President Biden Misrepresenting Wage Gains

President Joe Biden claims wages are rising faster than prices.

It might be unfair to say he’s lying, but he’s certainly misrepresenting the facts.

The fact is price inflation continues to eat away at your wages.

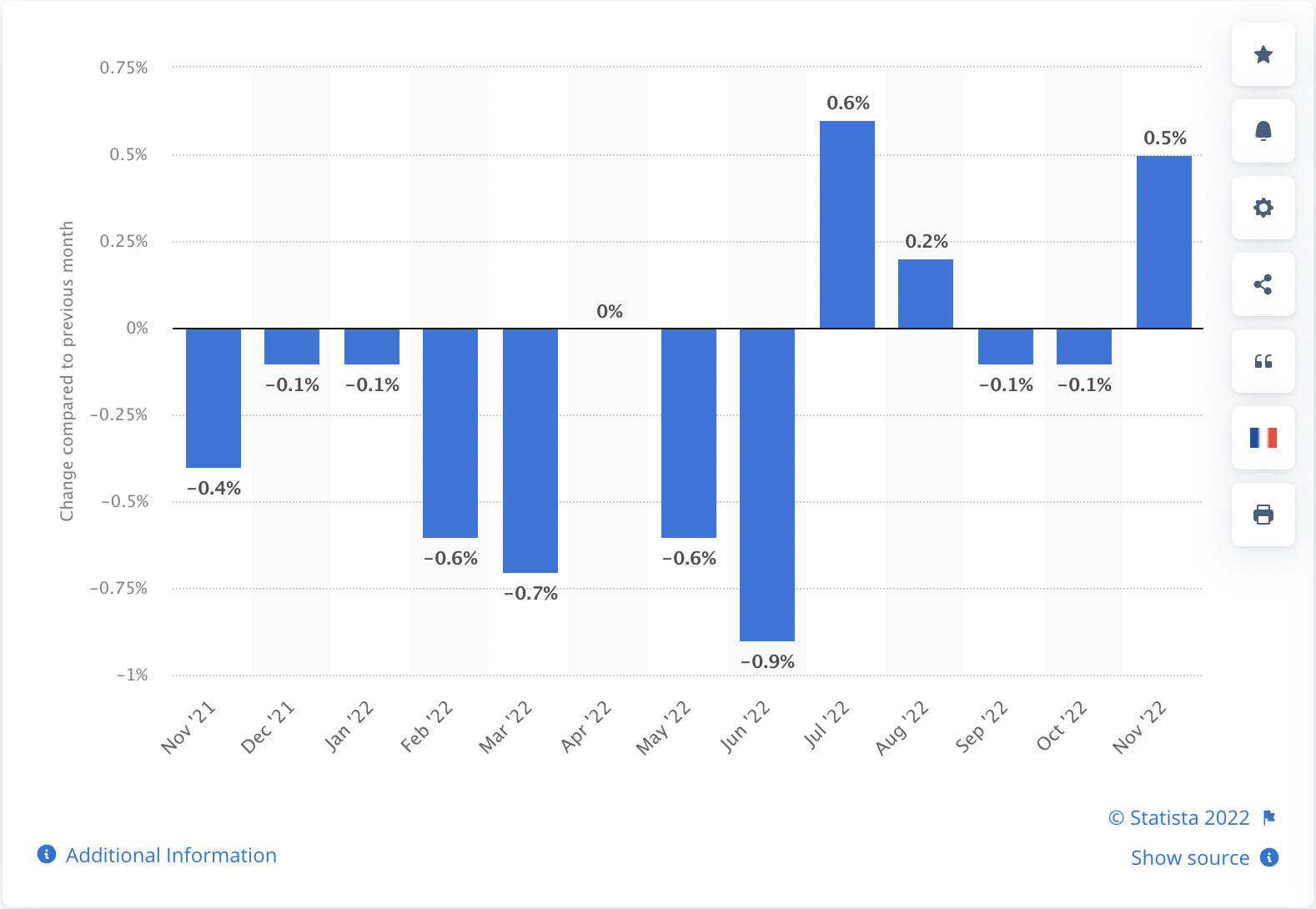

According to the latest data from the Bureau of Labor Statistics, average hourly wages rose by 0.6% in November. With the CPI coming in at just 0.1% month-on-month, workers got a 0.5% increase in real wages.

The rise in wages for the month of November amounted to 18 cents.

When factoring in the number of hours worked, real wages were up just 0.2% due to a 0.3% drop in the average workweek.

Biden bragged about this accomplishment (as if he actually handed you that 18-cent raise).

And all of this means that, for the last several months, wages have gone up more than prices have gone up. Wages have gone up more than prices have gone up.”

The fact is average real hourly earnings fell slightly in September or October. So, saying wages have gone up more than prices “for the last several months” is objectively false.

And focusing on monthly increases creates a false impression. The fact is, your pay is way behind the inflation curve.

Over the last year, real wages have decreased by 1.9%. So, while you’ve received a 5.2% raise in the last year, price inflation has eaten up all of it and more. This was the 20th consecutive month of declining real wages on an annual basis.

The news is even grimmer when you factor in a 1.1% decline in the average workweek. That increases the decline in real hourly wages to 3%.

Biden’s glib statements about your earnings have virtually no basis in reality.

And the reality is even worse. These numbers are based on a government-rigged Consumer Price Index. Using an honest CPI, total real income is down somewhere in the neighborhood of 10% from last year.

Many pundits in the mainstream blow off inflation by pointing out that wages rise along with prices. But as this data shows, wages rarely rise at the same pace as prices. That means inflation puts a significant squeeze on the pocketbook, at least in the short term.

You’re undoubtedly feeling that squeeze today.

But despite 18 months of declining real wages, economists keep telling us that American consumers are “healthy.” After all, they continue to spend. Retail sales have generally increased. How is this possible?

Americans are burning up their plastic in order to make ends meet in these inflationary times. Revolving credit, primarily reflecting credit card debt, rose by another $10.1 billion in October. To put the 18.1% increase into perspective, the annual increase in 2019, prior to the pandemic, was 3.6%. It’s pretty clear that with stimulus money long gone, Americans have turned to plastic in order to make ends meet as prices continue to skyrocket.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]