The fake debt ceiling fight rages on.

Last week, the US Senate agreed to a small increase in the borrowing limit, but it only kicked the can down the road a couple of months. The $480 billion increase raises the debt limit to $28.9 trillion, but that’s only going to last until Dec. 3.

Peter Schiff recently appeared on RT Boom Bust to debate economist Steve Keen and Professor Richard Wolf on the debt ceiling and more broadly the US economy.

The Federal Reserve held its September Federal Open Market Committee (FOMC) meeting last week. While there was a lot of talk about the central bank tapering its quantitative easing program, the Fed didn’t announce any concrete plans to slow asset purchases. The lack of concrete action was no surprise to Peter Schiff. After the Fed meeting, Peter appeared on NTD News to talk about it and the Fed’s apparent reluctance to take any concrete steps toward monetary tightening. He said the central bank is in the process of replacing America’s economic foundation with a money printing press.

Peter Schiff spent an hour and a half answering questions during a live chat on Instagram.

Peter Schiff recently appeared on RT Boom Bust to talk about Fed monetary policy and the possibility of a taper. He said even if the Fed does slow asset purchases, the taper won’t last long. Ultimately, the Fed will expand QE.

Peter Schiff recently appeared on the Matt Walsh podcast. During the interview, he broke down exactly how the Federal Reserve and the US government team up to hit you with an inflation tax.

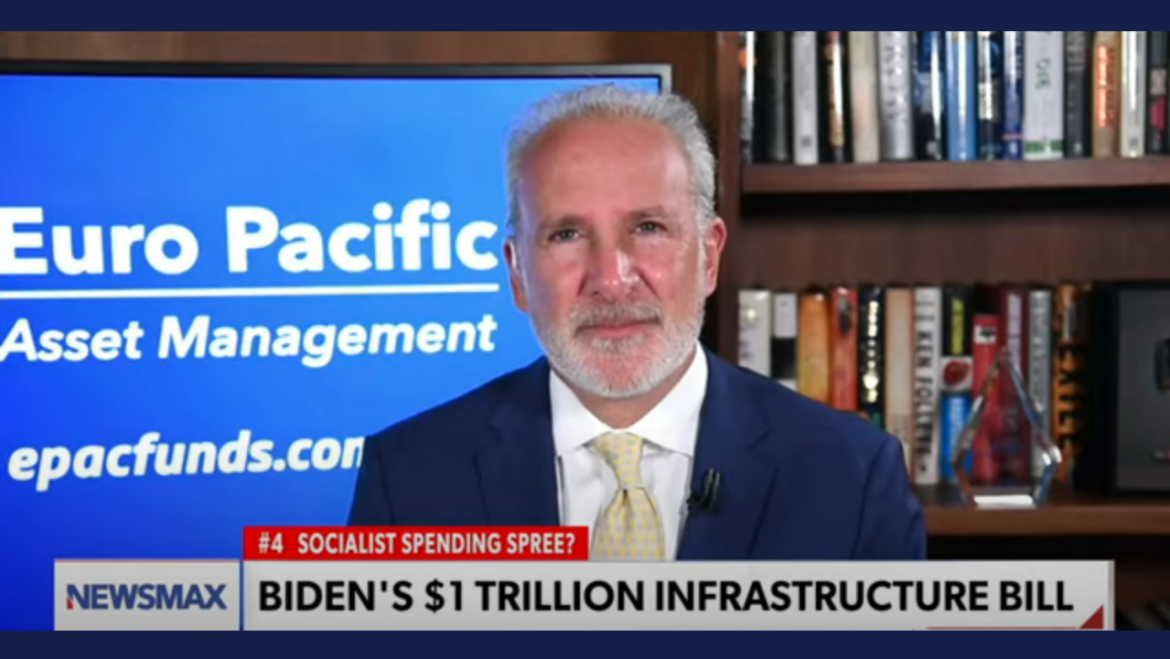

Congress is moving toward finalizing a $1 trillion infrastructure bill. Peter Schiff appeared on Newsmax “The Count” with Jenn Pellegrino to talk about the spending spree.

Biden said spending billions on government projects will help America to “build back better.” Politicians have been promising this for decades. But Peter said it’s the wrong approach. We should get government out of the way and let the free market work.

Inflation is running hot right now. The May CPI data came in hotter than expected, a trend we’ve seen every month this year. But the Federal Reserve and the mainstream financial media continue to insist inflation “transitory.” Peter Schiff recently appeared with Tucker Carlson on Fox News to talk about skyrocketing prices.

Is inflation “transitory,” the result of a quickly recovering post-pandemic economy as Jerome Powell insists? Or is it a long-term phenomenon resulting from loose monetary policy that’s not about to abate anytime soon? Peter Schiff recently participated in the “great inflation debate” on RT’s Cross Talk with Peter Lavelle, along with American Institute for Economic Research economist Pete Earle and Renaissance Capital economist Sofia Donets.

In many ways, it appears the economy is beginning to recover from the shocks of the coronavirus pandemic. GDP growth is way up. The stock market is soaring. A lot of people are optimistic. But during an appearance on the Ben Shapiro Show, Peter Schiff said this isn’t a real recovery, and he explains how all of the government “help” is actually wrecking the economy, distorting the job market and destroying the dollar.

The economy is actually sicker now than it was before COVID. And what’s really been hurting it was not the disease but the government’s cure.”

The Consumer Price Index came in much hotter than expected last week. The mainstream chalks rising prices to supply chain and production issues caused by the pandemic. But in a recent interview on NTD News, Peter Schiff says there’s more to it than that. Prices are rising because a surplus of printed dollars is bidding up prices.