In the latest episode of his podcast, Peter Schiff gives his take on the end of quantitative easing. Peter reviews CNBC’s reaction to the news and Alan Greenspan’s opinion of QE. He also shares his own predictions for the future of the American economy and the price of gold.

It’s official. The Federal Reserve has ended its third quantitative easing program, QE3. The Fed claims that the economy is continuing to improve, yet they’re still going to keep interest rates at near-zero for a “considerable time.” Stay tuned for Peter Schiff’s video response to the news later today.

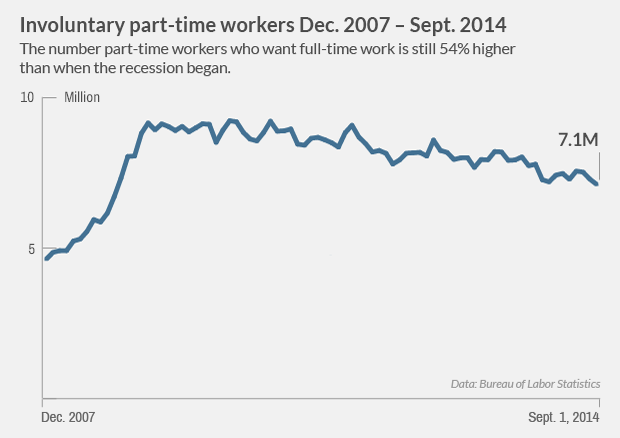

So the Fed claims the economy is getting better, particularly stressing how good the labor market is today. However, if you dig into the numbers, the labor market is actually terrible. There are 54% more involuntary part-time workers now than in 2007. On top of this, 1.4 million full-time jobs have been lost since 2008. Given this, it should come as no surprise that when you account for inflation, the 2013 median household income was 8% lower than 2007!

In his latest article from Merk Insights, renowned investment advisor Axel Merk shares his observations of Alan Greenspan’s performance at the New Orleans Investment Conference this last weekend. In particular, people tried to pin down Greenspan on the topic of gold. While it sounds like the former Federal Reserve Chairman was pretty cagey, he did drop some whoppers that Merk is quick to point out. Peter Schiff was also in attendance at the Conference – stay tuned to Peter Schiff’s Gold News for some exclusive video content from Merk and Peter.

Jim Rickards, author of The Death of Money, spoke with Erin Ade on RT’s Boom Bust this week. He explained why central banks around the world are incapable of preventing the inevitable fallout of the current international currency wars. Rickards isn’t sure what will trigger the next big crisis – a debt crisis in the United States, a panic in China, or the coming Swiss Gold Referendum at the end of the November.

Peter Schiff appeared on CNBC’s Futures Now this afternoon to defend his record on gold. Things got heated, because it seems the stock traders can’t wrap their heads around the strategy of holding physical gold and silver bullion as a long-term hedge against inflation in a well-diversified portfolio. Instead, they’re intent on blasting Peter for not being able to exactly predict when the precious metal will reach new highs.

Of course, Peter is basing his predictions on a fundamental analysis of the American economy and not on short-term technical indicators. Investors who buy gold for a quick profit don’t understand the reason for holding gold in the first place. At the end, Peter tries to point out that history is going to repeat itself – just as the traders missed the 2007 financial crisis, they’re going to be blindsided by the next crash. Enjoy a full transcript of Peter’s responses below the video.

If you are in the tri-state area this Saturday, please join us at the 3 West Club in Manhattan for an afternoon of discourse on free markets, the role of government, and everybody’s favorite precious metal – gold.

Precious Metals Specialists Erik Oswald and Dickson Buchanan will be in attendance. This is your chance to meet your gold broker in person, while enjoying a fun and educational evening.

Doctors Keith Weiner and Andrew Bernstein are the keynote speakers of the conference and will discuss a variety of topics, including:

- The philosophical implications and morality of capitalism

- Prognoses on the Federal Reserve’s monetary policy

- Gold as a monetary alternative in a world flooded with fiat currency

Please register online, as tickets will be more expensive if you pay at the door.

Click here for details and to register for the event.

We look forward to seeing you there.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In his latest podcast, Peter Schiff takes a look at the most recent earnings reports from Wall Street. Why are McDonald’s, Coca-Cola, and Amazon’s earnings so far off from expectations? If the economy is getting better, surely these companies – companies that are dependent on the prosperity of everyday Americans – would also be experiencing decent profits. Right? Think again. Peter Schiff explains what corporate America can tell us about the real condition of the United States economy.

Jeff Deist, President of the Mises Institute, interviewed Patrick Barron, a private consultant to the banking industry. In this not-to-be-missed conversation, Barron explains exactly how the United States dollar became the world’s “reserve currency,” allowing America to become a “monetary imperialist.” According to Austrian economist Hans Hoppe, a monetary imperialist is a dominant country that uses its power to enforce a policy of internationally coordinated inflation. However, the countries and corporations of the world are getting sick of US imperialism, and Barron is certain that the wheels are already in motion to abandon the US dollar.

This is part one of a two-part interview that covers the following topics:

- How does the world use the dollar as a weapon of economic and cultural power?

- How did the Bretton Woods agreement set the stage for the US dollar to dominate the world economy, and how long can it all last?

- What might the unprecedented collapse of the worldwide reserve currency look like?

- How do the BRIC nations and Asian central banks fight back?

Enjoy a partial transcript of the interview’s highlights below the video.

On Friday, we gave you an update on silver investment demand. While it’s a leading factor in the silver price, investment demand is just one side of the silver picture. More than half of global silver demand comes from the industrial sector, and the deficit of silver supplies keeps getting larger. 2013 saw the largest deficit in physical silver since 2008 – more than 113 million ounces of silver. In fact, silver supplies have been in deficit for a decade.

Silver is used in modern medicine for its anti-bacterial properties. It’s also essential to the production of ethylene oxide, which is used to create polyester fibers – a growing industry as emerging markets continue to pull their populations out of poverty. Solar power is also a major industry for silver, but we’ll get to that in a moment.

Last year, silver demand and investment broke a number of records thanks to the temporary correction in its price. It appears that this trend is not about it reverse. There has been a variety of news suggesting that both investment and industrial silver demand is going to remain strong for a while. Today we’ll take a brief look at investment demand.

In a recent press release, The Silver Institute projected that investment demand for silver is likely to increase by one billion ounces over the next ten years.