In January, retail sales came in much hotter than expected. Now we know how consumers paid for the spending spree. They put it on credit cards.

After slowing modestly in December, growth in revolving debt spiked again in January. But a slowdown in non-revolving credit moderated the overall increase in consumer debt.

Overall, this signals a pretty bleak trajectory for the economy.

Federal Reserve Chairman Jerome Powell performed some “open mouth operations” on Capitol Hill Tuesday.

Powell talked and the markets freaked out.

Silver demand was at record levels in 2022 and there is reason to believe it will continue to run hot over the next several decades. One reason is the rapidly increasing demand for silver in the green energy sector. In fact, an Australian study projects solar cells may use most of the world’s silver reserves by 2050.

Violent protests in Nigeria reveal that getting average people to embrace central bank digital currencies (CBDCs) might be more difficult than government officials would like.

Nigerians recently took to the streets to protest a cash shortage caused by government policies adopted in order to push the country into the adoption of its central bank digital currency (CBDC).

Protesters attacked bank ATMs and blocked streets, and demonstrations turned violent in some cities.

The Federal Reserve is bleeding money and losses are mounting.

So, what does this mean? Is the central bank in danger of going under?

Hardly.

In fact, losing money isn’t a problem for the Fed at all. But it is a big problem for the US government.

Joe Biden might be confident in the US economy. Federal Reserve Chairman Jerome Powell might be confident about the US economy. But the average American? Not so much.

The Conference Board Consumer Confidence Index fell for the second straight month in February, dropping from a downwardly revised 106.0 in January to 102.9.

There has been a lot of talk about central bank digital currencies (CBDCs). The powers that be sell CBDCs on the promise of convenience and security. But in reality, they are part of a broader “war on cash” and a push to give governments even more control and power over you and me. Digital currencies could allow governments to track and even control everybody’s spending.

But some state legislators are pushing back against CBDCs and working to implement laws to protect people in their state from this excessive federal government control.

Retail sales surged in January, creating the impression that the economy is humming along nicely. After all, there can’t be a problem if consumers are out there consuming, right?

But a lot of people are ignoring a key question: how are people paying for this shopping spree?

One of the characteristics of gold is that it preserves wealth in a world of constantly devaluing fiat currency.

Put another way, it preserves your purchasing power over time.

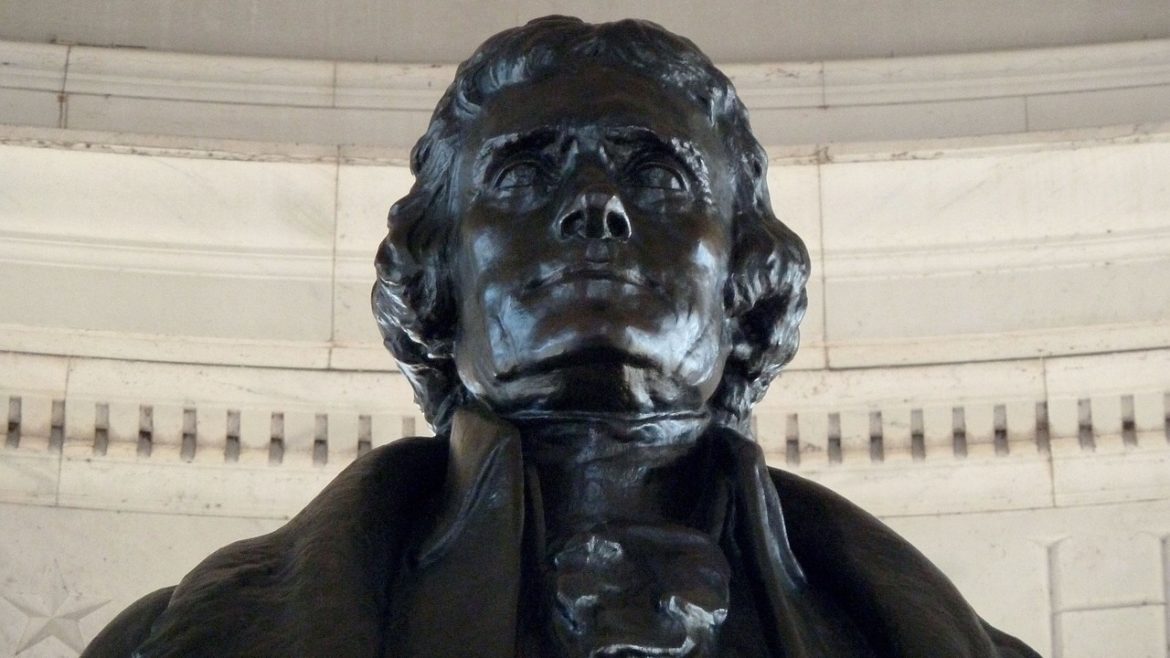

The way Thomas Jefferson handled the national debt should serve as a blueprint for today. But instead, modern presidents look more like college students on a spending spree with their first credit cards.