Peter Schiff appeared on The Joe Rogan Experience and chatted with Joe for almost three hours! From politics to Austrian economics, Peter and Joe covered the gambit in this entertaining conversation. Quantitative easing, Occupy Wall Street, oil companies, crony capitalism, modern medicine, minimum wage, gold investment, Bitcoin, and much more…

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In a recent interview, independent financial journalist Lars Schall and Jim Rickards have a fascinating discussion about the importance of gold to the stability of the global central banking system.

Central banks may turn to gold not because they want to, but because they have to as a way to restore confidence. Of course, the result of that would be much higher gold prices. When I say higher, I don’t mean $1,000 an ounce, I mean going up to… [as high as] $9,000 an ounce. That would be where you would have to price gold in order to have an international monetary system that could support trade without causing massive deflation.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Peter Schiff appeared on RT’s Boom Bust last week to explain how Federal Reserve’s monetary policy is preventing legitimate economic growth in the US and why that policy will lead to a currency crisis.

The central banks are trying to get everyone to irrationally fear a good thing – falling consumer prices – so that they can create inflation and we won’t complain about it. But the real reason they need inflation is to wipe out all of their debt and to sustain all of these phony bubble economies they’ve inflated.”

[youtube http://www.youtube.com/watch?v=LYoEWb7aPAE?start=223&end=776”frameborder=&w=640&h=360]

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Peter Schiff’s latest commentary for Euro Pacific Capital addresses the pernicious mainstream belief that inflation is good for the economy, while deflation is bad. If the government, supported by mainstream media’s propaganda, remains dedicated to inflationary strategies, there’s one surefire way to protect your wealth: physical gold.

Bron Suchecki, the Depository Administrator of the Perth Mint in Australia, has posted some interesting and alarming insights into the looming supply restraints on gold coins. If popular demand picks back up in the coming year, it could easily force mints to ration their supplies and send premiums surging.

Peter Schiff begins hist latest video blog with a review of December’s dismal jobs numbers and the latest data that reveal how poor the supposed US economic recovery really is. He then explains why Janet Yellen will soon be facing a bigger crisis than Ben Bernanke had to deal with when he first took charge of the Fed in 2006.

The monetary policies pursued by Bernanke were far more reckless than the ones pursued by Greenspan. And therefore, the bubble is much bigger. And therefore, the damage to the economy when it pops will be much bigger… We’re going to have another crisis early in the Yellen term that will be bigger than the crisis that we had early in the Bernanke term. Wall Street and government are equally as prepared – they will be equally blindsided.”

[youtube http://www.youtube.com/watch?v=myyRksPJe8I&w=640&h=360]

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

John Williams of Shadowstats.com appeared on USAWatchdog.com earlier this week to give his financial outlook for the US economy in 2014, and it wasn’t bright.

We have all sorts of things coming together that will give us a confluence of economic, political, and financial crises. You’ll see early on a crisis in the dollar, which will start to trigger the inflation… and as inflation picks up, that is going to savage the economy, which is already in a depression – it never recovered.”

[youtube http://www.youtube.com/watch?v=dQt-FFDM_5k&w=640&h=360]

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Jim Rickards is on a roll this week, with another interview on Bloomberg TV in which he tells some skeptical hosts that the Fed’s policies are a disaster and that the stock market is a bubble. He also stuck by his commitment to long-term gold, insisting that he’s bullish on it because of his fundamental analysis that the US dollar is going to collapse.

Gold correlates to one thing: the dollar… When gold goes up, what it really means is the dollar is down. So for gold to go to $7,000 – which I expect – what that means is that the dollar will lose 80% of its value, which it did in the 1970s… A gold rally is really a dollar collapse, and we should expect a dollar collapse.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Peter Schiff

There are two types of gold investors: those trying to make money on short-term market timing and those looking for long-term asset preservation. It was the fear-driven trading of the former that helped gold break $1900 in 2011, and for good reason – stormy markets steer investors to safe havens.

But gold’s fortune has shifted in the past two years, and finishing 2013 down 28% seems to have sealed its fate – at least in the eyes of the short-term speculators. In reality, the same forces that are stabilizing stocks and suppressing gold are also the fundamental reasons long-term investors have been buying gold since the turn of the new millennium. The so-called recovery we’re now experiencing is just a lull in a storm that hasn’t yet abated.

By Laurynas Vegys from Casey Research

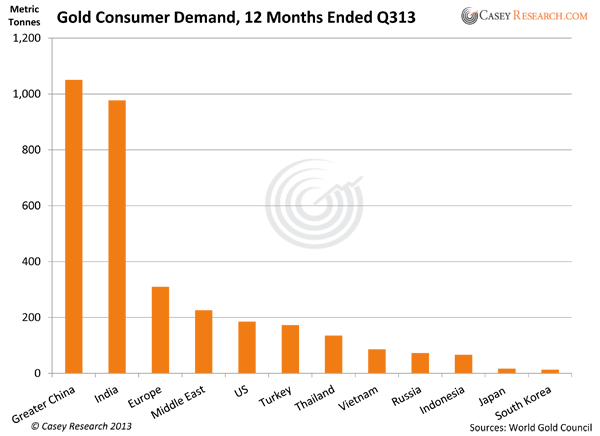

It’s been one of the worst years for gold in a generation. A flood of outflows from gold ETFs, endless tax increases on gold imports in India, and the mirage (albeit a convincing one in the eyes of many) of a supposedly improving economy in the US have all contributed to the constant hammering gold has taken in 2013.

Perhaps worse has been the onslaught of negative press our favorite metal has suffered. It has felt overwhelming at times and has pushed even some die-hard goldbugs to question their beliefs (which is not a bad thing, by the way).