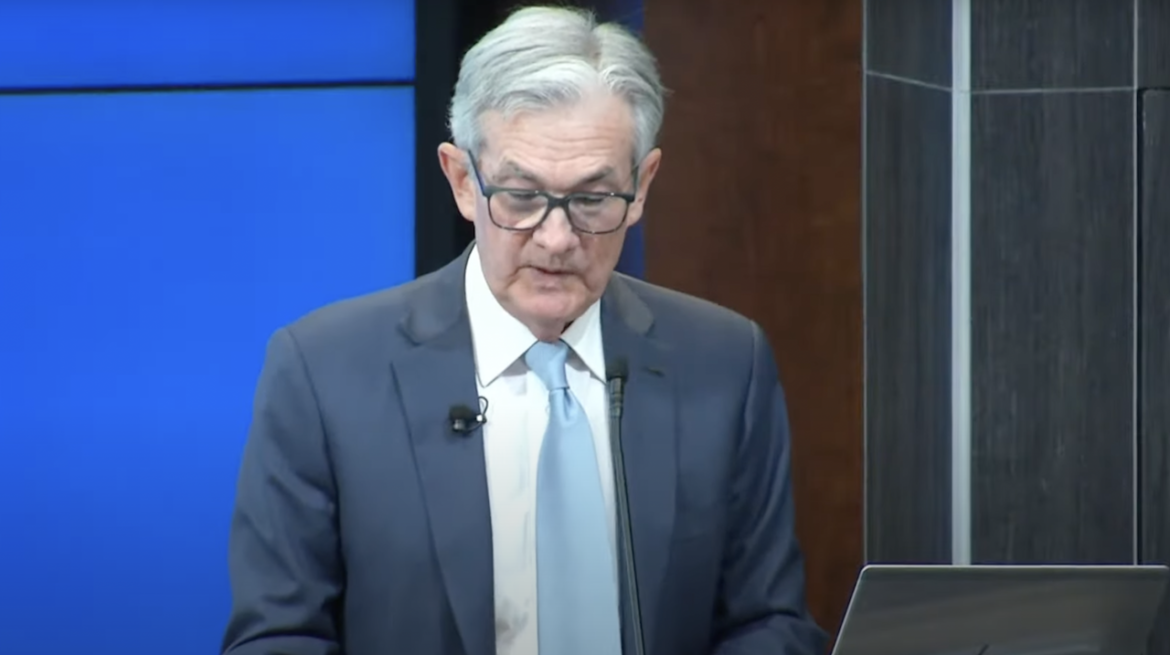

Federal Reserve Chairman Jerome Powell came out this week and indicated the central bank is set to pivot away from its aggressive rate hikes. But he couched the announcement in hawkish terms. The markets bought the pivot and ignored the hawkishness. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey puts Powell’s remarks in a broader context and speculates about what might be coming down the pike.

Federal Reserve Chairman Jerome Powell all but confirmed a soft pivot by the central bank in its inflation fight on Wednesday, while trying to maintain a hawkish demeanor.

The markets appear to be buying the pivot, but they are ignoring Powell’s “tough guy” spin.

Last week, the Federal Reserve delivered a 75-basis point rate hike, but Fed Chair Jerome Powell failed to deliver the more doveish rhetoric that many expected. The messaging did not indicate much softening in the stance on the future trajectory of rate hikes, despite an apparent “soft pivot” the week before.

In his podcast, Peter broke down Powell’s messaging and pointed out a number of very scary admissions that came out of the Fed meeting.

The Federal Reserve delivered a 75-basis point rate hike at its November meeting, as expected. But what’s next? That’s a little harder to decipher. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey digs into the mixed messaging that came out of the Fed meeting and concludes the central bank’s monetary policy is “a wing and a prayer.” He also covers the recently released Q3 gold demand data.

Last week the Fed raised interest rates another 75 basis points and continued to insist it was fully committed to doing whatever it takes to bring inflation back down to 2%. In his podcast, Peter argued that Powell still thinks he can pull off the impossible.

He can’t.

The September Federal Reserve meeting wrapped up this week with another 75 basis point rate hike. And Fed Chairman Jerome Powell admitted that there is going to be some pain as the central bank continues to fight inflation. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey reacts to the meeting and the Fed’s messaging. He said he thinks Powell & Co. are drastically understanding the coming pain.

During his post- FOMC meeting press conference, Federal Reserve Chairman Jerome Powell said, “Hope for the best; plan for the worst.”

I think he meant, “Live in hope; die in despair.”

Jerome Powell delivered his much-anticipated speech at Jackson Hole on Friday. He continued with the hawkish talk we’ve been hearing in recent weeks, pledging the Fed will “use our tools forcefully” to attack inflation. Powell even promised some pain. As Peter Schiff discussed in his podcast, the markets immediately delivered on the promise of pain. But the question remains: do Powell & Co. really have the pain tolerance they claim?

This week, President Biden announced a plan to forgive $10,000 to $20,000 in student loan debt. It sounds nice and some people will certainly benefit, but as SchiffGold Friday Gold Wrap podcast host Mike Maharrey explains, we’re all going to pay for this. In this episode, Mike also talks about Jerome Powell’s upcoming Jackson Hole speech, the state of the economy and some interesting gold market news.

The Federal Reserve delivered another 75 basis point interest rate hike at its July FOMC meeting. This pushes the federal funds rate over the 2% threshold to between 2.25% and 2.5%.

The mainstream media emphasized the size of the hike. One headline called it “a second super-sized hike,” with many other mainstream pundits noting that it matched a June hike was the biggest since 1994. But it wasn’t as big as the full 1% hike everybody thought was on the table after we got June’s flaming hot Consumer Price Index (CPI) data.

Here’s the question: has the Fed reached the end of its rope? Will this be the last hike in this cycle?