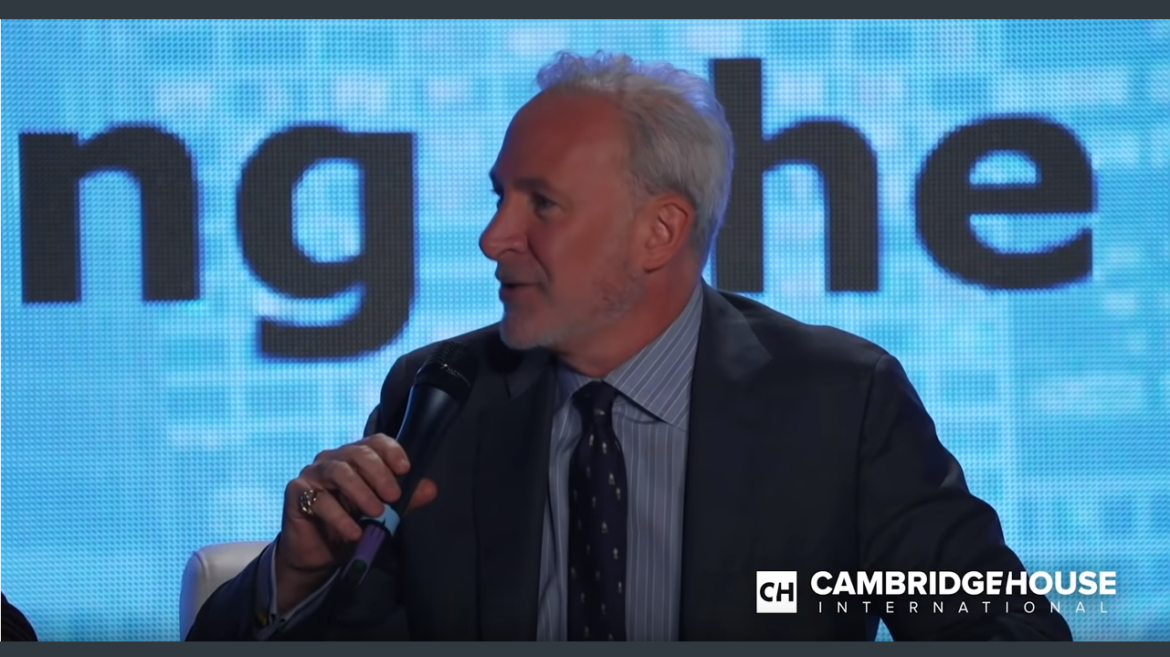

Last year at the Vancouver Resource Investment Conference, Peter Schiff bet Brent Johnson a gold coin that the Fed’s next move would be a rate cut. At this year’s conference, Peter collected his gold coin.

Brent and Peter went on to debate the future of the US dollar. Brent says the dollar will go up this year. Peter thinks it’s going down. Peter put his money where is mouth is and went double or nothing against the dollar.

Jerome Powell went to Capitol Hill this week. During his testimony before a congressional committee, the Fed chair insisted, “There is nothing about this economy that is out of kilter or imbalanced.” In this episode of the Friday Gold Wrap Podcast, host Mike Maharrey takes issue with Powell’s assessment and points out some things that are, in fact, way out of kilter.” He also touches on coronavirus and the markets, consumer debt, and Donald Trump.

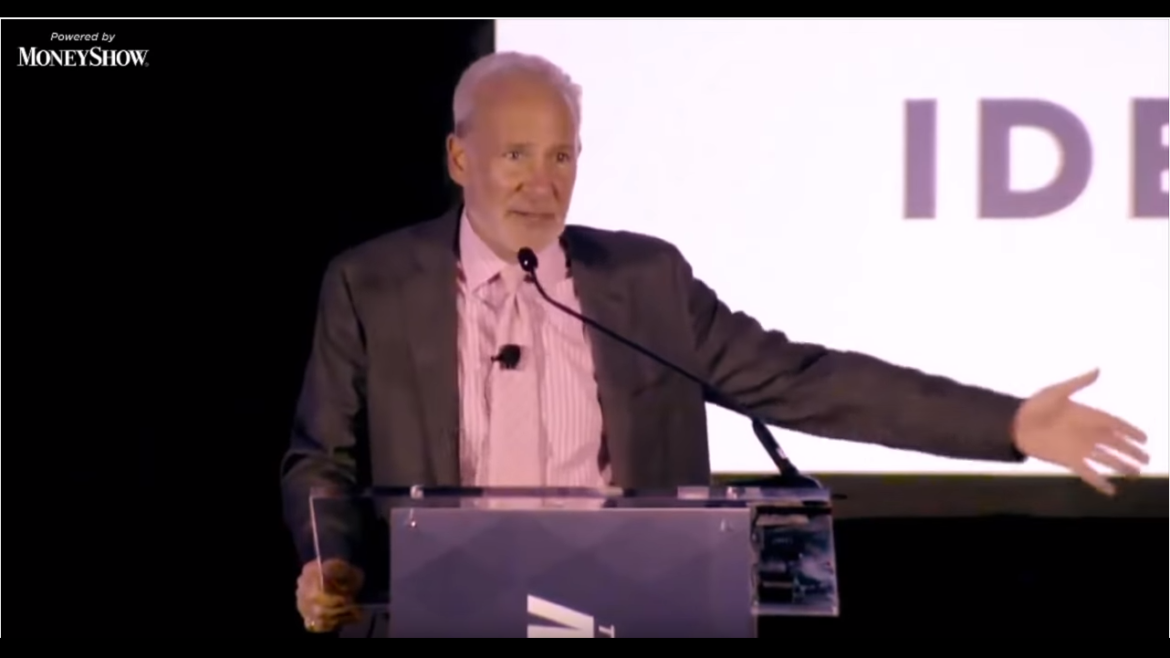

Last week, Peter Schiff gave a speech at the Orlando Money Show and made the case that all the hype about the greatest economy in history is just that – hype. Nobody should be taking credit for the economy. We should be asking who is to blame.

Last October, the Federal Reserve relaunched quantitative easing. Of course, Fed Chairman Jerome Powell insists it’s not quantitative easing. But as Peter Schiff pointed out in a recent tweet, that debate is really just semantics.

The argument over whether the current Fed balance sheet expansion constitutes QE is pointless. QE was always just a euphemism for debt monetization. The Fed monetized debt in the past, its monetizing more debt in the present, and it will monetize even more debt in the future!”

Those peddling the narrative that the US economy is great keep pointing to the stock market. Indeed, stocks have continued to push higher, setting records along the way. But Peter Schiff has been saying that stocks aren’t being driven higher by a great economy. In a recent interview on RT Boom Bust, Peter said that if you look at the economic fundamentals, stocks should be coming down.

The Federal Reserve held its first Federal Open Market Committee meeting this week. As expected, the central bank held interest rates steady but the overall posture of the Fed came off as rather dovish. Quantitative easing will continue into the near future and Fed Chairman Jerome Powell left the door open for future rate cuts.

The Federal Reserve funds rate will stay locked in at 1.5 to 1.75% and the vote was unanimous. Powell said, “We’re comfortable with our current policy stance and we think it’s appropriate.”

It’s like Dawn of the Dead on Wall Street. Zombies are everywhere.

Even as stocks continue to push to new highs, the number of money-losing companies listed on US stock markets has ballooned to levels not seen since the dot-com bubble of the late 1990s.

According to a recent Wall Street Journal article, nearly 40% of US-listed companies are losing money.

A week ago, nearly $100 billion in short-term liquidity was added via the Federal Reserve Bank of New York offering cash in the repo market.

As a reminder, the repo market is the overnight market of repurchase agreements. This is where one sells an asset with an agreement to purchase it back at a slightly higher price the next day. In other words, very short term collateralized lending.

We have a trade deal! Maybe. Meanwhile, the Fed wrapped up its last FOMC meeting of the year this week and did nothing. But Powell and Company did give us some indication about what we should expect next year. The week’s news played tug-o-war with gold. In this episode of the Friday Gold Wrap, host Mike Maharrey breaks it all down and says there’s a lot to be skeptical about, both with the trade deal and the rhetoric coming out of the Fed.

The Federal Reserve wrapped up its final Federal Open Market Committee meeting of 2019 on Wednesday doing pretty much what was expected — nothing. But in the processing of doing nothing, the central bank said a lot and managed to out-dove expectations.

After cutting interest rates three times in 2019, the FOMC stood pat during its final meeting of the year, holding the interest rate steady at 1.5%.