A 1980s era Far Side cartoon featured a veterinary student named Doreen studying equine medicine in Chapter 9 of her textbook. On the left-hand side of the page was a list of horse ailments. They included things like a broken leg, infected eye, runny nose, and a fever to name just a few. On the right-hand side of the page, the treatment for each ailment was “Shoot.” The caption read, “Like most veterinarian students, Doreen breezed through Chapter 9.”

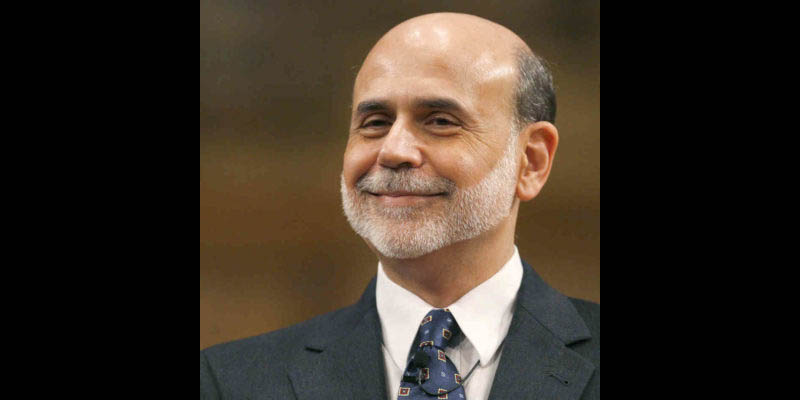

Ben Bernanke, Milton Friedman and the Ivy League economics departments that all regurgitate the same theory on the Great Depression pretty much treat the economy as simple-mindedly as Doreen’s textbook treated equine medicine.

The following article was written by Peter Schmidt. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

When currency was backed by gold, a central bank’s main function was to maintain the value of the issued currency in terms of gold. For example, if a central bank created too much money against the gold reserves in the banking system, an increasing number of people would begin to exchange their currency for gold. To combat this, a central bank would be forced to raise interest rates and decrease the money supply. The higher interest rates would incentivize people to exchange gold for larger savings on deposit that earn interest. Banking reserves – gold – would return to the banking system and the economy would return to balance. The prime reason for insisting on defining currency in terms of a precious metal was to provide a self-correcting braking mechanism to the creation of money. As expressed by the great Wilhelm Röpke:

Last week, Pres. Donald Trump nominated Marvin Goodfriend to fill a vacancy on the Federal Reserve Board of Governors. When we reported the news, we called him “another swamp creature” – a member of the Washington D.C./Wall Street clan Trump promised to drain away.

We’re not alone in our thinking. In an article on the Mises Wire, Tho Bishop called Goodfriend’s nomination “a dangerous act of outright betrayal to Trump’s core constituency of working-class voters.”

It’s true Goodfriend’s views on monetary policy don’t fit in with the current Fed status quo. But that’s not a good thing. Goodfriend isn’t a fan of the conventional radical policy of quantitative easing. He’s actually a proponent of an even more radical policy.

Following is Bishop’s analysis in its entirety.

It looks like Trump’s pick to chair the Federal Reserve plans to walk in the footsteps of his predecessors.

In other words, we can expect the legacy of Ben Bernanke and Janet Yellen to continue unbroken. That means a continuation of interventionist monetary policy, artificially low interest rates into the foreseeable future, and plenty of quantitative easing when the time comes.

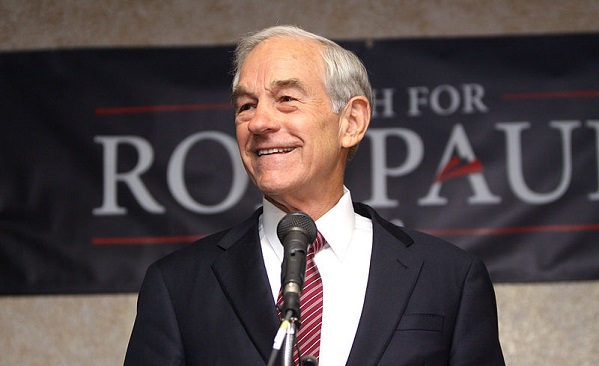

Ron Paul has identified an increase in what he calls the “most insidious tax” buried in the GOP tax reform bill.

A lot of Americans have put a lot of hope in tax reform. As Peter Schiff said in a recent Fox Business interview, the prospect of economic growth spurred by tax reform and other Trump policies have generated a great deal of optimism. But the question remains: can the GOP Congress deliver? And even if Congress does get a reform package passed, some question whether it will actually lead to the economic growth promised. Absent spending cuts, the tax plan will increase the federal debt even further. Evidence indicates high debt levels retard growth.

In a recent article published on the Mises Wire, Ron Paul identified another problem with the Republican tax plan. It actually increases the most insidious of all taxes – the “inflation tax.”

There’s been a lot of focus on the Federal Reserve lately.

Earlier this month, the central bank launched efforts to shrink its balance sheet after years of quantitative easing. Most analysts also expect one more interest rate increase this year. Then there is rampant speculation about who will take the reins at the Fed when Janet Yellen’s term ends early next year. Many observers think Trump will pick a more hawkish Federal Reserve chair who will increase the pace of “normalization.”

But Peter Schiff has said ultimately the Fed doesn’t want to do anything to upset the status quo. And at this point, the central bank is between a rock and a hard place. It can normalize, which will ultimately pop the bubble, or it can continue with its easy money policies and wreck the dollar. Peter has said the Fed will ultimately sacrifice the dollar on the altar of the stock market.

In a recent article published on the Mises Wire, economist Ryan McMaken weighs in, arguing along these same lines. He says the Fed won’t do anything that will spook the markets. That means we can expect more “easy money.” But this raises a question – what happens when the next recession rolls along?

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The price of gold has fallen four straight weeks, primarily driven down by anticipation of Federal Reserve monetary tightening. The kickoff of the Fed’s balance sheet normalization program and the expectation of rising interest rates have helped spark a dollar rally. But few people seem to be paying any attention to the pitfalls of quantitative tightening. In fact, the Fed’s policy to push interest rates higher could turn out to be a havoc-wrecking juggernaut.