Eric Sprott, the well-known billionaire asset manager, believes that investors need to buy gold and silver to protect themselves from the increasingly volatile currency markets. Last year, 84% of the world’s population would have made money owning gold. Sprott puts his money where his mouth is, claiming that 80% of his assets are in precious metals.

Since this January interview, the gold price has fallen in US dollars. However, Sprott is focused on the long-term picture of how the radical monetary policies of global central banks will damage the global economy. With banking policies like negative interest rates and massive money printing, the world is experiencing a completely new financial landscape. When paired with the fact that gold demand seems to be exceeding supply, he expects to see gold-backed currencies within the next decade.

In his new Gold Videocast, Peter Schiff explained how Obamacare has created a “job-sharing” economy that is skewing the government’s employment data. As he put it:

Obamacare forces employers to provide insurance for full-time employees. As a result, employers are hiring more part-time workers than they normally would and that is substantially influencing these numbers… [Suppose an employer] cuts [two full-time workers’] hours back to 10 hours a week and then he actually hires two more guys. So now he has four guys working 40 hours instead of two guys working 80 hours. He’s cut the hours in half but doubled his workforce. According to the government, he’s just created two jobs even though he has four people sharing one job.”

Jim Rickards, author of Currency Wars, describes a game he plays with audiences when he speaks about gold and paper money. He presents to them US dollars, Monopoly money, and a gold coin. Then he asks, “Which of these is not like the other?”

Ivy League professors nearly always rationalize that the dollars are different, because they are a store of value while the other two cannot serve as real money. However, Rickards reminds us that the US dollar has lost 95% of its purchasing power since 1913.

Five-year-olds, on the other hand, instantly recognize that the gold coin is different. They probably don’t understand that gold has been a form of money for thousands of years, with a relatively stable value that entire time. Nevertheless, you have to wonder about the state of our basic economic knowledge when the instincts young children are more accurate than the reasoning of elite academics.

RT asked Marc Faber why he invests in physical gold. Faber emphasized that nobody should put all of their assets into physical precious metals. However, if investors want to protect themselves from the volatile bubbles created by the Federal Reserve since the late 1990s, then gold and silver are essential assets. Precious metals are Faber’s “iron reserves,” and he doesn’t worry about short-term price fluctuations.

Peter Schiff has always emphasized that gold is a long-term safe haven asset and not a means of making quick profits. Investors need to understand the big economic picture to grasp why gold such an essential asset. Perhaps the biggest picture is the rise and fall of global currencies throughout history.

Jim Rickards, author of The Death of Money, walks us through the 20th century history of the US dollar and the pound sterling. He explains how a currency gains and loses the status of a global reserve currency.

Bloomberg has published a feature-length article about the history of the German gold repatriation movement partly led by Peter Boehringer. The piece is unusual for the mainstream American media in that it actively entertains the possibility that foreign gold stored in the New York Federal Reserve may not be the same gold originally deposited. Even worse, some of the gold could be missing, which might be the reason so many European central banks have begun to show interest in repatriation.

We live in an era of unprecedented sovereign debts and extraordinary monetary manipulation by central banks. There’s never been a more important time for both individuals and governments to protect themselves with gold reserves. However, it appears that Germany has always been a bit blasé about its reserves:

Last month, the Federal Reserve Bank of St. Louis published an essay that supposedly debunks the idea that a monetary gold standard can stabilize and improve economies. The piece is blatant propaganda that returns to the same excuse central bankers always use to discredit the gold standard. Namely, that tying a currency to gold prevents a government and its central bank from quickly responding to economic problems by manipulating the money supply. This is the same argument used to defeat the “Save Our Swiss Gold” campaign back in November, which would have forced the Swiss National Bank to significantly increase its gold reserves.

Casey Research published an article by Russian coin dealer Dmitriy Balkovskiy that provides fascinating insight into the lives of average Russians suffering from the crash of their ruble currency. He reveals that while the Russian central bank has been adding literally tons of gold to its reserves, the Russian people are not so enthusiastic about the yellow metal. In fact, Russians are very similar to Americans in their complete disregard to owning gold, which he considers a vital part of “personal fiscal hygiene.”

Greg Hunter of USAWatchdog spoke with Michael Pento, author of The Coming Bond Market Collapse. Pento agrees with Peter Schiff on the fundamental problems with the global economy. Central banks and irresponsible politicians have loaded governments with unsustainable levels of sovereign debt. The endgame is an inevitable financial crisis of epic proportions. Pento’s analysis is brutally honest and harshly critical of the financial media. What is his advice for the average investor? “Run for gold.”

We actually believe that small group of… plutocrats can decide better than the free market where commodity prices should be, where currencies should be, where equity prices should be, where bond yields should be. [Central bankers] haven’t just tinkered in that regard. They’ve dominated, usurped, vanquished the entire market. The free market is gone… We put it all in the hands of these few people, and they have screwed things up royally.”

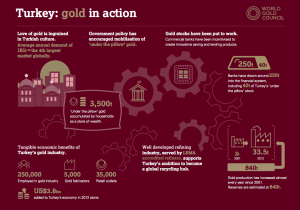

The World Gold Council has released a fascinating new report on Turkish gold demand and gold culture. Many gold investors are aware that China and India have been the top gold consumers in the world, but Turkey has a thriving gold economy as well. In fact, Turkey is the world’s 4th largest gold consumer, and in many ways, gold is even more integrated into the Turkish economy.

- At least 3,500 metric tons of gold is saved “under the pillow” of Turkish citizens.

- Turkey works actively to encourage wise investment and savings of this gold.

- Gold ATMs are common in Turkey, making it easy for consumers to buy high-quality physical bullion.