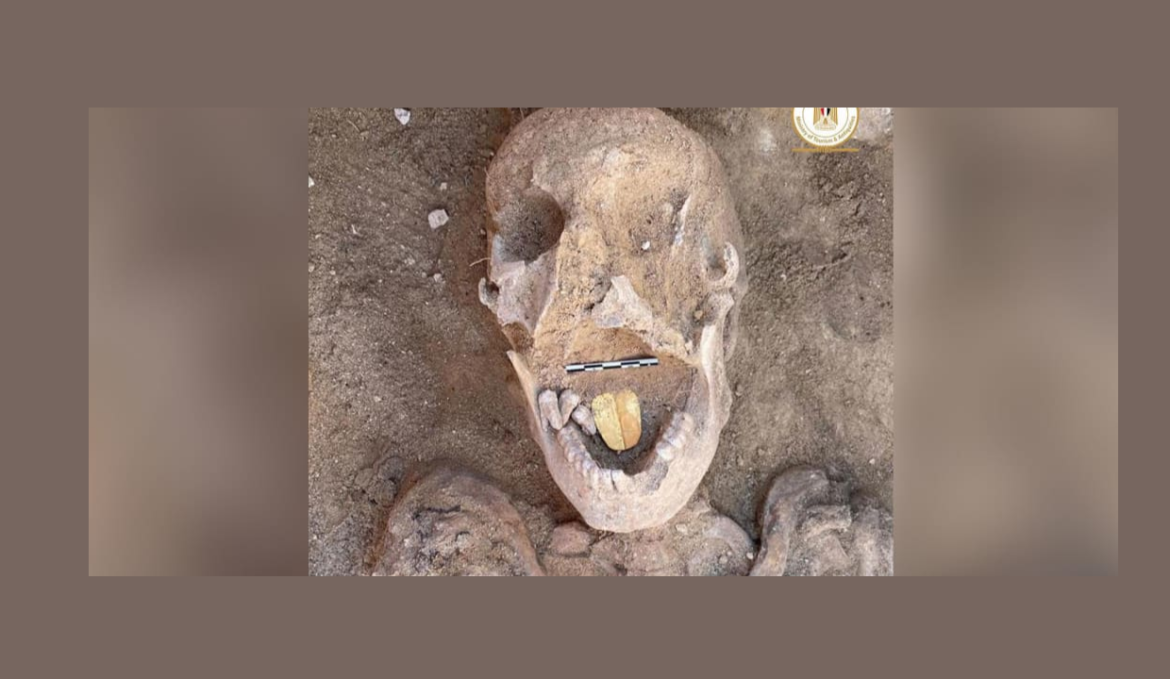

Over the years, I’ve done a number of Fun on Friday posts about eating gold. You can have gold on your steak, on your desert, and even in your beer. Well, apparently some ancient Egyptians wanted the taste of gold in their mouths for all eternity. Archaeologists recently discovered a 2,000-year-old mummy with a gold tongue at an ancient Egyptian site called Taposiris Magna.

It’s been a crazy, volatile week for precious metals. The Reddit Raiders pushed silver to over $29 an ounce and the white metal took gold up with it. But the run was short-lived and we saw a big sell-off in both metals later in the week. In this episode of the Friday Gold Wrap, host Mike Maharrey tries to cut through all the smoke and mirrors and talks about the underlying fundamentals in both the gold and silver markets.

Last year’s surge in demand for investment gold and silver continued into January if sales at the US Mint are any indication.

American Gold Eagle bullion coin sales were up 455% in 2020 and the selling continued through the first month of 2021. The mint called the current market demand for precious metals coins “exceptional.”

Minneapolis Federal Reserve Bank President Neel Kashkari has been making the rounds. Peter Schiff talked about Kashkari’s recent comments on his podcast.

Kashkari ranks as arguably the most dovish Fed president. Peter called him the “uber-dove” saying he basically wants to print as much money as possible. During an online seminar put on by Montana’s Bureau of Business and Economic Research, Kashkari said the Fed needs to do even more to boost the economy and he’s not worried about overdoing it.

On Monday, Feb. 1, Peter appeared on NTD Business to talk about the attempted short squeeze on GameStop and silver. He said we shouldn’t compare GameStop stock to silver. Unlike GameStop, there are fundamentally sound reasons to buy silver, with or without the endorsement of the Reddit traders.

When the Reddit Raiders turned their attention to silver, Peter tweeted that they were getting smarter. “Silver stocks are actually cheap and represent good investment value. The fact that some investors were foolish enough to short these stocks makes their trade even better.”

Total gold supply fell 4% year-on-year in 2020 to 4,644 tons. It was the largest annual decline since 2013, according to data from the World Gold Council.

The decline was primarily driven by disruptions in mine production due to the COVID-19 pandemic. Gold mine output fell 4% on the year. More significantly, it marked the second straight yearly drop in mine production and continued a trend of flatlining gold mine output.

The Reddit Raiders turned their eyes toward silver over the weekend. Interest in the white metal sparked a surge in retail demand and pushed the spot price of silver briefly over $29 an ounce. As Peter Schiff put it, the Reddit Riders were riding silver instead of piling into heavily shorted stocks.

But how should we look at this recent run-up in silver? And where might it go from here? Peter talked about it in his podcast.

The COVID-19 pandemic put Federal Reserve easy-money policy on hyperdrive. But make no mistake, the Fed was already forcing interest rates artificially lower and engaging in quantitative easing long before coronavirus arrived on American shores. In fact, there was no plausible exit strategy from this policy after the 2008 financial crisis and there is no exit for it today.

Silver is getting a lot of attention right now thanks to the so-called Reddit Raiders. But as Peter Schiff pointed out in a recent podcast, silver is a fantastic buy right now even absent the attention of message board investors. In fact, silver was poised to go up even before the Reddit crowd looked its way.

Overall, the fundamentals are extremely bullish for silver in the long-term, without or without a push from the Reddit Raiders.

As of Monday morning, the Reddit Raiders had driven silver to a 6-month high of over $29 an ounce. Peter Schiff talked about what’s going on in the silver market on his podcast Friday. He said that silver is a great buy right now, with or without the attention of the Reddit message boards.