Powell Lectures Congress About Government Spending the Fed Facilitates

Fiscal 2020 started just like fiscal 2019 ended – with a massive federal budget deficit. And that has Federal Reserve Chairman Jerome Powell worried. In an ironic bit of political theater, Powell lectured Congress about the spending he helps facilitate.

The budget shortfall last month was 34% higher than the October 2018 deficit, coming in at $134.5 billion, according to the latest Treasury Department report. That starts fiscal 2020 off on track to eclipse a $1 trillion deficit.

The October deficit continues a well-established trend. The FY2019 deficit was $984 billion and ranked as the largest budget shortfall since 2012. The federal deficit has only eclipsed $1 trillion four times, all in the aftermath of the 2008 financial crisis.

The FY2019 deficit was 26% higher than FY2018’s massive budget shortfall.

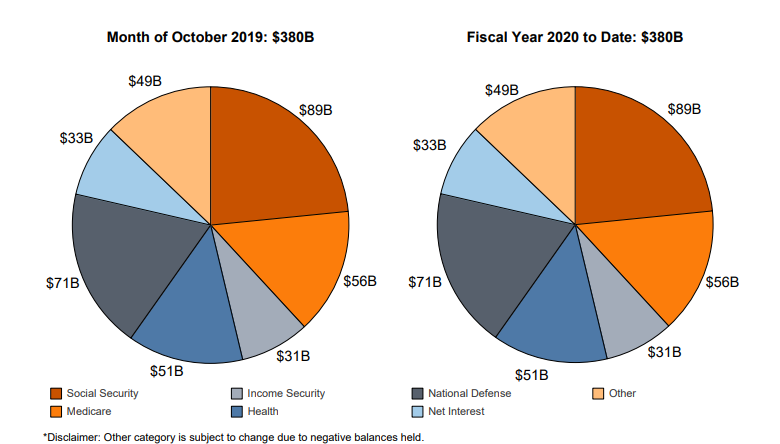

Uncle Sam continues to spend enormous amounts of money. In October alone, the Federal government blew through $380 billion. That was an 8% increase over October 2018. Federal outlays were higher for defense, education, healthcare and Social Security.

Meanwhile, federal receipts fell 3% year-on-year.

During testimony before Congress, Powell called the federal debt “unsustainable.”

Over time, this outlook could restrain fiscal policymakers’ willingness or ability to support economic activity during a downturn.”

Powell is concerned that with federal spending already through the roof, Congress may not be willing or able to bring large amounts of economic stimulus to the table in the event of a recession. And the Fed chair knows that the central bank’s inability to “normalize” interest rates after the Great Recession leaves very little ammunition in its own arsenal, as he warned Congress.

Nonetheless, the current low-interest-rate environment may limit the ability of monetary policy to support the economy.”

The Fed is operating from a position of fear as Powell’s remarks reveal. Although he insists the economy is strong, the Fed is already engaging in extraordinary monetary policy. The central bank just cut interest rates for the third time and has launched a new round of quantitative easing – that it emphatically refuses to call quantitative easing. As Peter said in a recent podcast, the central bank has no intention of normalizing monetary policy.

Despite the fact that the economic data is deteriorating. Despite the fact that corporate earnings are falling, it is the Fed that is pushing this market to new highs by cutting interest rates, by indicating to the markets that they don’t have to worry about rate hikes no matter what happens with inflation. The Fed’s not going to raise interest rates. Oh, and by the way, they’re doing quantitative easing, and they’re going to print as much money as they have to keep the markets going up and to keep the economy propped up.”

Powell lecturing Congress about spending is ironic given that the Fed’s low interest rate policies and debt monetization make the spending possible. The whole reason the Fed is buying Treasury bonds in this “not QE” program is to allow the spending and borrowing to continue without pushing up interest rates. This is basically the drug dealer lecturing the junkie about his habit.

Peter summed it all up in a tweet.

Powell pretends that the trend of falling interest rates despite rising government deficits has nothing to do with Fed policy. It’s entirely due to Fed policy, and because an accommodative Fed has enabled the debt to grow so large, the Fed owns the coming debt and dollar crisis!”

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […]

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […] California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […]

California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […] The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […] Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]