By Laurynas Vegys from Casey Research

It’s been one of the worst years for gold in a generation. A flood of outflows from gold ETFs, endless tax increases on gold imports in India, and the mirage (albeit a convincing one in the eyes of many) of a supposedly improving economy in the US have all contributed to the constant hammering gold has taken in 2013.

Perhaps worse has been the onslaught of negative press our favorite metal has suffered. It has felt overwhelming at times and has pushed even some die-hard goldbugs to question their beliefs (which is not a bad thing, by the way).

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Based upon his recent visit to European gold refiners, Jim Rickards explains the alarming trend of physical gold being gobbled up by China in preparation for the day when the US dollar finally collapses. This short Bloomberg interview with Rickards, author of Currency Wars, is well worth watching.

The physical demand is through the roof… [Swiss refineries] are working triple shifts to produce gold. For the first time ever…[they’re] having difficulties sourcing gold… The floating supply is disappearing. This gold is coming out of GLD… It’s going straight to China, it’s being put underground. It will never see the light of day for 300 years… China is redefining the global gold market.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

US Mint Silver Coin Sales Hit Yearly Record

Bloomberg – By the second week of November, the US Mint’s American Eagle silver coin sales had reached 40.2 million ounces for 2013, a new annual record. The previous record was ~39.9 million ounces for all of 2011. Strong retail sales are attributed to lower silver prices since April and uncertainty created by the government shutdown in October. The mint will sell its last batch of 2013 coins on December 9th, which metals dealers suspect will push retail premiums higher.

Read Full Article>>

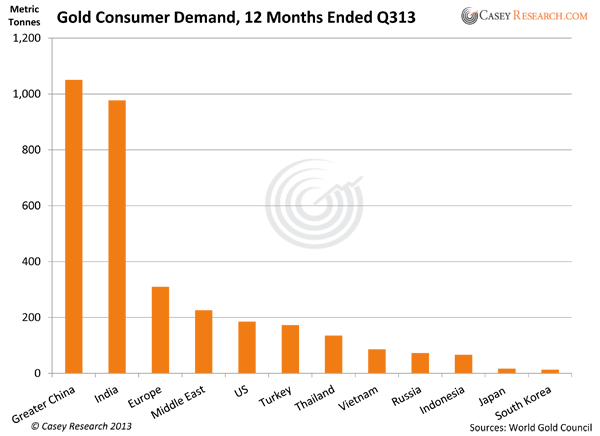

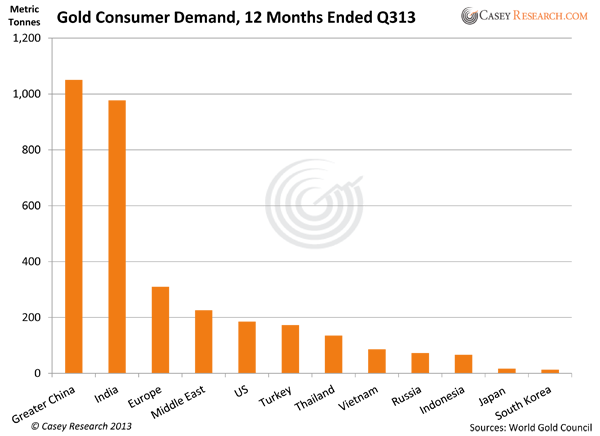

China Officially Surpasses India as Top Gold Consumer

CNNMoney – China has passed India as the world’s largest gold consumer, according to the latest World Gold Council data. China has bought 798 metric tons of the metal this year, while India bought 715. China’s total purchases are expected to surpass 1,000 metric tons by year-end. Strong Chinese demand is attributed to a growing middle class with greater disposable income. Also, Chinese stocks and property have under-performed relative to gold this year, driving greater demand for the metal. Indian demand was down 32% YoY in the third quarter due to government restrictions, while Chinese demand rose 18% YoY in the same period.

Read Full Article>>

European Refiners Recast Gold for Asian Demand

Bloomberg – The World Gold Council reported that larger bars of European gold are being refined into the smaller sizes preferred by Asian consumers. This is part of a trend, the Council has noted, of gold moving from West to East. European gold demand fell 11% in the year ending in September, while Asian and Middle Eastern demand climbed 30% in the same period. A 2,000-ton storage vault opened this month in Shanghai to accommodate growing Asian demand.

Read Full Article>>

Perth Mint Considers Expanding to Meet Demand

Wall Street Journal – The Perth Mint, one of the world’s largest producers of gold coins, is considering expanding its refining capacity to meet ongoing robust demand. Even operating its factory 24/7 on weekdays and throughout the weekend, it still sold out of 1-ounce silver and gold Australian Lunar coins in just one month. Sales and marketing director Ron Currie attributes the strong demand to consumers believing the gold price has bottomed. Germany is the mint’s largest buyer, though Chinese demand is increasing – with the mint now the largest foreign importer of gold into the PRC. The mint currently refines 10 million ounces of gold per year. The timeline and size of expansion remains unknown.

Read Full Article>>

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Fox Business interviewed Peter Schiff about the stock market’s strong performance following Christmas. Peter elaborated on the problems with the Fed’s upcoming taper and why he thinks it will be forced to increase QE in the future.

If the Fed did the right thing for the economy and let interest rates go up, the stock market would come crashing down. But I don’t believe the Fed is going to do the right thing. They’re going to keep doing the wrong thing. This bubble is too big to pop. The Fed knows it, so they’re going to keep on supplying air. So…the dollar’s going to go down a lot more in real terms. And yes, gold is going to go up.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Enjoy the December 2013 edition of the Silver Institute’s Silver News. This issue includes articles on silver’s use in 3-D printing electrical componenets, testing for cystic fibrosis, and drone cloud seeding to control weather in California.

Some goldbugs might be feeling glum this holiday season after a rough year for the yellow metal, but there are still plenty of contrarian voices advocating gold investment. Casey Research has published a valuable article highlighting the long-term gold bulls who haven’t lost faith. Besides renowned investors like Jim Rogers and Marc Faber, persistent goldbugs also share the company of global central banks and even major commercial banks that have been talking down gold while secretly buying.

When does a taper really mean more stimulus? When zero percent interest rates are pretty much guaranteed for the foreseeable future. Peter Schiff explains why the “taper lite” is simply an admittance that the economy is addicted to artificial stimulus. Peter also shares his opinion on gold’s sell-off and why investors should be using the opportunity to buy before it’s too late.

“There’s plenty of legitimate support for gold all around the world. Yes, all the speculators who were convinced that everything is great (the same people who thought it was great in 1999)… are convinced that there’s no reason to own gold and so they’re going to sell it and they’re going to short it. But there’s a larger community around the world, particularly emerging markets, central banks – China in particular – that see it differently. And they’re using this opportunity to buy as much gold as they can…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The Wall Street Transcript released its Gold and Precious Metals Report, which includes an interview with Peter Schiff on gold’s performance in the past year and what to expect in the physical precious metals market going forward. The full report is available for download here. Yahoo! provides an excerpt from the interview:

TWST: Gold has been not a great performer this year. What’s going on?

Mr. Schiff: Well, obviously some of the people who made a lot of money in gold over the years may have decided to cash in, but I think – more likely I think the speculators, who finally, finally got into the gold market over the last couple years decided to get out and cut their losses, because I think they saw the big run-up in the stock market, they believed all the hype about the recession being over, about the Fed being ready to tighten and take away the QE, and I think they believe that the case for gold was undermining.

So they sold their gold and went back into the stock market, because that’s where a lot of that speculative money came from. It came from stock market investors, who had lost money in the market over five or 10 years, didn’t own any gold, and then after seeing gold go up four or five times decided that they would want to buy some. And they got shaken out of the market in its last correction, and I think that’s very healthy, because I think the next leg up in the bull market – I think we have a long way to go before some of those speculators get back into the market, and of course by the time they do the prices will probably be well in excess of $2,000 an ounce.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In his latest piece with Casey Research, Jeff Clark lays out the main factors that might lead to a gold shortage in 2014. The trends Clark cites have been apparent for several years, but 2014 might be the year that Western purchasers of gold really start to notice the squeeze.