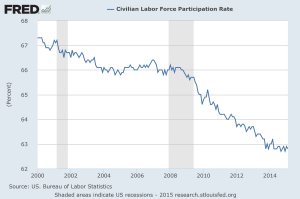

Peter Schiff isn’t the only one warning that the economic data of the United States is much worse than the media portrays. Michael Snyder has shared 10 charts pulled straights from the Federal Reserve’s own records that show how things have gotten worse since last crisis, not better. Some of these are points Peter has raised time and again, such as the low labor force participation rate. You can see it has been ticking steadily lower since the turn of the millennium.

However, Snyder goes on at length about a number of other important data points. Whether he is looking at the ballooning national debt or the velocity of money, he draws attention to the most important key fact:

Fox Business’ Kennedy spoke with Peter Schiff about President Obama’s praise for a mandatory voting system. Peter argued that mandatory voting doesn’t automatically lead to better government, because people won’t necessarily be making informed decisions. What’s worse, mandatory voting could only be enforced with monetary penalties, which would just become another tax burden. Kennedy and Peter also discussed why the United States needs to experience a recession for the economy to truly grow out of the problems created by the Federal Reserve’s monetary policy.

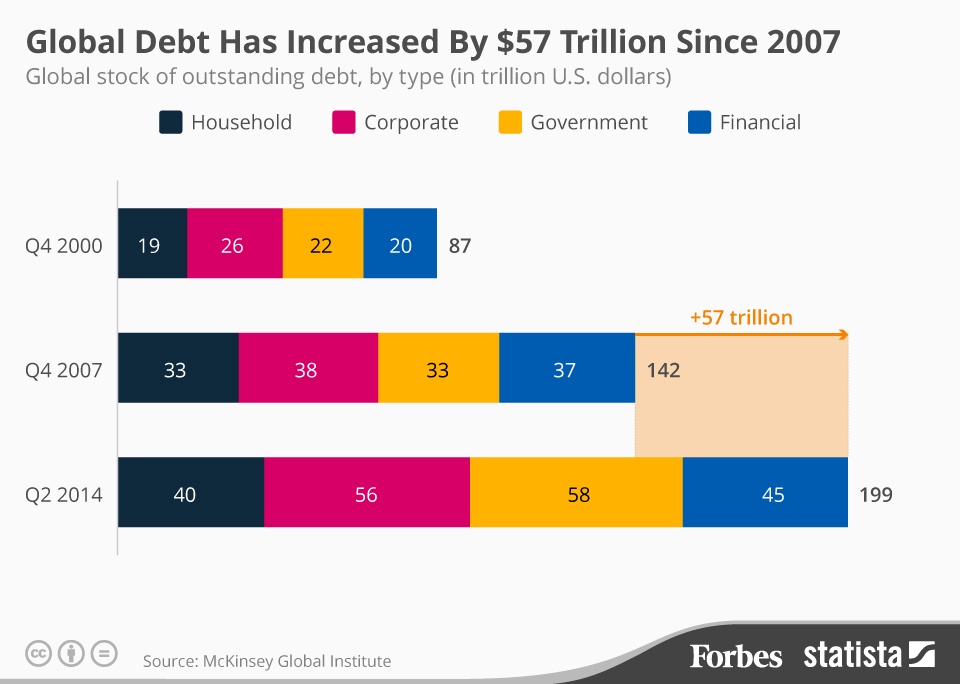

An article from the New York Post pointed out that many analysts are joining Peter Schiff in saying that the global debt explosion is unsustainable. In fact, it’s pushing countries around the world towards yet another precipice of financial collapse. The Post cites some grim statistics of American and global debt:

- Global debt has expanded $57 trillion since 2007, reaching a total of $199 trillion last year.

- Total US debt was $40 trillion last year, or 233% of US gross domestic product.

- Even the Atlanta Fed has cut its estimate for first-quarter GDP growth to 0.3%.

- Central banks in the eurozone adopted a $60 billion per month QE program, pushing bonds to an all-time low.

David Stockman told Fox Business that the United States’ biggest economic priority should be getting the Federal Reserve under control. With a balance sheet that has quadrupled in just a few years, the Fed is incapable of sustaining its fiscal policy. Raising the Fed funds rate will add billions more to the already ballooning debt. The only way out of this perilous scenario, according to Stockman, is to get out of blind currency printing and back to sound money.

Deflation is a terrible thing, according to central bankers and politicians. Even mainstream economists decry deflation as an economic disaster, ignoring the basic supply and demand principles of Economics 101. Peter Schiff is one of the few advisors on mainstream media who will debate the point.

An article by Edin Mujagic, published at the Mises Institute, takes a look at some modern-day examples of deflation and the associated economic data.. Japan, Greece, Spain, and the Netherlands have all been experiencing deflation, while simultaneously experiencing a stronger GDP and consumer confidence. Mujagic focuses on the effects of deflation on “Joe Average,” which are roundly positive. However, there’s one economic player for whom deflation is an enemy — governments overburdened with debt.

Recent Economic Data Shows the Good Side of Deflation

By Edin Mujagic

The Fed, the ECB, and the Bank of England repeatedly tell us that deflation is extremely dangerous for an economy. Central bankers, most economists, and the media speak of deflation as one of the greatest disasters that can strike an economy.

The Fed, the ECB, and the Bank of England repeatedly tell us that deflation is extremely dangerous for an economy. Central bankers, most economists, and the media speak of deflation as one of the greatest disasters that can strike an economy.

It is stunning then, given the apparent importance of the subject — and the possible collateral damage of pro-inflation policies — that few seem to bother to ask the deeper, fundamental question: does the historical data show that deflation is actually a terrible thing? The data suggests that it is not. In fact, looking at recent GDP, inflation, and employment data, one could even say that a shot of deflation is what many economies need. Let us take a look at the recent real-life examples.

In another interview on Yahoo! Finance, Peter Schiff contradicted the conventional narrative of the dollar’s future. He argued that the dollar’s brief, but dramatic dip this week is only a taste of what’s to come. Just like those who invested in subprime mortgages, people will get caught in the reversal and implosion of the dollar. This will likely come on the heels of massive consumer inflation thanks to the endless money-printing of global central banks. When this happens, investors will return to gold as a store of wealth. Peter pointed out that gold has no ceiling because there’s no limit to how low the dollar can sink.

Appearing on Yahoo! Finance, Peter Schiff underscored that the Federal Reserve has been bluffing about raising interest rates. In fact, they will continue to bluff for as long as possible until they’re forced to deal with a deflating asset bubble. He also pointed out the arbitrariness of the Fed’s supposed goal posts: previously they had said they would raise rates when unemployment officially got below 6.5%, it is now at 5.5% and they want to keep waiting. Peter said the Fed has the same confused attitude about inflation:

I think they’re going to be just as tolerant on inflation when inflation is 2.5 or 3%. They’re still not going to raise rates, but believe me, when it’s officially at 3%, it’s going to be a lot higher than that, and consumers are really going to be feeling the pain.”

Laurence Kotlikoff, Professor of Economics at Boston University, appeared before Congress last month and called them out on phony accounting. He told Greg Hunter of USAWatchdog that despite his best attempts, he could not make senators see how the fiscal situation of the country is not as rosy as official numbers would have us believe. In his interview with Hunter, Kotlikoff talked a lot about social security, but he ultimately underscores what Peter Schiff has been saying for a long time: another financial collapse is coming.

Some of Kotlikoff’s key points include:

- The current deficit is actually $5 trillion, not the $500 million Congress claims.

- The entire government is in terrible fiscal shape, with a true debt load of over $200 trillion.

- The US is risking the same path as Argentina with its out-of-control money creation, which dropped it from the 5th largest GDP in the world to the status of a developing country.

- Real wages and the savings rate are extremely low. In the 1950s, Americans saved about 15% of their income, compared to just 4% today.

- Long-term Treasury bonds are extremely risky, because the Federal Reserve won’t be able to keep interest rates suppressed forever. Eventually, true inflation will ruin banks that relied too heavily on bonds.

Peter Schiff has been making the rounds of the financial media this week, warning that the Federal Reserve has no intention of raising interest rates. Fox Business moved on from this topic and asked Peter to defend the latest weakness in the gold price. Peter noted that gold has risen 5-fold in the last decade — far outpacing the stock market. Every investment will see a few down years inside a larger trend, and investors need to keep that trend in mind. Official inflation might be low now, but there’s clearly a bubble in asset prices. When the Fed inevitably fails to maintain this bubble, inflation will spread to the rest of the economy.

The stock market is inflated, the bond market is inflated, the real estate market is inflated. But all this represents claims to wealth, when actually people want to convert their claims to real stuff, when they want to spend their gains. That’s when you really see prices surging for consumer goods and that’s when it finally shows up in official measures of inflation.”

The Federal Reserve removed “patient” from its policy statement and the media exploded with speculation on what the move might mean. Peter Schiff appeared on a panel discussion on Canada’s Business News Network to address the idea that removing the word means the Fed intends to raise rates. The discussion turned into a lively debate about the real condition of the American economy.