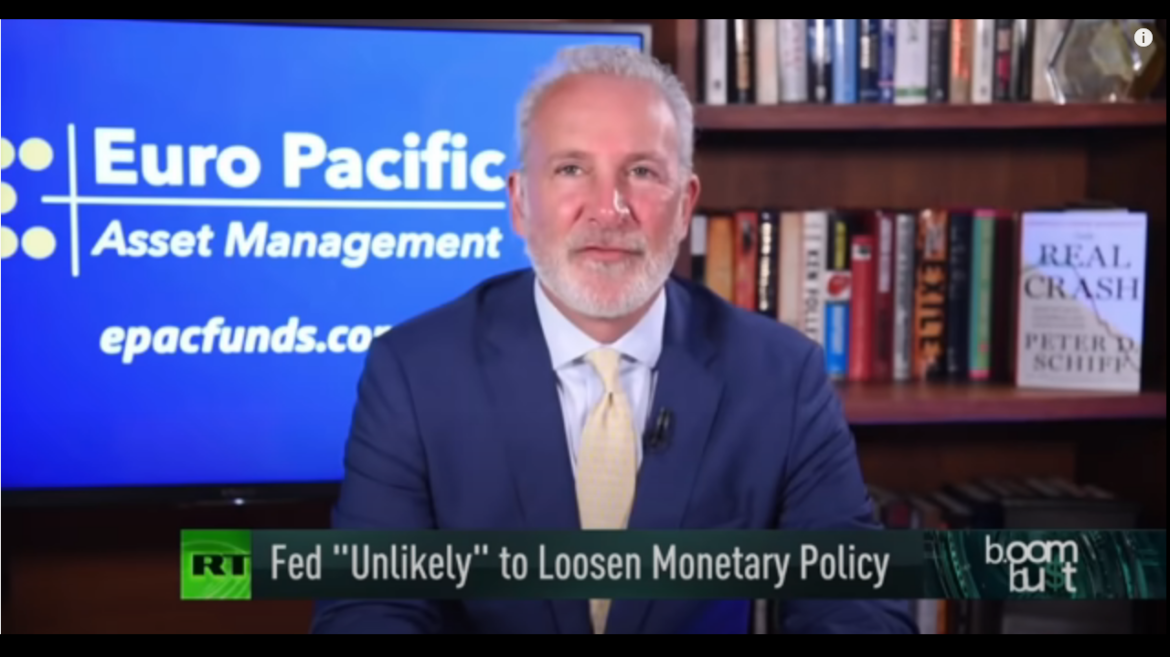

During his recent 60 Minutes interview, Federal Reserve Chairman Jerome Powell reiterated that he thinks any spike in price inflation will be transitory. As he put it during the interview, we may see “temporarily higher prices but not persistent inflation.” Peter Schiff appeared on RT Boom Bust to talk about Powell’s view on rising prices. He called the Fed chair’s position, “laughable.”

We’re told inflation isn’t a problem. But a quick trip out to the grocery store or to fill up your car with gas tells you otherwise. Prices are going up. Peter Schiff recently appeared on Tucker Carlson’s show to talk about inflation. He said the price of everything is going up and the value of everything is going down.

What is the ballooning trade deficit telling us about the US economy? Peter Schiff recently appeared on NTD News to talk about it. He said the US has never been worse on trade and it is a sign that we don’t have a recovering economy. In fact, we have a phony economy in danger of collapse.

Peter Schiff recently appeared on RT Boom Bust to talk about inflation, the Fed and gold. He said a lot of people still think the Fed will soon tighten monetary policy to deal with rising inflation pressure. But they’re wrong. Ultimately, the Fed is going to surrender to inflation without a fight. When the markets realize this, the dollar is going to crash through the floor and gold is going through the roof.

Last week, Peter Schiff appeared on NTD News to talk about the Federal Reserve’s increasing dovishness. He said despite all of the assurances from Jerome Powell that the central bank’s monetary policy isn’t stoking inflation, the economy and the dollar are both at risk for collapse. The Fed is the only thing standing in the way and it can’t stand there forever.

During this interview, Peter also touched on his recent Twitter debate with Elon Musk about bitcoin.

So, what’s wrong with stimulus, money printing, trade deficits, and the minimum wage? Peter Schiff appeared on Meet Kevin to tackle these questions and more.

On Monday, Feb. 1, Peter appeared on NTD Business to talk about the attempted short squeeze on GameStop and silver. He said we shouldn’t compare GameStop stock to silver. Unlike GameStop, there are fundamentally sound reasons to buy silver, with or without the endorsement of the Reddit traders.

When the Reddit Raiders turned their attention to silver, Peter tweeted that they were getting smarter. “Silver stocks are actually cheap and represent good investment value. The fact that some investors were foolish enough to short these stocks makes their trade even better.”

For months, Peter Schiff has been warning that the stock market is a bubble. It is detached from any political or economic reality and is being driven by Federal Reserve monetary policy. During an interview on NTD Business News, Peter said a lot of investment advisors know this too, but they are advising people to stay in because the bubble has more room to grow. But he warned this isn’t good advice. When it comes to bubbles, you have to know when to leave the party.

Peter Schiff recently did an interview with David Lin on Kitco news. Peter talked about the devaluing dollar, the stock market bubble, his investment strategy, the trajectory of the global economy, and finally, what he would do if he was president of the United States. In a nutshell, Peter said he would veto everything.