The Chinese yuan became one of the top five payment currencies in the world in November, according to the latest data from SWIFT, one of the largest international interbank transaction companies. The yuan jumped from seventh to fifth place, overtaking the Australian and Canadian dollars. With the yuan accounting for 2.17% of global payments, it is not far behind the Japanese yen, which has a 2.69% share.

As Wim Raymaekers, Head of Banking Markets at SWIFT, puts it:

The RMB breaking into the top five world payments currencies is an important milestone. It is a great testimony to the internationalisation of the RMB and confirms its transition from an ’emerging’ to a ‘business as usual’ payment currency. The rise of various offshore RMB clearing centers around the world, including eight new agreements signed with the People’s Bank of China in 2014, was an important driver fueling this growth.”

Canadian television network BNN spoke with Peter Schiff about the US economy and the potential for gold in Canadian dollars in 2015.

Gold has started 2015 with a bang. The physical price is soaring in currencies around the world. Even the rising dollar hasn’t hampered gold, which is a very bullish signal. Gold stocks are also exploding. The largest gold ETF is up nearly 10% already. Yahoo! Finance interviewed Peter Schiff to see what he predicts for gold in the rest of 2015.

Casey Research published an article by Russian coin dealer Dmitriy Balkovskiy that provides fascinating insight into the lives of average Russians suffering from the crash of their ruble currency. He reveals that while the Russian central bank has been adding literally tons of gold to its reserves, the Russian people are not so enthusiastic about the yellow metal. In fact, Russians are very similar to Americans in their complete disregard to owning gold, which he considers a vital part of “personal fiscal hygiene.”

Peter Schiff appeared on Fox Business yesterday to discuss whether or not the Federal Reserve is going to start quantitative easing again in 2015. Anchor David Asman gave Peter credit for predicting that the economy is too weak for the Fed to rase interest rates, which Morgan Stanley now believes as well. On top of that, Asman credited Peter for predicting poor UPS earnings in the fourth quarter. Peter and Asman still wrangled over whether or not the US is falling into another recession.

Greg Hunter of USAWatchdog spoke with Michael Pento, author of The Coming Bond Market Collapse. Pento agrees with Peter Schiff on the fundamental problems with the global economy. Central banks and irresponsible politicians have loaded governments with unsustainable levels of sovereign debt. The endgame is an inevitable financial crisis of epic proportions. Pento’s analysis is brutally honest and harshly critical of the financial media. What is his advice for the average investor? “Run for gold.”

We actually believe that small group of… plutocrats can decide better than the free market where commodity prices should be, where currencies should be, where equity prices should be, where bond yields should be. [Central bankers] haven’t just tinkered in that regard. They’ve dominated, usurped, vanquished the entire market. The free market is gone… We put it all in the hands of these few people, and they have screwed things up royally.”

Russia has added more gold to its foreign reserves, making December the ninth month in a row that it has bought the yellow metal. Russia’s gold holdings are now the largest they’ve been in two decades, according to the International Monetary Fund.

Smaller countries have also been stocking up on the yellow metal. Kazakhstan added to its reserves for the 27th straight month. Malaysia, Belarus, Greece, Kyrgyz Republic, and Serbia also bought gold.

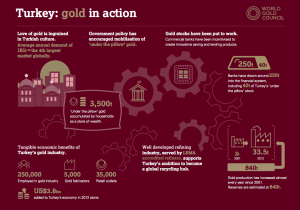

The World Gold Council has released a fascinating new report on Turkish gold demand and gold culture. Many gold investors are aware that China and India have been the top gold consumers in the world, but Turkey has a thriving gold economy as well. In fact, Turkey is the world’s 4th largest gold consumer, and in many ways, gold is even more integrated into the Turkish economy.

- At least 3,500 metric tons of gold is saved “under the pillow” of Turkish citizens.

- Turkey works actively to encourage wise investment and savings of this gold.

- Gold ATMs are common in Turkey, making it easy for consumers to buy high-quality physical bullion.

The World Economic Forum’s meeting in Davos ended this past weekend, and much of the mainstream news focused on the hypocrisy of the world’s wealthiest individuals discussing the plight of the global economy. Research released by Oxfam in the middle of the conference shows that the richest 1% own 48% of the world’s wealth. Politicians love broad statistics like this, which they can use to justify more government “solutions” to this inequality.

However, it’s these same successful (and rich) businessmen who are sounding the alarms about the destructive policies of global central banks. These monetary policies are the single biggest contributor to income inequality, because they enrich the financial elite while destroying the economic fundamentals that allow the lower and middle classes to prosper. Renowned business magnate George Soros made the news at Davos when he stated the obvious:

Peter Schiff gets a bit riled up in his latest podcast while responding to Obama’s State of the Union Address. Of course, Peter has good cause to get upset as he picks apart the outright lies in Obama’s speech, including Obama’s claim that he has reduced America’s debt and that the middle class lifestyle is better off thanks to big government.