By hiking interest rates, the Federal Reserve has pulled some of the monetary stimulus out of the economy. While the Fed hasn’t done nearly enough to put the inflationary fire it lit with more than a decade of easy money, the cooling consumer price index (CPI) indicates that this has put a modest dent in price inflation — for now. But the Biden administration has opened the fiscal stimulus spigot even wider and this is mucking up the inflation fight. In fact, unless the federal government reins in spending, there is no way inflation will lose this fight.

That’s not going to happen.

American consumers continued to pile on debt in February, but the pace of borrowing slowed significantly, another sign the economy could be heading toward a recession.

Overall, consumer debt grew by $15.3 billion in February, a 3.8% annual increase, according to the latest data from the Federal Reserve. That compares with an upwardly revised 19.5 billion increase in January.

Bills introduced in the Texas House and Senate would create a state-issued, gold-backed digital currency. Enactment of this legislation would create an option for people to transact business in sound money, set the stage to undermine the Federal Reserve’s monopoly on money and create a viable alternative to a central bank digital currency (CBDC).

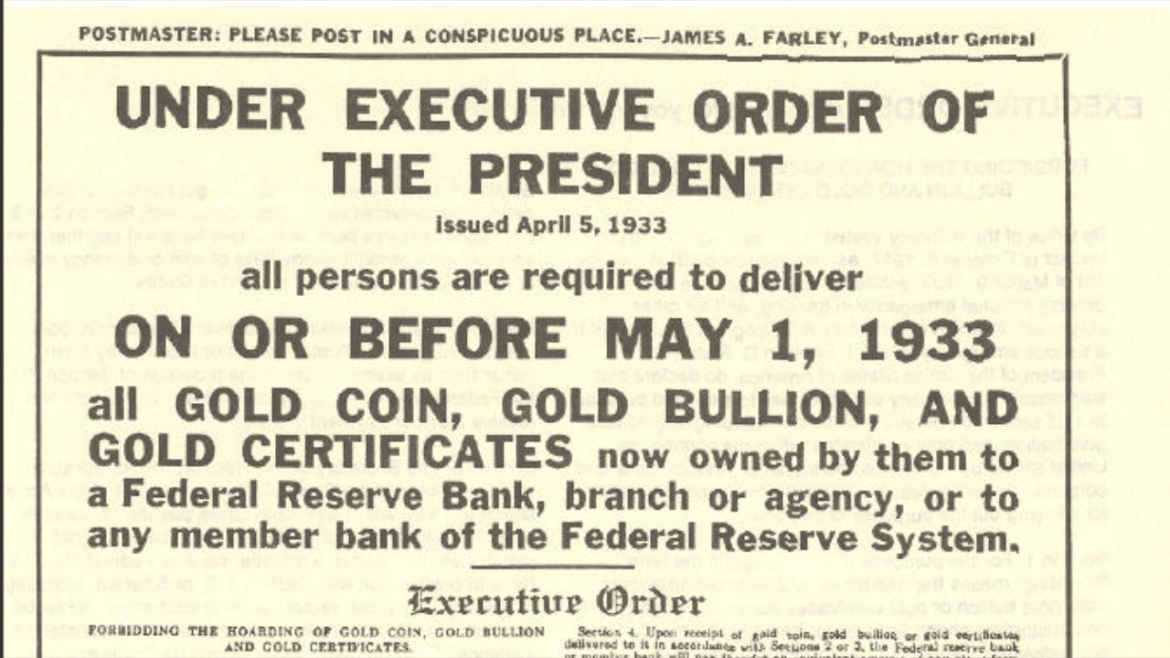

Yesterday (April 5) marked the anniversary 0f the signing of Executive Order 6102 by President Franklin D. Roosevelt. It was touted as a measure to stop gold hoarding, but it was in reality, an attempt to remove gold from public hands.

Many people refer to EO-6102 as a gold confiscation order. But confiscation is probably not the best word for what happened in practice.

China and Brazil recently finalized a trade deal in their own currencies completely bypassing the dollar, but that’s not the only bad news for the world’s reserve currency.

Last week, a Russian official announced that the BRICS nations are working to develop a “new currency,” yet another sign that dollar dominance is waning.

Most people in the mainstream seem to think that the recent bank bailout plugged the crack in the dam and stabilized the banking sector. But one big bank boss disagrees. In an annual letter, JP Morgan Chase CEO Jamie Dimon said that the banking crisis isn’t over and that we will feel its repercussions for years to come.

More bad news for the dollar.

Last week, China and Brazil announced a trade deal in their own currencies, completely bypassing the dollar.

This represents another small shift away from dollar dominance.

Energy prices have moderated and the price of some goods has dropped in recent months, but the cost of services continues to rise at a red-hot pace and is at the highest level since 1984.

As a result, the core personal consumption expenditures price (PCE) index rose by 4.6% year on year. This is yet another signal that the Federal Reserve is not anywhere close to winning the inflation fight.

Could the commercial real estate market be the next thing to break in this bubble economy?

The rampant money creation and zero percent interest rates during the COVID pandemic on top of three rounds of quantitative easing and more than a decade of artificially low interest rates in the wake of the 2008 financial crisis created all kinds of distortions and malinvestments in the economy and the financial system. It was inevitable that something would break when the Federal Reserve tried to raise interest rates in order to fight the price inflation it caused with its loose monetary policy.