Joe Biden says the economy is great. Paul Krugman says the inflation war is over and we won. But Americans aren’t buying the narrative. They’re growing increasingly worried about the economy and inflation.

The University of Michigan Index of Consumer Sentiment tanked in October with inflation worries at the highest level since last May.

“Hotter than expected.”

This seems to be a recurring theme when it comes to price inflation.

The September CPI data gave us another variation on that tune. And it should once again remind us that the Federal Reserve is nowhere near its 2% target.

I write a lot about the national debt.

And most people don’t care.

That’s because there’s a widespread belief that the dollar is invincible.

It isn’t.

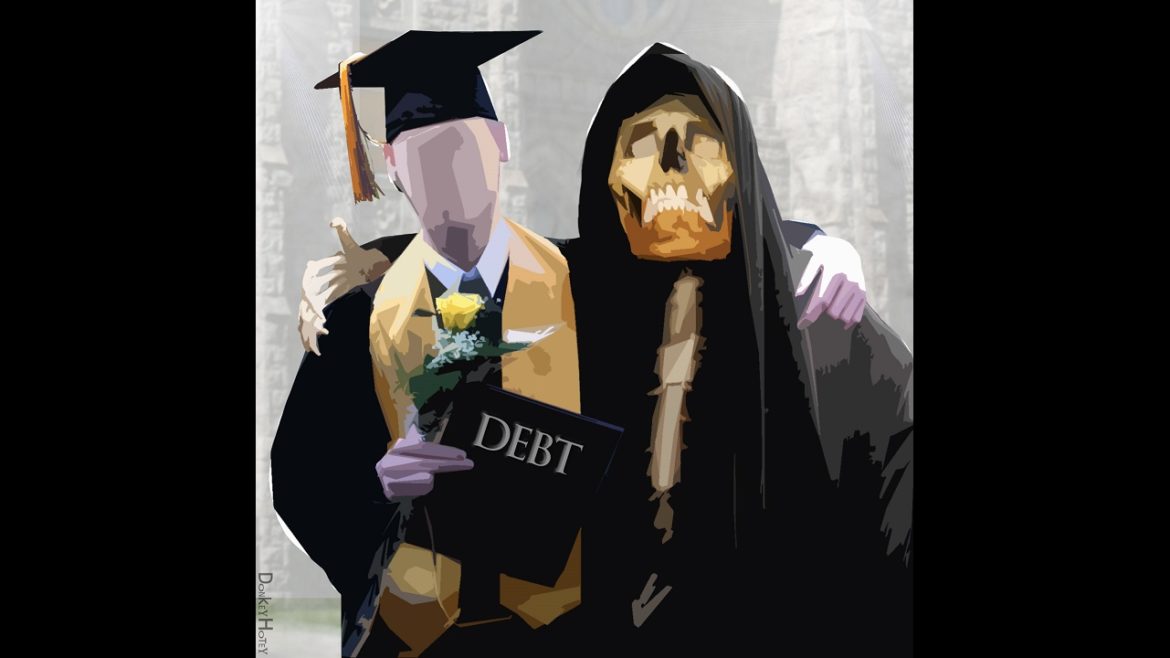

After a more than 3-year pause, government student loan repayments started again this month and it’s already putting the squeeze on borrower’s wallets. This is bad news for an economy already strained by massive levels of debt and rising interest rates.

Interest accrual on student loans resumed on September 1 with the first payments coming due in October.

Twenty days.

That’s how long it took the Biden administration to add another half-trillion dollars to the national debt.

Bidenomics certainly requires a lot of borrowing and spending.

American consumers continued to pile up debt on credit cards while borrowing for big-ticket items fell into the basement in August.

This is the behavior of extremely financially stressed people.

I recently ran across a video produced by CNBC back in July 2020. It is titled “Why Printing Trillions of Dollars May Not Cause Inflation.”

That aged poorly, didn’t it?

And people wonder why I keep saying you should be skeptical of mainstream narratives.

Price inflation has been even worse than advertised.

Of course, you know that because you’ve lived it. But it is nice when the data crunchers swerve a little closer to reality.

The Bureau of Economic Analysis did just that, revising its Personal Consumption Expenditure (PCE) data higher for the entirety of this inflation cycle.

We keep hearing about a “soft landing.” According to government officials, central bankers, and mainstream financial media pundits, the US economy has dodged a recession.

So why are recession warning signs still flashing?

The Fed people insist the economy is strong. They upped their GDP growth projections at their last meeting. Joe Biden thinks the economy is strong. He keeps bragging about the marvelous achievements of “Bidenomics.” Mainstream economists keep telling us the economy is strong.

But the average American isn’t buying any of it. (Perhaps price inflation makes it too expensive?)