We’ve written extensively about the government intentionally devaluing our money. As one economist put it, the intentionally inflationary policies of central banks and governments are “daylight robbery.” But what’s the solution to this problem?

Economist Thorsten Polleit argues we need a free market in money. But is this possible? Wouldn’t this create monetary chaos?

When governments started locking down the economy in response to coronavirus, the Federal Reserve sprung into action. First, it slashed interest rates to zero. Then it quickly launched what we’ve dubbed QE infinity. In effect, that meant printing trillions of dollars out of thin air and pumping them into the economy.

Meanwhile, the US government did its part, passing a massive stimulus bill – pumping trillions of dollars of borrowed money into the economy. Of course, the Fed monetized a big chunk of that debt via QE infinity. So, in effect, the federal government joined forces with the central bank to pump trillions of dollars out of thin air into the economy.

This summer, Peter Schiff and Jim Rickards discussed the possibility of $15,000 gold. In a recent interview. economist Rafi Farber took this line of thinking to the next level, arguing the dollar price of gold could eventually hit infinity – meaning simply that the value of the dollar will go to zero.

Gold has helped Indians weather the economic storm caused by the coronavirus pandemic.

The government response to COVID-19 has ravaged the Indian economy. As a result, many banks are reluctant to extend credit due to fear of defaults. In this tight lending environment, many Indians are using their stashes of gold to secure loans.

The Dow Jones is back of 25,000 and despite increasing tensions with China, people seem pretty optimistic about the economic future as states begin to open back up. SchiffGold Friday Gold Wrap host Mike Maharrey says people should know better. He makes his case by digging into some of the long-term ramifications of the economic shutdown and the government/central bank response to it. He also recaps the last month in the gold and silver markets.

A lot of people still seem to think the economy will fire right back up and things will snap right back to normal when the government-imposed coronavirus lockdowns end. I don’t believe we’re going back to normal for a number of reasons – primarily because things weren’t normal before coronavirus. The economy was a big, fat, ugly bubble. Coronavirus was a pin that popped the bubble.

But even if things were normal before the pandemic, the economy still wouldn’t just fire back up and restart on a dime.

Gold took a hit on Tuesday but held a key support level and rebounded as the week went on, even as stocks set new records. Why does gold continue to keep showing strength even with all the headwinds? Is it just coronavirus? Or is something else going on? Host Mike Maharrey talks about it in this week’s Friday Gold Wrap podcast.

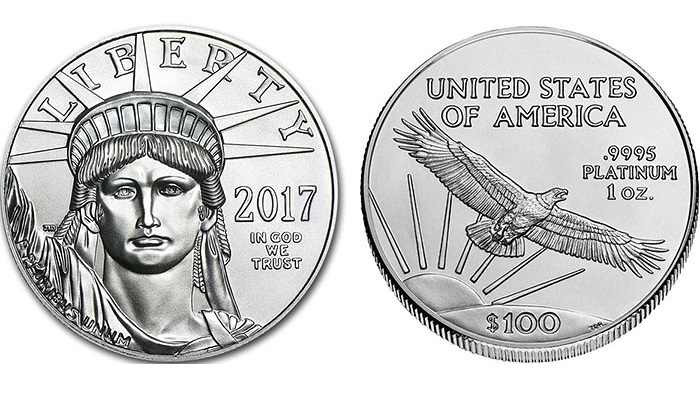

While investors often treat gold as a commodity, at its core, gold is money. Silver also has a long history as a monetary metal. But what about other rare metals? Could they serve as money as well?

In the following guest column, SchiffGold client Antony Pouros makes the case for platinum.

Gold is money. Gold has been money for thousands of years. And one of the reasons gold is money is because it’s immutable.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.