Korea Begins Spot Gold Trade

Wall Street Journal – The South Korean stock exchange has started trading physical spot gold for the first time, hoping to increase tax revenue from the yellow metal. South Koreans trade about 110 tons of gold every year, of which about 70 tons, worth $3 billion, are traded on the untaxed black market. Black market gold is a popular way to hide income and avoid taxes. The government is incentivizing gold traders to use the Korea Exchange by waiving import duties and offering tax reductions on these gold transactions. Read Full Article>>

China Gold Imports & Consumption Rise

Bloomberg – Chinese gold imports from Hong Kong increased to 109.2 metric tons in February, compared to 83.6 tons in January and 60.9 tons YoY. Chinese buyers purchased a total of 125 tons in February, compared to 102.6 tons in January and 97.1 tons YoY.

There was big news last week in the precious metals industry. Anthony Columbo and his companies (Premier Precious Metals Inc., Rushmore Consulting Group Inc., and PPM Credit Inc.) were banned by the FTC from selling precious metals “investment opportunities.”

The FTC charged Columbo with swindling millions of dollars from investors through hard-sell telemarketing schemes.

The saddest part is that a large number of his victims were senior citizens, who were probably looking for a way to protect their hard-earned savings from inflation and a crumbling US economy. We expect there’s going to be a lot more stories like this in the coming years as gold and silver start to make headline gains once again.

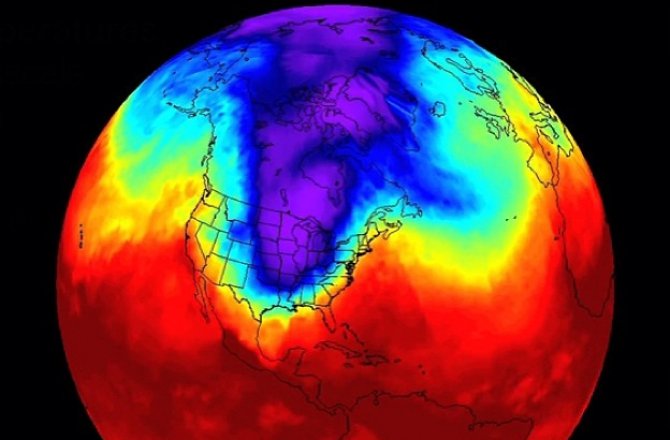

In his latest commentary, Peter Schiff pokes holes in the theory that the polar vortex and exceptionally cold winter is solely responsible for the poor economic data of the past several months. Peter argues that economists and the media are blowing a lot of hot… er, cold air to convince the public that the economy is doing better than it really is.

Politicians and the Federal Reserve are spinning tales of a slow but steady economic recovery in the United States. But economists and financial advisors like Peter Schiff are not fooled by the double speak. The Economic Collapse Blog published a good summary of recent major economic data and news that indicate the picture is not nearly as rosy as Washington would like us to believe.

By Peter Schiff

Before Bear Stearns and Lehman collapsed, the market for physical gold was limited to a relatively small group of investors who understood the havoc inflation was wreaking on our savings and the US markets. As the financial crisis took hold, a flood of new and inexperienced buyers entered the market, creating an opportunity for unscrupulous metals dealers to swindle their way to massive profits. This is what drove me to launch my very own gold dealer, Euro Pacific Precious Metals, to provide a safe alternative for those who were taking my advice to diversify into sound money. In our first year of business, I released Classic Gold Scams and How to Avoid Getting Ripped Off, a free report that has saved countless investors from losing their shirts.

By Peter Schiff

The most puzzling part of the investment business is seeing how the vast and largely economically illiterate masses interpret any given piece of news. Take the recent gold selloff: many large players were motivated to sell by news that Cyprus will have to liquidate its gold stockpiles to pay off acute debt obligations. But just a moment’s reflection shows this reaction to be knee-jerk.

The real story behind Cyprus’ deal has much more profound ramifications – and they are positive for gold.

On his radio show this morning, Peter Schiff interviewed Bill Murphy of the Gold Anti-Trust Action Committee. Peter and Bill discussed the possible price suppression of gold and the bullish fundamentals of the yellow metal.

What’s even more amazing is that the price of gold is not reacting, not only to the inflation that has already taken place, but all the inflation that we know is baked into the cake. Because we have all these governments with massive amounts of debt, [and] no prayer of ever repaying it. So there’s massive debt monetization and inflation on the horizon. That should be factored into the price of gold right now.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In his latest video blog post, Peter Schiff analyzes the latest economic data and the overwhelming negative sentiment against gold. Picking apart some anti-gold headlines from Forbes and The Wall Street Journal, Peter counters the gold naysayers and explains why they’re completely misinterpreting the fundamental condition of the US economy.

But rather than the price of gold collapsing to meet the expectations of the price of gold stocks, I think the reverse is going to happen… I think the price of gold stocks will soar to catch up to the price of gold… If you look at the price of stocks relative to gold this year, we have resumed our down trend. And so even though the stock market is now heading higher in terms of dollars, it is now headed lower in terms of gold. And that is a trend that I am convinced will continue.”

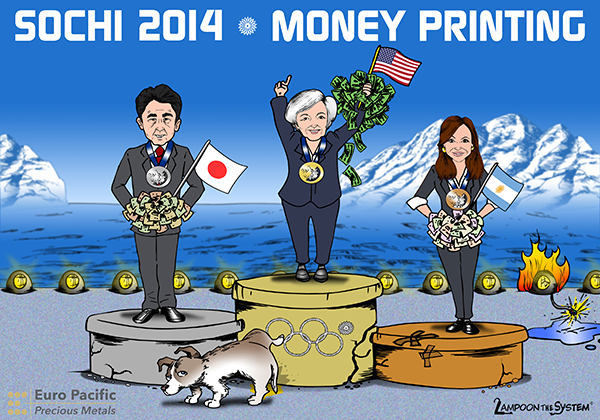

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

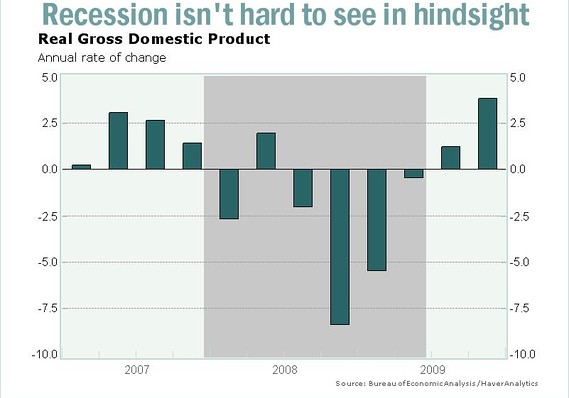

A MarketWatch commentary has analyzed the Federal Reserve’s transcripts from the 2008 recession and found that it is grossly incompetent at predicting and understanding recessions. There doesn’t seem to be any good reasons to expect that the Fed has improved its market diagnostic skills. What does that mean for investors today? Don’t trust the official hype – the economy is doing a lot worse than Yellen’s Fed claims.