Dr. Ron Paul discussed the future of the dollar on the Ron Paul Liberty Report this week. He believes that the value of the dollar is in a bubble that will eventually pop when the Federal Reserve is forced to raise interest rates.

The best measurement throughout history for the value of a currency is its relationship to gold… On the long run, it is in the interest of governments to make sure gold prices do not go up. During the 60s and the 70s, they did everything to dump gold and pretend gold was $35 an ounce… Even though gold may seem to be in the doldrums right now, eventually [it] will break out.”

The war on cash is a growing collection of laws and banking regulations that discourage or prevent citizens from doing business in physical currency. Last month, we reported on new laws in France that will limit the size of cash transactions. On a smaller scale, the state of Louisiana has recently made it illegal to use cash when transacting secondhand goods. For years now, American banks have been required to file “Suspicious Activity Reports” when cash transactions or withdrawals of more than $5,000 occur.

According to lawmakers, these regulations ostensibly ensure that business transactions are properly reported and taxed. They don’t want any potential tax revenue slipping through the cracks. They tell the public that these laws will help to prevent white collar crime, organized crime, and terrorism.

However, the privacy of financial transactions is simply the tip of the iceberg when it comes to the war on cash.

Yesterday a British stock trader was arrested on criminal fraud charges for stock market manipulation. The Commodity Futures Trading Commission and the United States Department of Justice accused Navinder Singh Sarao of single-handedly triggering the “flash crash” of May 2010. During this crash, the Dow Jones Industrial Average plunged about 600 points in just minutes, representing a loss of almost $1 trillion in market value.

According to Bloomberg Intelligence, China’s gold bullion reserves may have tripled since its last official report in 2009. Bloomberg estimates that the People’s Bank of China could now own as much as 3,510 metric tons of the metal. If true, China now has the second largest store of gold in the world, following the United States with 8,133 tons.

While there has been a lot of speculation in the past few years that the Chinese government has been stockpiling more gold, this is the first mainstream American news source that we have seen seriously look into the possibility. Bloomberg reached its estimate by analyzing China Gold Association data, as well as domestic production and trade figures.

Why this sudden attention to China’s gold hoard?

There are very few investment professionals voicing concern about the Federal Reserve’s easy monetary policies nowadays. Most economists still believe the Fed will likely raise the Fed Funds interest rate in June, or at least by September. The financial media takes it as a given that the United States economic recovery remains relatively robust, while China’s economy seems to be on the verge of disaster.

Enter Stanley Druckenmiller, one of the most successful hedge fund managers of the past thirty years. He has made big waves in the past month after a transcript of a speech he gave at a private club became public. In the speech, he explained that he is concerned that the economic climate is starting to look eerily similar to 2004 and the lead-up to the financial crisis.

Peter Schiff just returned from a family vacation and starts his latest podcast by discussing his observations about Disney World. He goes on to review the latest economic data. Finally, Peter picks apart Paul Krugman’s latest commentary, which is largely a response to German Finance Minister Wolfgang Schauble’s rational, conservative economic advice.

The Daily Bell interviewed Peter Schiff last week and published the first half of their conversation yesterday. Peter explained why the United States economy isn’t recovering and why he blames the Federal Reserve.

Peter also answered a slew of other questions. Does Janet Yellen know that the Fed’s monetary policies have been destructive, or is she just very ignorant? Will the Federal Reserve raise interest rates soon, or will a dollar crisis force its hand? Why do US stocks continue to rise when American economic data remains so weak? Will the presidential race actually affect the economy and the Fed’s policies? Could Rand Paul make a difference as president?

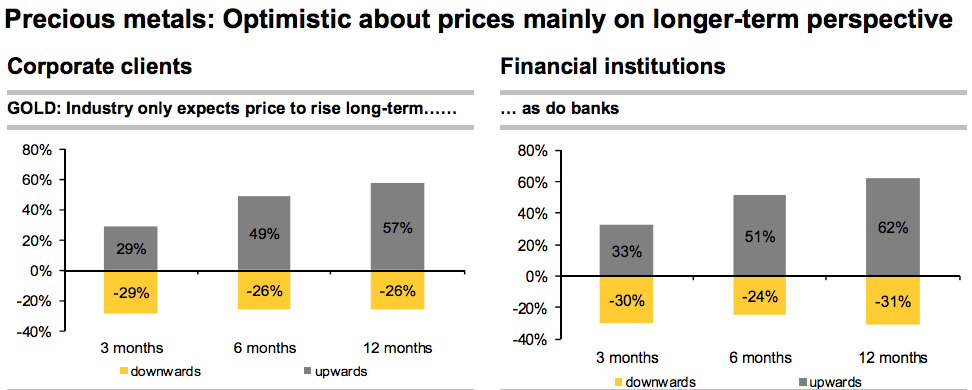

Many global banks and precious metals analysts are now forecasting that gold has seen its bottom and will be moving higher in the coming years. The timeframe varies from institution to institution, but the consensus seems to be that the price of gold in dollars will rise significantly after 2015. Very few expect it to move dramatically lower this year.

The German Commerzbank published the results of a commodity survey at the beginning of April, showing overwhelming bullishness for precious metals in the long-term. For investment bankers, “long-term” means next year. For investors interested in buying physical gold, that means they should make plans for investing in bullion very soon.

Peter Schiff spoke with Graham Ledger about why the United States economy will only truly recover when the Federal Reserve completely abandons quantitative easing and zero-percent interest rates. Unfortunately, Peter thinks this is highly unlikely due to the political ramifications. Raising interest rates to normal levels right now would likely pop the current stock market bubble. If that happens while Obama is still in office, it will be much easier for a Republican to get elected. That’s exactly why Obama will likely pressure Janet Yellen to keep suppressing interest rates until after the 2016 elections.

Why did we have QE3? Because QE2 didn’t work. Why did we have QE2? Because QE1 didn’t work. We’re going to have QE4 for the same reason, and it’s going to make the problem worse, which means we’re going to have QE5. It’s not going to end until we have a complete collapse of the dollar.”

Currency traders have been blaming the weak first quarter GDP on poor weather. Peter Schiff argues that they’re going to have to start looking for new excuses, because April data is starting to trickle in and it doesn’t look good at all.