Despite an inflationary freight train, gold struggled to gain ground in 2021 as the markets fixated on the Federal Reserve and the possibility of tighter monetary policy to fight inflation. Will gold continue to fight headwinds in 2022 as the Fed launches its “inflation fight,” raises rates and possibly begins to shrink its balance sheet? Or could gold shine in 2022 despite the Fed’s feckless inflation fight?

Peter Schiff recently appeared on the Rob Schmidt Show on Newsmax to talk about the trajectory of the US economy. Peter explains how the Federal Reserve and the US government created a massive bubble, why it is going to ultimately pop, and how to protect your savings and investments when it does.

With 2021 now in the rear-view mirror, I believe that future financial historians may regard it as the year of peak speculation.

While the history of American markets is littered with periods of irrational exuberance, none of those episodes can really match the current market for outright delusion and the blatant disregard for basic investment discipline.

Inflation in the US is at historically high levels.

So, why hasn’t gold taken off?

We hear this question over and over again. In this video, Peter Schiff answers this question and explains why the markets will eventually wake up to their misperception.

The Fed FOMC minutes came out last week, signaling tighter monetary policy. Peter Schiff talked about the minutes in his podcast, arguing that the Fed can’t do what it says it’s going to do. If it does, it will crash the markets and the economy. And it won’t lower inflation.

The Federal Reserve released the minutes from the December FOMC meeting this week. They were even more hawkish than expected. That sparked a big taper tantrum in the markets. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey gives an overview of the minutes and then asks seven poignant questions they raise that aren’t being asked by the mainstream.

The Fed has a difficult choice to make.

Will it crash the economy? Or will it crash the dollar?

Whichever way this coin flip turns out — you lose.

The Federal Reserve released the minutes from the December FOMC meeting on Thursday (Jan. 5) and the markets freaked once again at the prospect of monetary tightening. The minutes seem to indicate an even more abrupt shift to tighter monetary policy to fight inflation. But I have questions.

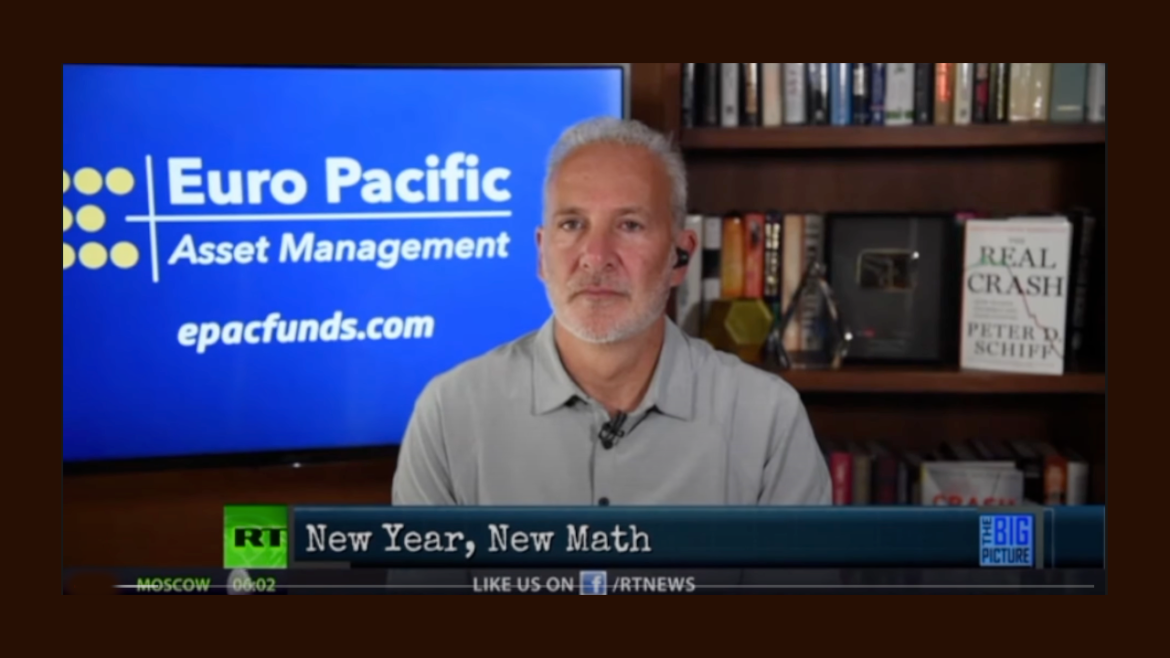

How are the dollars and cents of your life changing as we move into 2022? Peter Schiff joined University of Miami Business School Dean John Quelch and host Holland Cooke on RT’s “Big Picture” to talk about the year ahead. Peter left us with an ominous warning. 2022 will be worse than 2021 as inflation continues to mount.

As 2021 goes into the history books, Peter Schiff looks back over what he calls “a year of peak speculation.”

Of course, the big story of the year was inflation.