Peter Schiff Finally Getting Some Love from the Mainstream Press

With the madness in the markets over the last couple of weeks that led the Federal Reserve to implement a 50-basis point interest rate cut, Peter Schiff is starting to get some love in the mainstream media.

Peter was a regular on MSNBC, Fox News and other mainstream outlets in the months leading up to the 2008 financial crisis. He was typically the lone contrarian, insisting that the economy wasn’t great. Of course, in 2008, he was proved correct.

Over the last few years, there’s pretty much been a mainstream blackout on Peter, with the exception of appearances with Liz Claman on Fox Business. It’s hard to understand why. Whether you agree with everything he says or not, Peter is one of the best interviews out there. Perhaps the mainstream pundits were a little salty about getting showed up. Or maybe the powers that be were worried people would listen to him this time around. Whatever the reason, Peter was persona non grata for quite a while.

But that’s changing.

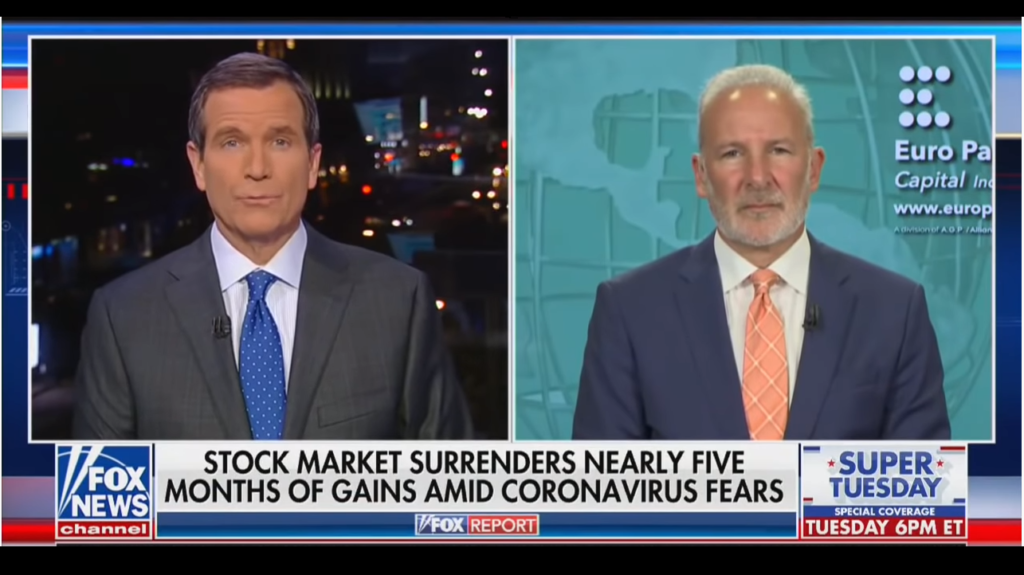

On Sunday, Peter was on Fox News. He talked about the fact that everything the Fed has done since the 2008 financial crisis has only exacerbated the problems that created that crisis.

Which is why we’re on the precipice of a much larger one and why the pricking of this bubble is so risky. And if the Fed, of course, goes back to the drawing board and just cuts rates again, all it’s doing is throwing gasoline on the fire that it lit.”

That was followed up by an article published by MarketWatch. The rather long-winded headline proclaimed, “Man who predicted the 2008 financial crisis says coronavirus may mean his bets of stock-market carnage are finally beginning to crystallize.”

The article characterized Peter as a “polarizing Wall Street prognosticator.”

In his interview with the MarketWatch reporter, Peter reiterated that coronavirus may well be the pin that pricked the stock market bubble. But coronavirus isn’t the real problem.

The problem isn’t the pin, the problem is the bubble and once the bubble is pricked, the damage is done and the air is coming out of this bubble, If it wasn’t the coronavirus, it would have been something else.”

Peter said this time, we may well see a dollar collapse along with a stock and bond market implosion.

We are going to have a collapse of the bond market and the financial crisis that’s coming will be much worse than the one we had in 2008.”

MarketWatch conceded it’s hard to be too dismissive of Peter.

One of his calls—that the collapse of the housing market in 2008 would lead to a global crisis of historic proportions—was dead on, and, perhaps has fortified his status as an investor and commentator who demands some attention on Wall Street.”

Despite the half-percent rate cut this week, the Fed continues to insist that the US economy is strong. MarketWatch noted that some call this “puzzling.” Why would you engage in emergency monetary policy if the economy is strong? Peter said it supports his theory that the Fed can’t get away from interest rates at historically low levels, after attempting to do so at the end of December 2015. (He was right about that too, by the way.)

MarketWatch asked Peter what he had to say to people who call him “a broken clock who is right twice a day.”

They are betting on a losing hand and I am betting on a winning hand and I want to go home with everybody’s chips.”

Peter’s main criticism of the article on Twitter was the photo.

I'm finally getting some press. They need to use a more recent photo. I've lost a lot of weight since then and stopped dying my hair.https://t.co/AaFdwnl447

— Peter Schiff (@PeterSchiff) March 4, 2020

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]