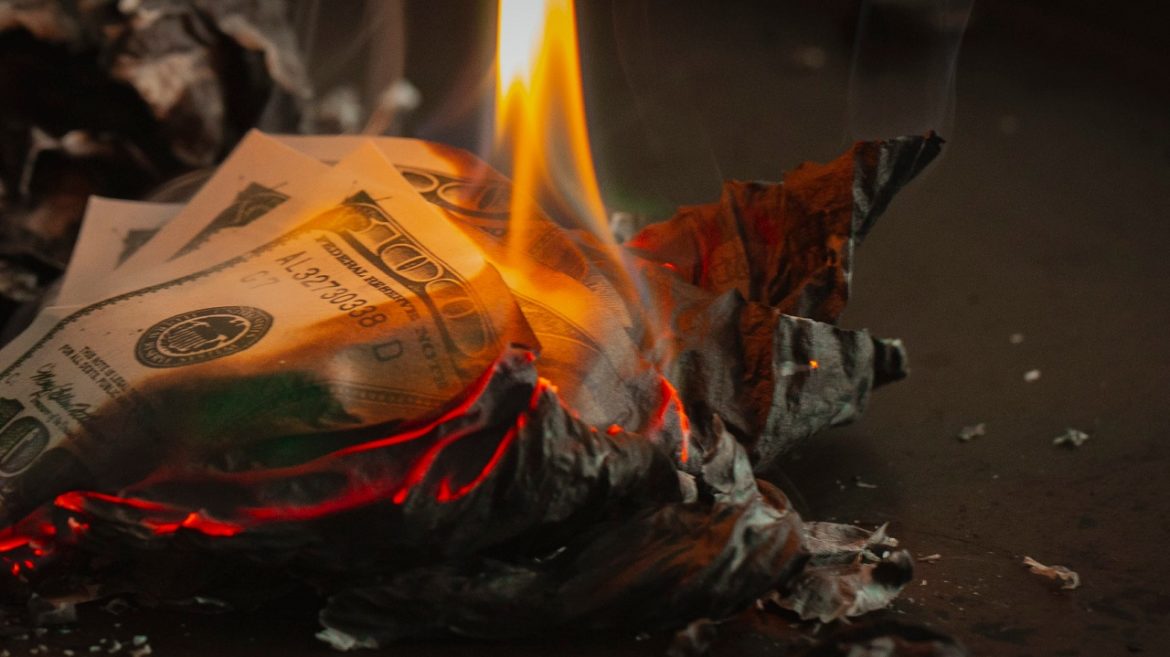

The money supply grew by 37.08% year-on-year in November based on the True Money Supply Measure (TMS). It was effectively the same rate of growth we saw in October and remains near September’s all-time high rate of growth.

The staggering growth in the money supply becomes more clear when you compare this year with last. TMS growth in November 2019 was just 5.9%.

The big story last week was the dollar’s slow meltdown. The dollar index broke below 90 for the first time since the spring of 2018.

The financial media hasn’t ignored the dollar weakness, but Peter said they don’t seem to grasp the significance of what’s going on, nor do they realize how much further the dollar has to fall. In fact, a lot of the talk has focused on the positives of dollar weakness. In his podcast, Peter argues this growing dollar weakness is not America’s win.

The Federal Reserve held its last meeting of the year this week. There were no big surprises policy-wise. But Jerome Powell and company made it clear that the easy-money spigot will remain wide open pumping trillions of dollars created out of thin air into the economy. In this episode of the Friday Gold Wrap podcast, Mike Maharrey talks about the Fed meeting and the ramifications of its monetary policy.

In its last meeting of 2020, the Federal Reserve made it clear the easy-money spigot will remain wide open into the foreseeable future. During his post-meeting press conference, Federal Reserve Chairman Jerome Powell seemed clueless about the ramifications of this policy – particularly the impact of inflation. Peter Schiff talked about the Fed meeting and Powell’s comments in his podcast, saying Powell’s ignorance won’t be bliss.

There is a lot of talk about student loan forgiveness. The idea is wildly popular and it would relieve a huge burden crushing millions of Americans. But is there any downside to this idea? In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about the student loan debacle and the possible downside of loan forgiveness. He also touches on the shaky labor market and why the bond market can’t tell us anything about inflation.

Saxo Bank projects silver will soar to a record $50 an ounce in 2021, powered by loose Federal Reserve monetary policy and a weak dollar, and turbocharged by surging demand for the white metal in the solar energy sector.

A lot of pundits and analysts insist inflation isn’t a problem because the bond market isn’t signaling any inflation concerns. But in his podcast, Peter Schiff argues that you can’t rely on this bond market to tell you anything. The bond market is broken, thanks to the Federal Reserve. It’s rigged and it’s sending false signals.

The US dollar has been showing significant weakness over the last several weeks. The dollar index closed at 90.814. Just two weeks ago, it was in the 94 range. Compared to the Swiss franc, the dollar is at a 6-year low. In his podcast, Peter talked about the dollar weakness and the Federal Reserve policy that’s causing it. The crazy thing about the rising inflation expectation is that the Fed appears poised to try to fight it with even more inflation.

After a dismal November, gold and silver are starting to show some signs of life. But what caused the big drop in the price of precious metals last month? Was it warranted? In this episode of the Friday Gold Wrap podcast, host Mike Maharrey looks at the economic and monetary fundamentals and tries to bring us back to reality. He argues that despite the optimism about a coronavirus vaccine, nothing will fundamentally change.

The money supply continues to grow at a torrid rate.

Based on the “true” or Rothbard-Salerno money supply measure (TMS), the money supply grew by 37.08% year-on-year in October. That was down just slightly from September’s record rate of 37.54%.