The second richest man in Egypt has put half of his $5.7 billion net worth in gold.

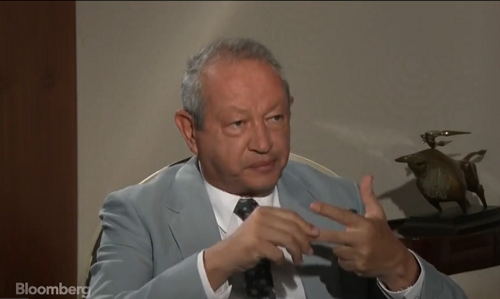

During an interview with Bloomberg, Naguib Sawiris said he expects gold to rally above $1,800 per ounce as “overvalued” stock markets crash.

Jim Rickards has been talking $10,000 gold for a while. This seems like an absurd number, but Rickards insists the dynamic exist to push gold to that level – when the world financial system collapses under its own weight.

Rickards has been making the rounds again lately, saying gold is in the midst of its third bull run and has plenty of room to go.

In my view, we’re in the third bull market of my lifetime. The first one was 1971 to 1980. Gold went up over 2,000%. The second one was 1999 to 2011. Gold went up 655%. We’re in a new bull market that started in December 2015. Gold’s up 27% since then. Gold was up in 2016-2017. First back-to-back year of gold gains since 2011-2012. So, 2018 will be a breakout year … we’re actually in the third year of a bull market with a very long way to run.”

Loose monetary policy has dumped billions of dollars of easy money into the world’s financial systems over the last eight years, pumping up a whole slew of bubbles. We are still on the upside of the business cycle, with stock markets hitting record levels it seems like on a daily basis. But if history serves as any kind of indicator, a crisis is on the horizon.

What will precipitate it? That’s the proverbial $64,000 question.

Jim Rickards has compared financial crises to an avalanche. Snow piles up becoming increasingly unstable. Eventually, it reaches the point when all it takes is one more snowflake to set off an avalanche.

In a recent column, Rickards highlights three potential “snowflakes” that could set off the next deluge.

Over the last year, we’ve talked a lot about geopolitical risk. Could turmoil around the world now be the new normal?

Some analysts think so.