As expected, the Federal Reserve raised interest rates by 50 basis points at the December Federal Open Market Committee (FOMC) meeting. That pushed the federal funds rate to 4.5%. The last time rates were this high was in 2007. That’s bad news for an economy addicted to easy money.

While the pace of rate hikes slowed, the messaging coming out of the Fed was substantially the same as the November meeting.

President Joe Biden claims wages are rising faster than prices.

It might be unfair to say he’s lying, but he’s certainly misrepresenting the facts.

The fact is price inflation continues to eat away at your wages.

The Federal Reserve got just the news it needed to plausibly go forward with a soft pivot in its monetary policy and begin to slow its pace of rate hikes. But while price inflation appears to be retreating, it’s far from beat.

The Consumer Price Index (CPI) for November came in lower than expected, according to the latest data from the Bureau of Labor Statistics.

The US government ran a massive $248.5 billion deficit in November, according to the latest Monthly Treasury Statement. There was only one month in fiscal 2022 with a bigger budget shortfall. This is bad news for the Federal Reserve as it tries to raise interest rates and shrink its balance sheet to fight price inflation.

When the October CPI came out, the mainstream spin was that inflation had peaked. But they might have gotten a little ahead of themselves. The Producer Price Index (PPI) data for November indicates that we may well see more consumer price inflation down the road.

After household debt grew by the largest amount since 2007 in the third quarter, American consumers kicked off the fourth quarter by piling on even more debt.

Consumer debt grew by another $27 billion in October, a 6.9% year-on-year increase. Americans now owe $4.73 trillion in consumer debt, according to the latest data released by the Federal Reserve.

Have you ever had a gut feeling that the labor reports put out by the Bureau of Labor Statistics are hinky?

If so, trust your gut.

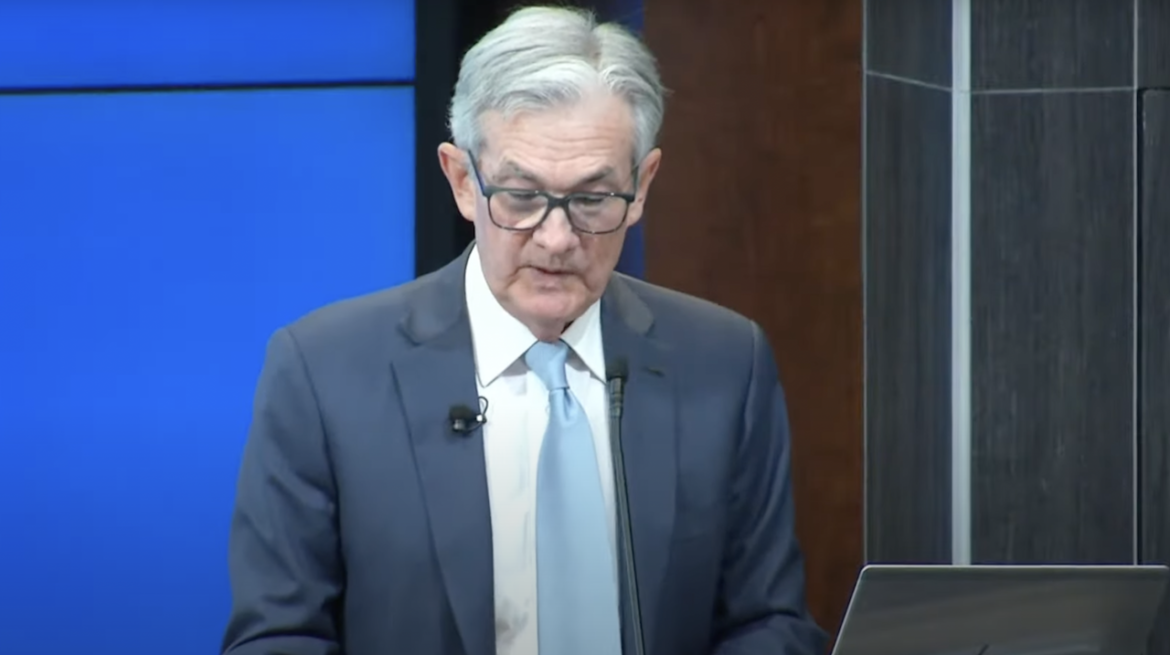

Federal Reserve Chairman Jerome Powell all but confirmed a soft pivot by the central bank in its inflation fight on Wednesday, while trying to maintain a hawkish demeanor.

The markets appear to be buying the pivot, but they are ignoring Powell’s “tough guy” spin.

In another bad sign for a housing bubble that is quickly deflating, investor purchases of single-family homes tanked in the third quarter.

Meanwhile, overall home sales continue to tumble and prices are falling.

When people talk about “inflation” today, they generally mean rising prices as measured by the Consumer Price Index (CPI). But historically, “inflation” was more precisely defined as an increase in the amount of money and credit causing advances in the price level. Inflation used to be understood as an increase in the money supply. Rising prices were a symptom of inflation.

I find this change in definition problematic. But many disagree with me. They argue that I’m being pedantic and the definition doesn’t really matter all that much.