A Sunny Outlook for Industrial Silver Demand

On Friday, we gave you an update on silver investment demand. While it’s a leading factor in the silver price, investment demand is just one side of the silver picture. More than half of global silver demand comes from the industrial sector, and the deficit of silver supplies keeps getting larger. 2013 saw the largest deficit in physical silver since 2008 – more than 113 million ounces of silver. In fact, silver supplies have been in deficit for a decade.

Silver is used in modern medicine for its anti-bacterial properties. It’s also essential to the production of ethylene oxide, which is used to create polyester fibers – a growing industry as emerging markets continue to pull their populations out of poverty. Solar power is also a major industry for silver, but we’ll get to that in a moment.

Just as with gold, we have to turn to the East and China when talking about silver. In general, industrial demand for silver in China rose for the fourth straight year in 2013 – up 9% to 179.7 million ounces, a new record. Lots of that demand is for the electronic goods the Chinese produce and export, but solar power is also a big chunk of it.

Silver is used in solar panels for its amazing conductivity of electricity and heat. In fact, it’s one of the best conductors known to man. Your average solar panel contains about 20 grams of silver – that’s just about two-thirds a troy ounce of silver. A single solar power installation will use many of these panels, and the number of solar power projects is steadily increasing around the world. In China, the figures are astounding.

In 2013, China became the biggest solar market in the world, installing a total 13 gigawatts of solar power – this is a world record for a single country’s solar installation in one year. Pollution is a big problem in China, so this trend is not likely to end soon. In fact, China is shooting for 14 GW of new solar capacity in 2014.

These are just installations within China, which is also the world’s largest producer and exporter of solar panels. In fact, China dominates the market; check out this chart:

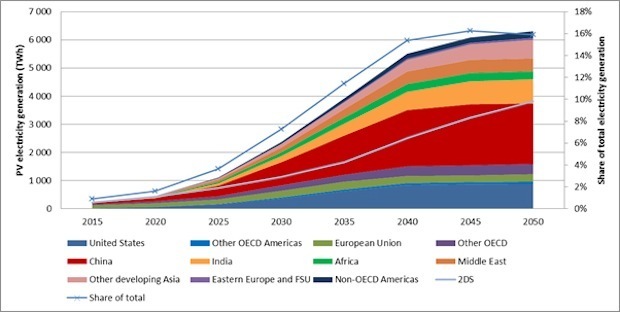

Even if you rule out China, there has been some big news from the solar industry – solar power is getting cheaper and more efficient. New reports from the International Energy Agency have some encouraging statistics for the future, which Computer World magazine summarizes nicely. Among the highlights:

- Solar power is en route to 4 cents per kilowatt-hour of electricity. Compare this to about 13 cents per hour for residential power in the United States.

- At the current rate of adoption, photovoltaic panels could produce 16% of the world’s energy by 2050.

Another report found that the price for solar power could become competitive with coal and gas electricity by the early 2020s. This isn’t that far-fetched when you consider that the prices of solar modules have dropped by 80% since 2008!

The burgeoning solar industry means more and more demand for the white metal in the coming years. You shouldn’t invest in physical silver bullion because of its industrial demand. The fact that it has been considered money for thousands of years, just like gold, is the main reason to own it as a safe-haven asset. But the industrial picture for silver means that the limited supplies of this metal are likely to become more precious in the years to come. Learn more about the excellent potential silver has as an investment in our free special report: The Powerful Case for Silver.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Leave a Reply