The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The Federal Reserve Open Market Committee met yesterday and held interest rates steady in the 2.25-2.50% range. This wasn’t really a surprise. More significantly, Fed Chair Jerome Powell kept up the dovish rhetoric, saying, “The case for rate increases has diminished. I would need to see a reason for further rate hikes that would have to include higher inflation.”

We’ve called this the Powell Put, and it appears it’s still solidly in play. But in his most recent podcast, Peter Schiff called it the “Powell Pause” and said it wasn’t going to be enough.

Global gold demand grew by 4% in 2018, driven by a multi-decade high in central bank buying, according to the World Gold Council’s Gold Demand Trends 2018 Report.

Gold demand came in at 4,345.1 tons in 2018. That was up from 4,159.9 tons the previous year. This was in line with the five-year average growth.

Peter Schiff recently participated in the Ultimate Gold Panel at the Vancouver Resource Investment Conference.

Hosted by Daniela Cambone of Kitco News, the panel delved into a deep discussion about the future of gold based on both historical analysis and current economic trends.

Peter is joined on stage by Frank Holmes, Peter Hug, and Roy Sebag. This is a must-see for any investor serious about profiting from gold.

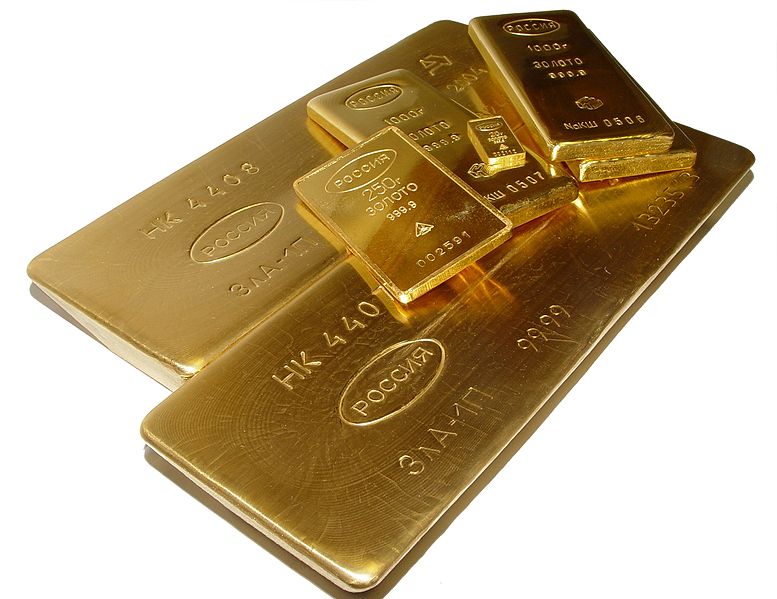

During a speech at the lower house of the Russian parliament, the CEO of the country’s key trading floor suggested Russian investors should replace investments they’ve made in dollars with gold.

“Let’s offer an alternative to the US dollar in the form of Russian gold, which we produce… investment gold,” Moscow Exchange (MOEX) CEO Alexander Afanasiev said.

Bitcoin investors are selling cryptocurrency and buying gold, according to a number of investment analysts.

“I do think that Bitcoin pulled a little bit of demand away from gold last year, in 2017,” Jan Van Eck told CNBC’s ETF Edge last week. “Interestingly, we just polled 4,000 bitcoin investors and their number one investment for 2019 is actually gold. So gold lost to bitcoin and now it’s going the other way.”

The government shutdown apparently didn’t save Uncle Sam any money. The US Treasury Department said it will borrow about $8 billion more than originally estimated in the first quarter of 2019 as deficits continue to spiral upward.

According to new Treasury Department projections, the US government will issue $365 billion through credit markets in the January-March quarter. This stacks on top of the $426 billion borrowed through credit markets in the October-December quarter.

From the moment we enter the education system, we’re taught that government provides a benevolent hand that guides the economy and protects its citizens. For more than 50 years, Reason Magazine has been exposing the cracks in this narrative, contrasting the heavy hand of government with the beauty of free minds and free markets.

In this episode of It’s Your Dime, Mike Maharrey talks with Reason editor-at-large Nick Gillespie.

Stocks got a boost on Friday and gold rose 1.8% on further signs that the Federal Reserve is capitulating.

An article in the Wall Street Journal basically confirmed the Fed is now thinking about winding down its quantitative tightening program. As a CNBC headline put it, “The Fed may be moving closer to ending its rally-killing balance sheet reduction.” As Peter put it in a recent podcast, “The Federal Reserve is having to prematurely abort quantitative tightening, which is exactly what I said they were going to do before they shrunk the balance sheet by the first dollar.”

Not too long ago, it was on autopilot, they were just going to leave it alone and it was going to keep on going and then the market started to cave and then they change that to, well, we’re data dependent and now the market starts to go down a little bit more and all of a sudden we’re almost done. “

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.