This article was written by Nelson Gilliat, a millennial supporter of sound money and Austrian economics. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

During March 16th’s FOMC meeting, the Fed announced that it would leave interest rates unchanged and scaled back its December projections for higher rates in 2016, 2017, and 2018. The Fed’s backtracking comes just three months after raising interest rates 25 basis points, its first hike since June 2006.

While the Fed’s backtracking on higher interest rate projections was the big news of the meeting, another emerging trend also deserves attention – – the Fed’s backtracking from being US data dependent and toward being global data dependent.

Global factors are playing an increasingly larger role in the Fed’s decision to raise interest rates.

According to last week’s FOMC statement, “economic activity has been expanding at a moderate pace despite the global economic and financial developments of recent months” and warned that “global economic and financial developments continue to pose risks.”

This is not an April Fools’ Day joke!

These are the winners in Peter Schiff’s Gold Giveaway.

Winners collected more than $4,500 worth of prizes, including gold coins, silver bars, and books signed by Peter Schiff.

These lucky people were drawn at random from all of the entries submitted.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

Perhaps you are familiar with David Stockman and his mind-bogglingly long in-depth economic analyses topped off with blustery bombastic titles. Clearly, he’s an incredibly smart guy, and he’s produced some great stuff. But something is off in this recent article, and unfortunately, it betrays a fundamental lack of understanding of what’s really going on in the financial system.

It only took the first two paragraphs of his tirade for him to go astray:

Simple Janet should have the decency to resign. The Fed’s craven decision last week to punt on interest rate normalization is not merely a reminder that she is clueless and gutless; we already knew that much. That’s right. In the midst of vastly inflated and combustible financial markets, the all-powerful Fed is being led by a Keynesian school marm stumbling around in an explosives vest. She apparently has no idea that a 38 bps money market rate is not a pump toggle on some giant bathtub of GDP; it’s an ignition fuse that is fueling the greatest speculative mania in modern history.”

Essentially, Stockman is calling for Yellen’s resignation because all the economic data is pointing toward the appropriateness of a Fed rate hike after almost a decade of ZIRP. Instead, at the latest Fed meeting Yellen, “paused” the rate normalization, and, as such, is merely fanning the flames of the current speculative bubbles at work in the economy that will inevitably burst.

Stockman makes two errors in his analysis.

The Russians have launched into a gold buying spree.

Based on recently released International Monetary Fund numbers reported at Mining.com., the Russian central bank ranked as the world’s leading gold buyer in February, adding 356,000 ounces to its reserves:

Last December, Russia announced plans to increase its gold reserves to $500 billion within the next five years. As a Russian publication put it, “Gold is considered to be a buffer against external economic risks and is currently in favor in Russia.”

When we talk about increasing gold demand, the focus tends to fall on Asia. Earlier this week, we reported surging investor demand for the yellow metal in China. The Japanese have also gone on a gold buying spree since that country’s central bank plunged interest rates into negative territory. But it isn’t just Asians who are bullish on gold. Analysts say they see signs of growing demand for the metal in Europe as well.

According to an article published at CNBC, central bank action appears to be rejuvenating gold in Europe, as the entrenchment of negative interest rates makes depositing cash in banks less and less rewarding. UBS strategist Joni Teves said European central bank policy could become increasingly influential on the gold market:

Although gold is very much driven by US Federal Reserve policy, the impact of European Central Bank (ECB) policy decisions may become increasingly relevant for gold price action, as concerns about negative interest rates gain traction among investors.”

You may have heard that you can’t purchase more than $10,000 worth of gold without it being reported to the IRS.

This is a myth.

You can avoid IRS reporting requirements, even on large-scale purchases. You just have to know the rules. Our brand new Guide to Tax-Free Gold and Silver Buying provides the information you need to navigate the complex world of IRS reporting. You’ll learn:

- The truth about $10K reporting requirements.

- What kind of sales transactions trigger IRS reporting.

- How to buy and sell gold and silver in complete privacy.

Download The Free Tax-Free Gold and Silver Buying Guide Here

Generally speaking, rising prices tend to temper demand, but when it comes to gold in China, the recent price rally has created the opposite effect. As the Wall Street Journal put it, “Chinese investors see a golden opportunity.”

Demand for gold has surged in China over the last several weeks, during a period generally considered out of season. And it’s not typical Chinese jewelry purchases driving the demand. Chinese investors are buying gold coins and bars.

Typically, gold purchases in China are strongly associated with jewelry buying around the Lunar New Year holiday, which this fell in early February. But the uncertainty confronting global economies has driven up demand from a different sort of buyer—the hard-nosed investor.”

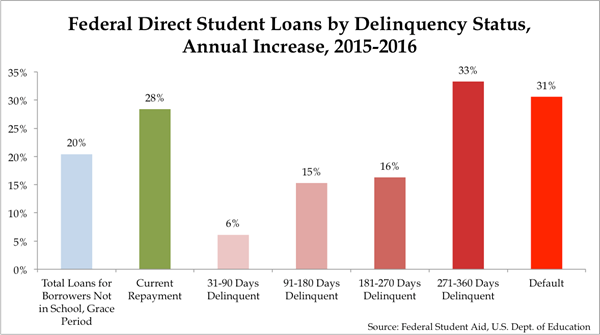

The feds recently released new data on student loan debt. The Department of Education press release claimed it showed “promising repayment trends.”

If these latest numbers are good news, I’d hate to see the bad.

As the Foundation for Economic Education (FEE) pointed out in its blog, total student loan debt increased at a healthy clip last year:

The total amount of outstanding direct student loans stood at $855 billion at the beginning of the first quarter of 2016, distributed among over 30 million recipients. (This total does not include loans still outstanding under the now-discontinued FFEL program, which guaranteed private-sector student loans.) The total direct loan amount outstanding is up roughly 15% over a year ago, doubtlessly the result of relentless tuition increases.”

The numbers also reveal that 46% of student loans are not currently being repaid. That doesn’t include debt held by students still in school or within the six-month grace period after graduation. Here’s a breakdown by the FEE:

Why Bother with Cash When You Can Own Gold? – Peter Schiff’s Gold Videocast with Albert K Lu (Video)

The conventional knock on gold is that it is inconvenient and expensive to hold, and doesn’t provide yield. But as Albert K Lu shows in his latest Gold Videocast, in a world of negative interest rates, this argument is becoming applicable to cash.

For instance, the world’s second largest reinsurance company has decided to pull cash from banks and store it in its own vaults to avoid negative rates. If you are going to do that, why not buy gold? Especially in a very weak economic environment.

I think people are figuring out that if you’re going to go to all this trouble holding physical bills, taking your deposits out of the bank where they once were very liquid and apparently very safe, and go to the trouble of vaulting them at home or in your company’s vaults as in Munich Re, maybe you should start thinking about gold.”

Peter Schiff’s Gold Giveaway ended at midnight last night. Winners will be drawn at random from all of the entries that were submitted. We will be announcing them soon.

Lucky winners will collect more than $4,500 worth of prizes, including gold coins, silver bars, and books signed by Peter Schiff.